Current trend

The XAU/USD pair is consolidating near 2030.00 after moderate growth the day before, awaiting the emergence of new drivers for movement. Quotes are supported by increased tensions in the Middle East: some analysts are concerned about the possible expansion of the crisis after the incident at an American military base on the border of Syria and Jordan.

The upward movement is also developing against the backdrop of expectations of a possible adjustment in the cost of borrowing by the US Federal Reserve as early as March. Market participants hope that the results of the regulator's meeting, which will be announced tomorrow at 21:00 (GMT 2), will clarify the prospects for the start of the monetary policy easing cycle. It is worth noting that other global central banks are guided by the rhetoric of the US Fed, so the beginning of an interest rate reduction in the United States could become a driver for a global change in trend in the economies of developed countries.

On Friday, February 2, January statistics on the American labor market will hit the market. It is assumed that the Unemployment Rate will adjust from 3.7% to 3.8%, and the Average Hourly Earnings will decline from 0.4% to 0.3% on a monthly basis, remaining at 4.1% on an annual basis. At the same time, Non-Farm Payrolls may decrease from 216.0 thousand to 180.0 thousand.

The correction in the gold contract market continues. According to the report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in precious metal decreased to 169.5 thousand from 179.9 thousand a week earlier. The balance of the "bulls" with swap dealers amounted to 76.257 thousand versus 234.251 thousand for the "bears": last week, buyers increased the number of contracts by 2.211 thousand, and sellers decreased it by 11.280 thousand, reducing their positions in the asset for the fourth week in a row.

Support and resistance

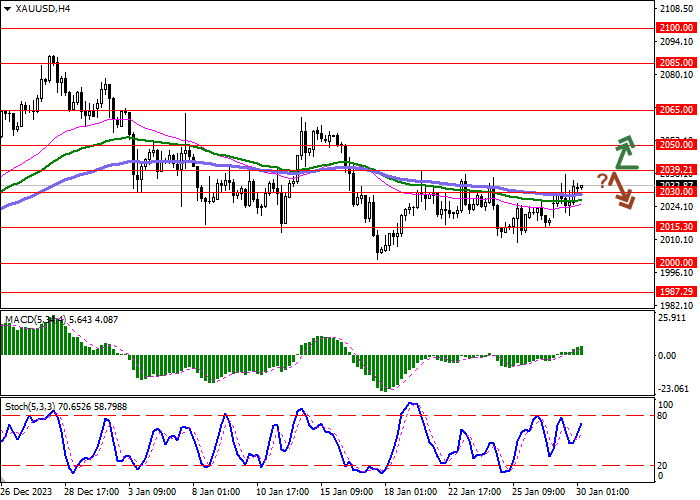

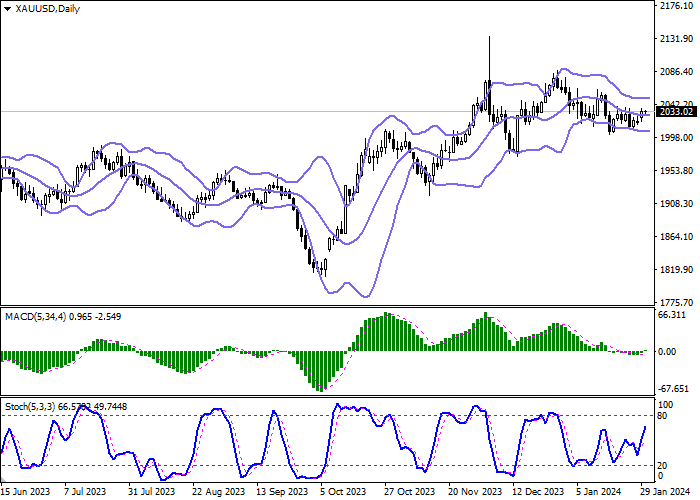

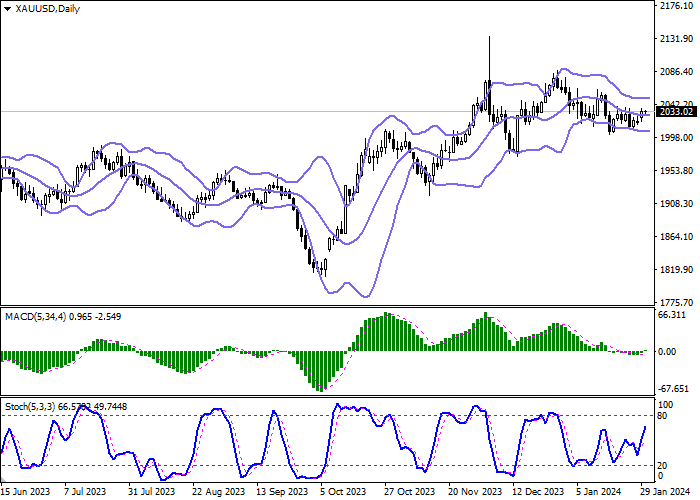

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is unchanged, but it remains rather spacious for the current level of activity in the market. MACD has reversed to growth having formed a new buy signal (located above the signal line). The indicator is also trying to consolidate above the zero level. Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought gold in the ultra-short term.

Resistance levels: 2039.21, 2050.00, 2065.00, 2085.00.

Support levels: 2030.00, 2015.30, 2000.00, 1987.29.

Trading tips

Long positions can be opened after a breakout of 2039.21 with the target of 2065.00. Stop-loss — 2025.00. Implementation time: 2-3 days.

A rebound from 2039.21 as from resistance, followed by a breakdown of 2030.00 may become a signal for opening of new short positions with the target at 2015.30. Stop-loss — 2039.21.

Hot

No comment on record. Start new comment.