Current trend

The AUD/USD pair is practically unchanged, consolidating near 0.6610. The instrument showed quite active growth the day before in the absence of macroeconomic publications at the beginning of the week. Trading participants are awaiting a meeting of the US Federal Reserve, the results of which will be announced tomorrow at 21:00 (GMT 2). Analysts do not expect the regulator to change the parameters of its monetary policy, but the updated forecasts and comments from officials are of high importance. It is assumed that the transition to easing monetary conditions will begin in March, although over the past month the likelihood of such a scenario has decreased somewhat.

Significant pressure on the position of the Australian currency today is exerted by statistics on the dynamics of Retail Sales: in December, their volumes decreased by 2.7% after growing by 2.0% in the previous month, while analysts expected -0.9%. Tomorrow the focus of investors will be on inflation data in Australia. According to forecasts, in the fourth quarter of 2023, the Consumer Price Index will slow down from 5.4% to 4.3% in annual terms and from 1.2% to 0.8% in quarterly terms. Over the past six months, domestic businesses have expected inflation pressures to continue to fall but remain on average above the Reserve Bank of Australia's (RBA) target range of 2.0-3.0%, according to the regulator's January Bulletin, which records businesses' assessments of current economic conditions. It is reported that recent years are still seeing significant cost increases in some parts of supply chains, which in turn are acting as a catalyst for higher product prices, which could be slowed by lower demand.

Also tomorrow, January statistics on business activity in China will hit the market: the Manufacturing PMI from the National Bureau of Statistics (NBS) may be adjusted from 49.0 points to 49.2 points.

Support and resistance

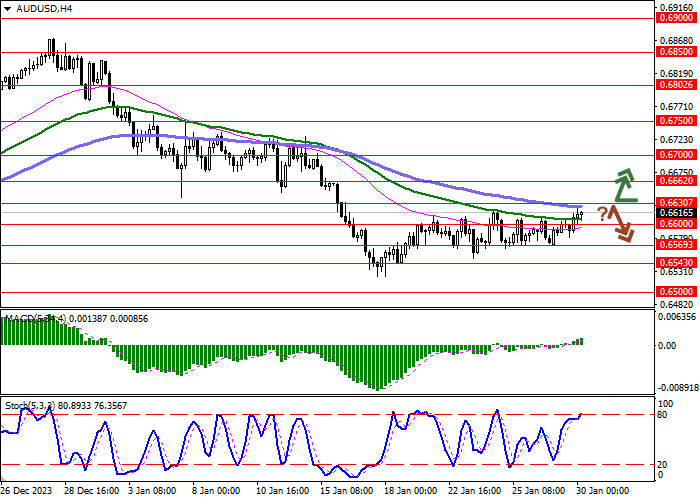

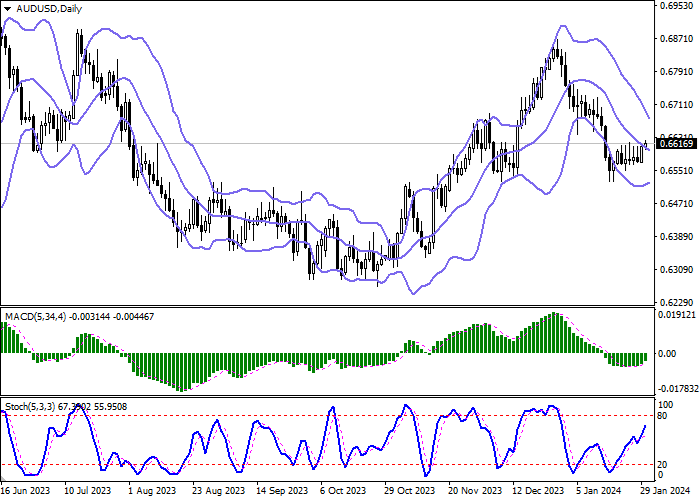

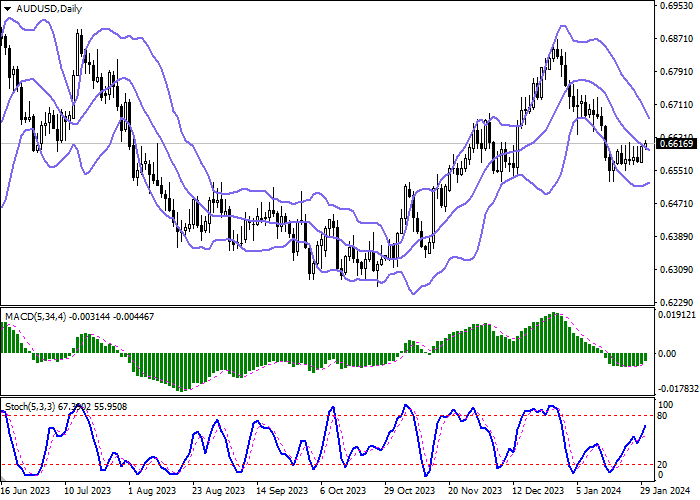

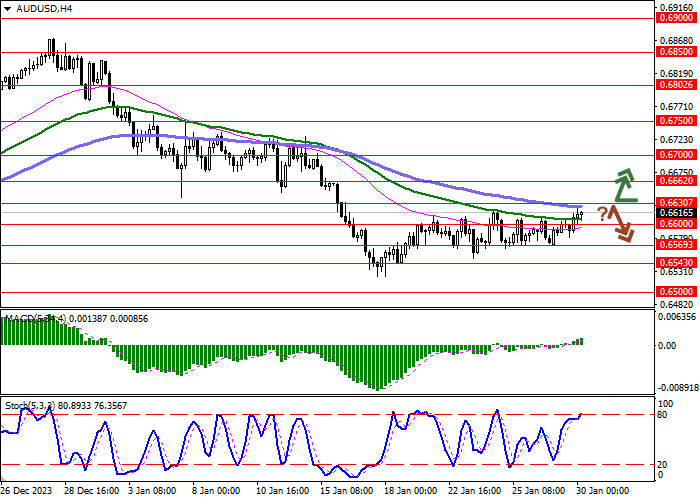

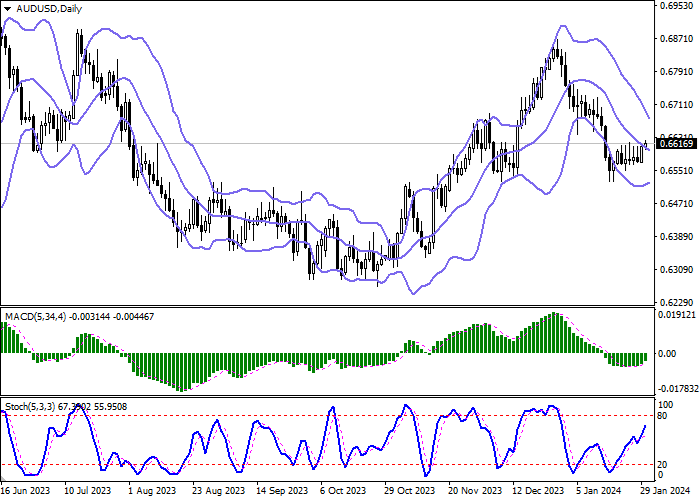

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic shows more confident growth and is quickly approaching its highs, indicating the risks of the Australian dollar being overbought in the ultra-short term.

Resistance levels: 0.6630, 0.6662, 0.6700, 0.6750.

Support levels: 0.6600, 0.6569, 0.6543, 0.6500.

Trading tips

Long positions can be opened after a breakout of 0.6630 with the target of 0.6700. Stop-loss — 0.6600. Implementation time: 2-3 days.

A rebound from 0.6630 as from resistance, followed by a breakdown of 0.6600 may become a signal for opening of new short positions with the target at 0.6543. Stop-loss — 0.6630.

Hot

No comment on record. Start new comment.