Current trend

During the Asian session, the USD/CHF pair declines slightly, testing 0.8610 for a breakdown and holding near the lows of January 16.

Activity in the market remains subdued as traders are in no hurry to open new positions ahead of the US Federal Reserve’s interest rate meeting this week: experts do not expect changes in monetary policy parameters but they are interested in the possibility of a possible decrease in borrowing costs in March amid further weakening inflation: the core price index of personal consumption expenditures fell from 3.2% to 2.9% in December, below expectations of 3.0%, and personal expenditures of citizens increased from 0.4% to 0.7%, while analysts did not predict any changes. On Friday, the January report on the labor market will be published: according to preliminary estimates, nonfarm payrolls in January will slow down from 216.0K to 180.0K, the unemployment rate will adjust from 3.7% to 3.8%, and average hourly wages from 0.4% to 0.3%.

Today, traders will pay attention to key statistics on the dynamics of imports and exports for December from Switzerland: previous data reflected a slight increase in export volumes from 23.14B francs to 24.22B francs, while imports rose from 18.42B francs to 20.51B francs, as a result of which the trade surplus fell from 4.712B francs to 3.707B francs.

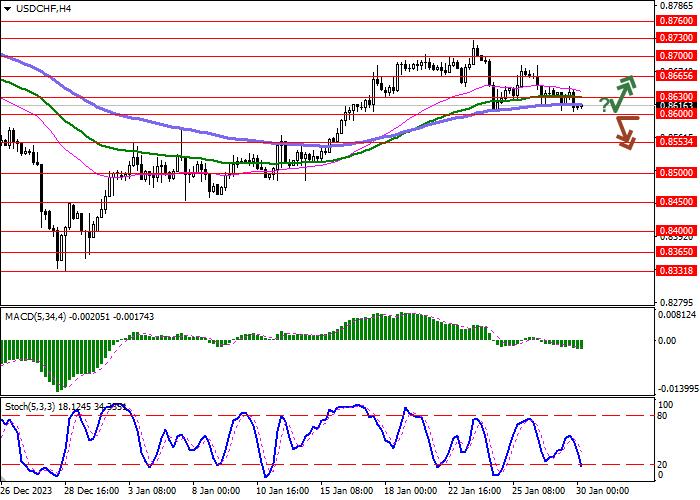

Support and resistance

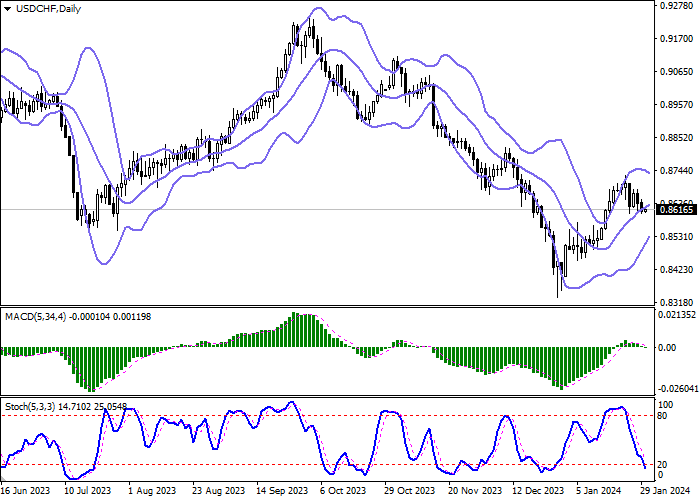

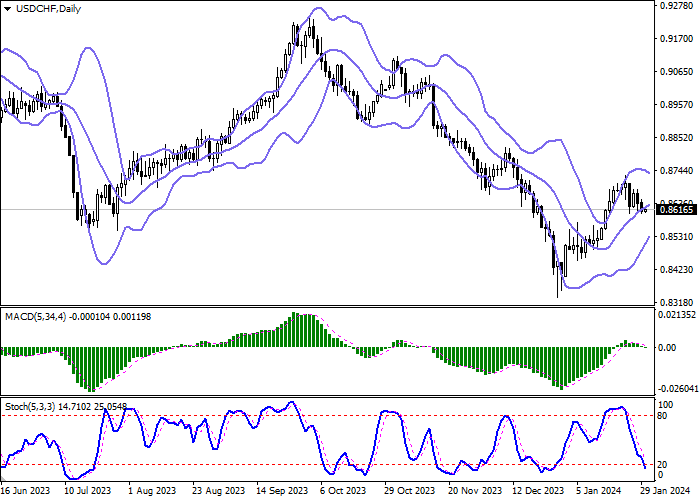

On the daily chart, Bollinger Bands are growing uncertainly: the price range is actively narrowing, reflecting the emergence of downward dynamics in the short term. The MACD indicator is declining, having formed an unstable sell signal (the histogram is below the signal line), and is trying to consolidate below the zero level. Stochastic shows a more confident decline but is near the lows, indicating that the American dollar may become oversold in the ultra-short term.

Resistance levels: 0.8630, 0.8665, 0.8700, 0.8730.

Support levels: 0.8600, 0.8553, 0.8500, 0.8450.

Trading tips

Short positions may be opened after a breakdown of 0.8600 with the target at 0.8500. Stop loss – 0.8650. Implementation time: 2–3 days.

Long positions may be opened after a rebound from 0.8600 and a breakout of 0.8630 with the target at 0.8700. Stop loss – 0.8590.

Hot

No comment on record. Start new comment.