Current trend

Shares of Caterpillar Inc., a global manufacturer of construction and mining equipment, are trading in a corrective trend at 300.00.

Yesterday, it became known about the successful partnership between Caterpillar Inc. and Microsoft Corp., which was aimed at testing hydrogen fuel cells manufactured by Ballard Power Systems Inc. During the test, all elements of the system confirmed high reliability and uptime of 99.99%. A week earlier, the corporation signed a strategic agreement with CRH Plc. in the field of implementing zero-emission exhaust solutions, which provides for the production of Caterpillar battery electric off-road trucks and chargers for them in North America.

Caterpillar Inc.'s next financial report will be presented on February 5: analysts expect revenue to increase from 16.8 billion dollars to 17.09 billion dollars, and earnings per share (EPS) may decrease from 5.52 dollars to 4.75 dollars, while in the previous 4 quarters the company managed to significantly exceed profit forecasts.

Support and resistance

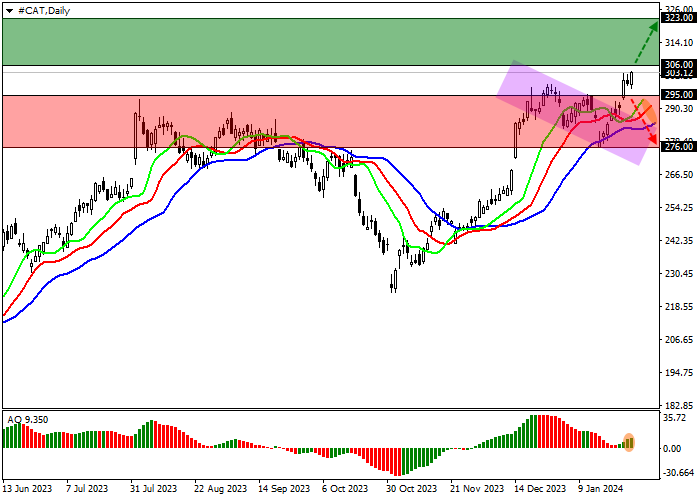

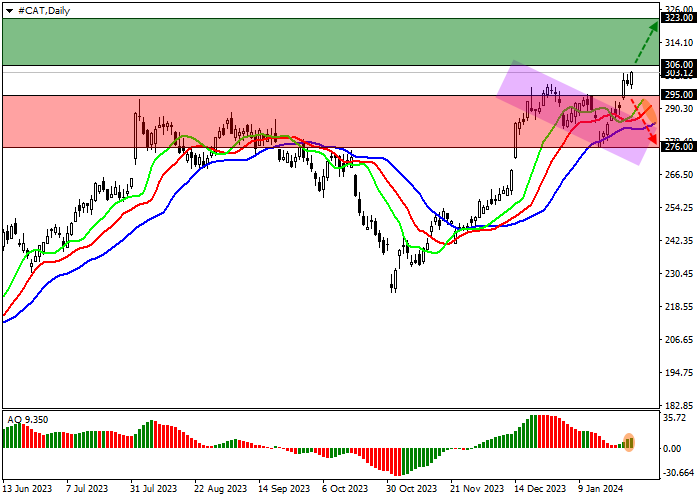

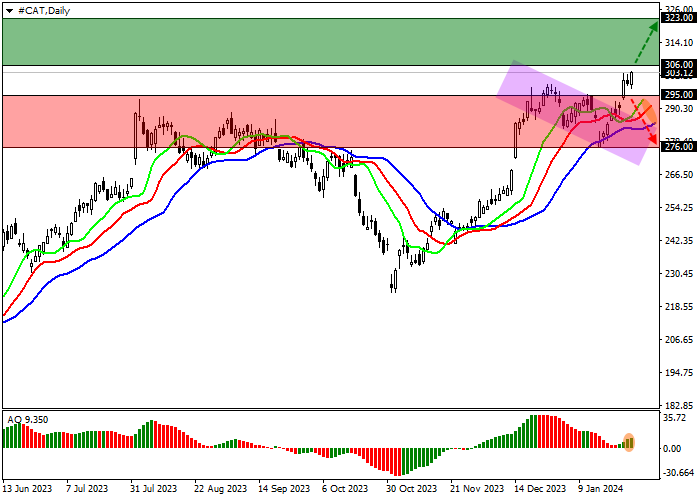

On the D1 chart, the trading instrument has updated the annual maximum at 298.00 and may continue its upward movement in the near future.

Technical indicators hold the buy signal, which is still stable: the fast EMAs on the Alligator indicator are well above the signal line, and the AO histogram is trading in the buy zone.

Support levels: 295.00, 276.00.

Resistance levels: 306.00, 323.00.

Trading tips

If the local growth of the asset continues and the price consolidates above the resistance level at 306.00, one may open long positions with the target of 323.00 and stop-loss of 300.00. Implementation time: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level at 295.00, one can open short positions with the target of 276.00 and stop-loss of 302.00.

Hot

No comment on record. Start new comment.