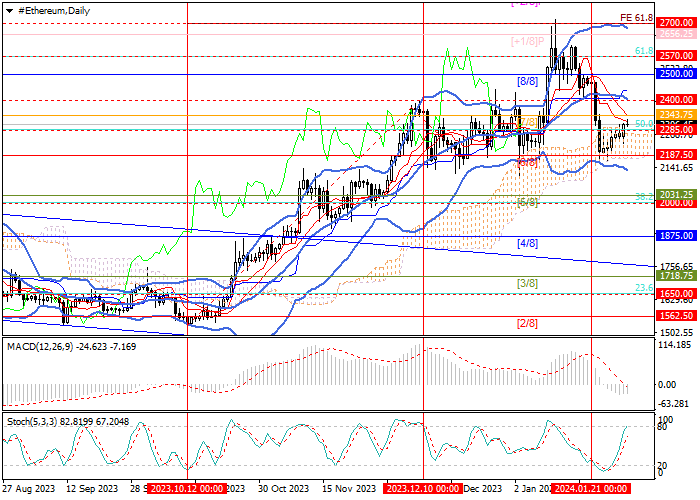

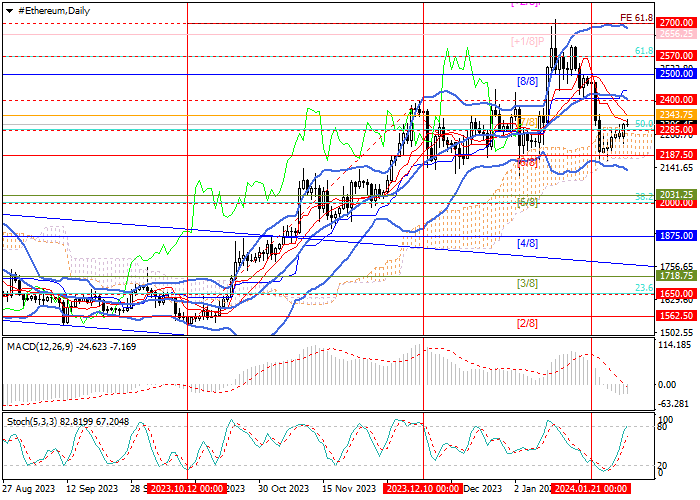

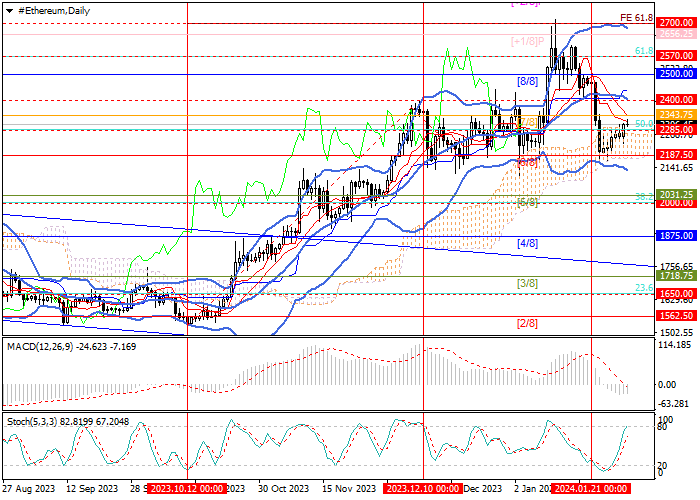

Current trend

Last week, the ETH/USD pair had mixed dynamics: quotes dropped to 2187.50 (Murrey level [6/8]), but were unable to break below it and partially recovered their lost positions. A full upward movement will become possible after the price consolidates above the center line of the Bollinger Bands around 2400.00. In this case, the targets will be the levels 2570.00 (Fibonacci retracement 61.8%) and 2700.00 (Fibonacci extension 61.8%, area of January highs). The key level for the "bears" remains the level of 2187.50, which has already been unsuccessfully tested several times over the past two months. Consolidation below it will allow quotes to develop a decline to the levels of 2000.00 (Fibonacci retracement 38.2%), 1875.00 (Murrey level [4/8]) and 1718.75 (Murrey level [3/8]).

The potential for a resumption of upward dynamics currently looks limited, as the market is experiencing attempts to change the medium-term trend, which is confirmed by technical indicators: Bollinger Bands are starting to reverse downwards, MACD has stabilized in the negative zone, and Stochastic is approaching the overbought zone.

Support and resistance

Resistance levels: 2400.00, 2570.00, 2700.00.

Support levels: 2187.50, 2000.00, 1875.00, 1718.75.

Trading tips

Short positions could be opened below 2187.50 with targets at 2000.00, 1875.00, 1718.75 and stop-loss at 2285.00. Implementation period: 5-7 days.

Long positions may be opened above 2400.00 with targets at 2570.00, 2700.00 and stop loss at 2290.00.

Hot

No comment on record. Start new comment.