Current trend

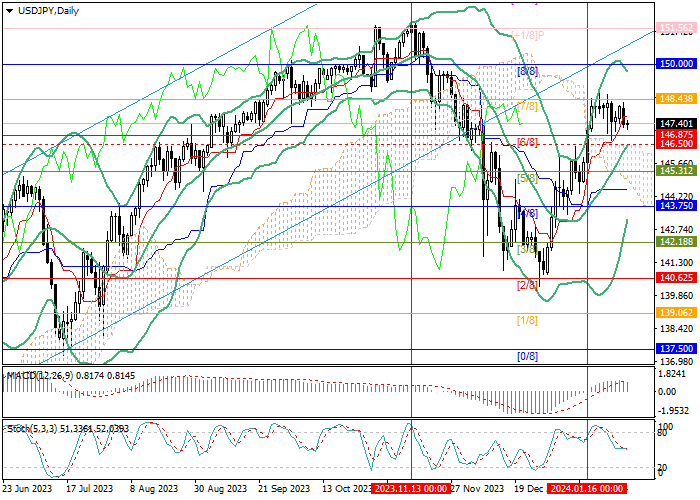

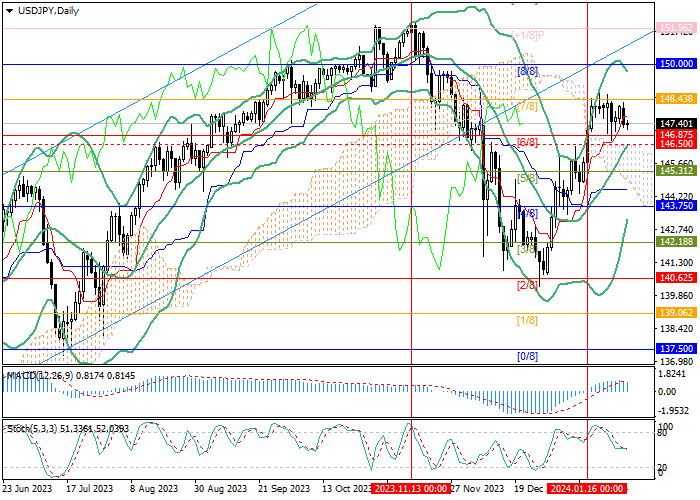

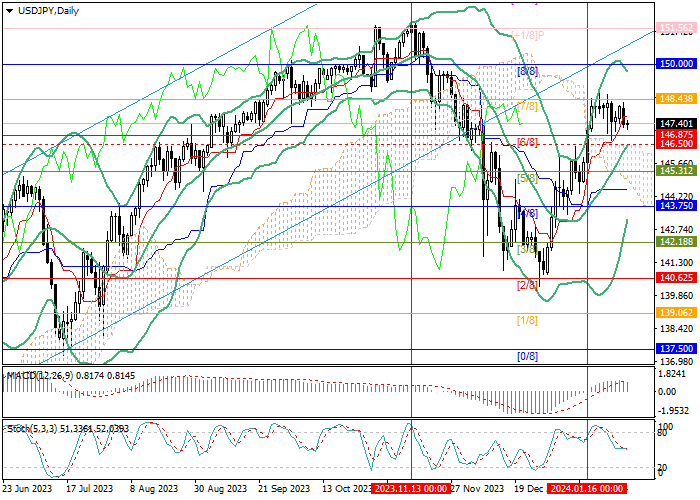

The USD/JPY pair has been trading in the lateral range of 148.43–146.87 for the second consecutive week (Murrey level [7/8]-[6/8]).

Investors are waiting for the central event of the week – the US Federal Reserve monetary policy meeting, which will be held tomorrow at 21:00 (GMT 2). Any hints from officials about the imminent start of an interest rate cut from the current 5.50% will lead to a weakening of the position of USD. Nevertheless, given the renewed inflation growth because of the prolonged reorientation of maritime cargo flows due to the blockade of shipping in the Red Sea, the head of the regulator Jerome Powell may well declare the need to maintain the current monetary policy for a longer period, and then the position of the national currency against its main competitors will strengthen.

The further actions of Bank of Japan officials also look uncertain: last week the interest rate was kept at -0.10% and, probably, the monetary authorities will continue to keep it negative, contrary to the forecasts of investors counting on an early change in the "ultra-dovish" rhetoric, since the inflation rate in the country has signs of slowing down. According to January data, the consumer price index in the Tokyo metropolitan area fell to 1.6%, which is below the Bank of Japan's target level of 2.0%. In this situation, maintaining pressure on the Japanese currency in the medium term seems more likely.

Support and resistance

Technically, the price remains within the range of 148.43–146.87, a break above the upper border of which will allow quotes to grow to the levels of 150.00 (Murrey level [8/8]) and 151.56 (Murrey level [ 1/8]). To continue a serious decline, quotes will have to break below the support zone of 146.87–146.50 (Murrey level [6/8], the central line of Bollinger Bands), after which the downtrend will continue to the targets of 145.31 (Murrey level [5/8]) and 143.75 (Murray level [4/8]), but this scenario seems less likely.

Technical indicators confirm the continuation of the uptrend: Bollinger Bands are directed upwards, MACD is stable in the positive zone, and Stochastic is pointing downwards, which does not exclude a corrective decline, but its potential is seen to be limited.

Resistance levels: 148.43, 150.00, 151.56.

Support levels: 146.50, 145.31, 143.75.

Trading tips

Long positions can be opened above the 148.43 mark with targets of 150.00, 151.56 and stop-loss around 147.45. Implementation period: 5–7 days.

Short positions should be opened below the level of 146.50 with targets of 145.31, 143.75 and stop-loss around 147.30.

Hot

No comment on record. Start new comment.