Current trend

Ahead of the US Federal Reserve’s monetary policy meeting, the NZD/USD pair is trading at 0.6141, poised to continue rising.

The interest rate decision will be published tomorrow at 21:00 (GMT 2), and the rate is expected to remain at 5.50%, with market participants looking for hints in officials’ comments about the timing of the transition to the “dovish” rhetoric. Previously, experts assumed that it would take place in March. However, January statistics showed that the American economy remains strong, and the likelihood of a new acceleration in inflation amid worsening geopolitical tensions in the Middle East and the reorientation of maritime cargo flows remains. Most traders expect the regulator to begin cutting borrowing costs in May or June, with interest rate adjustments of 140.0 basis points for the year. If, during the press conference, the head of the department, Jerome Powell, announces his refusal to tighten monetary policy, the American dollar may weaken against its main competitors.

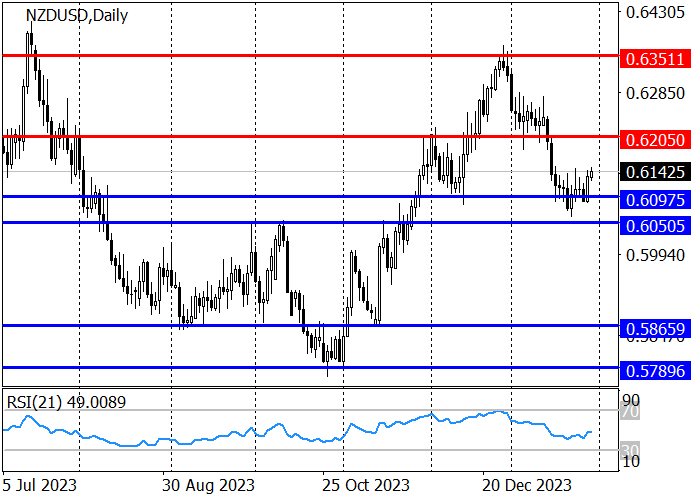

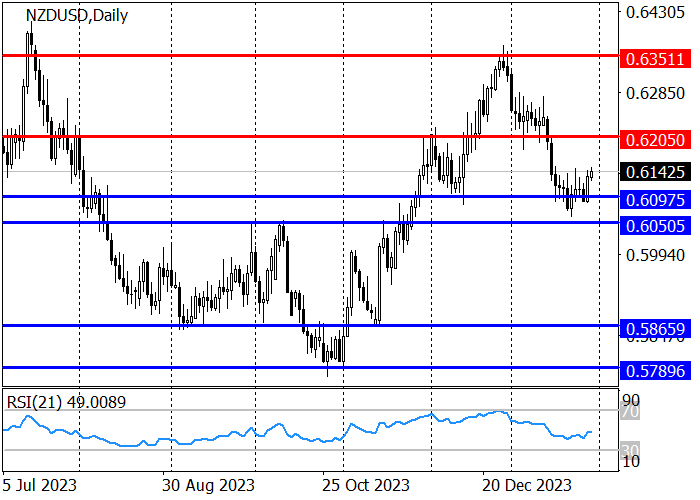

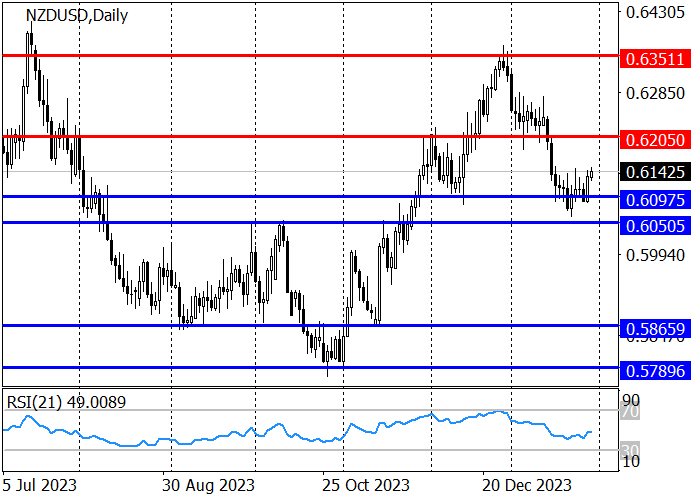

The long-term trend is upward: in January, the price corrected and reached the support area of 0.6097–0.6050, from where it began to rise to the current level of 0.6140 with the prospect of testing 0.6205 and then 0.6351. In case of a reverse breakdown of the zone 0.6097–0.6050, the upward scenario will be canceled, and short positions with the target at 0.5865 are relevant.

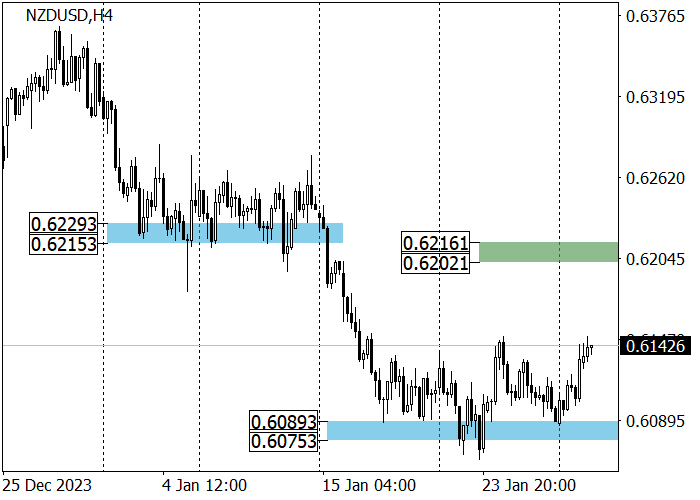

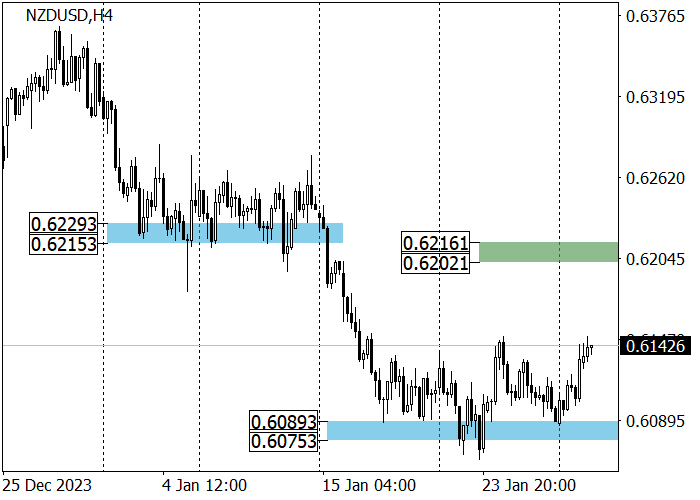

The medium-term trend is downward but now a correction is developing to the key trend resistance area 0.6216–0.6202, after testing which the trading instrument may decline to zone 2 (0.6089–0.6075), in the event of a breakdown of which the sales target will be 0.5949–0.5935.

Support and resistance

Resistance levels: 0.6205, 0.6351.

Support levels: 0.6097, 0.6050, 0.5865.

Trading tips

Long positions may be opened from 0.6097 with the target at 0.6205 and stop loss around 0.6055. Implementation time: 9–12 days.

Short positions may be opened below 0.6000 with the target at 0.5865 and stop loss around 0.6060.

Hot

No comment on record. Start new comment.