Current trend

The XAU/USD pair is consolidating at 2030.0, correcting after a two-day rally that led to a short-term update of the January 16 highs.

The price is moving in a global sideways trend, which reflects the low demand for gold contracts from investors amid a new aggravation of the geopolitical situation, although usually in such a situation, traders redirect their capital to shelter assets such as precious metals but now they prefer American 10-years bonds at 4.018%, up from mid-January’s 3.945% yield, and German ones trading at 2.264%, up from 2.165% at mid-month.

Additional pressure on the asset is exerted by the position of the American dollar, which has been holding above 103.000 in USDX for the second week, which will change after the long-term course of monetary policy by the US Federal Reserve is clarified. Today at 21:00 (GMT 2), this year's first meeting of the regulator will take place. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the probability of maintaining the interest rate is 97.9%, which practically guarantees that the current yield of leading bonds will remain unchanged above 3.0% and gold dynamics will continue.

As for investor demand on commodity exchanges, at the moment, open interest from investors is still lower than in early January: according to the Chicago Mercantile Exchange (CME Group), the average daily volume is 294.0K positions, while during January 10–20, it was 417.0K positions.

Support and resistance

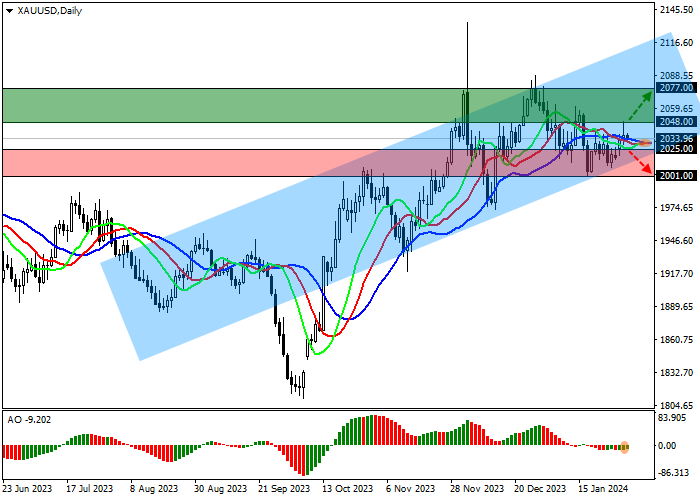

On the daily chart, the trading instrument is correcting, retreating from the support line of the local ascending channel with dynamic boundaries of 2088.0–2000.0.

Technical indicators are ready to give a buy signal: fast EMAs on the Alligator indicator are just below the signal line, narrowing the range of fluctuations, and the AO histogram forms corrective bars close to the transition level.

Resistance levels: 2048.0, 2077.0.

Support levels: 2025.0, 2001.0.

Trading tips

Long positions may be opened after the price rises and consolidates above 2048.0 with the target at 2077.0. Stop loss – 2035.0. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 2025.0 with the target at 2001.0. Stop loss – 2040.0.

Hot

No comment on record. Start new comment.