Current trend

Shares of Microsoft Corp., a global giant in the development and sale of operating systems and computer software, are trading in a corrective trend around 403.59.

Tomorrow, the company will publish a financial report for Q4 2023: according to the consensus estimate of analysts, net profit will grow to 20.6 billion dollars from 17.4 billion dollars a year earlier, which will mean 2.77 dollars per share (EPS), also above 2.20 dollars in 2022, while revenue is expected at 52.94 billion dollars , which is below 56.5 billion dollars a quarter earlier, but above 52.7 billion dollars last year.

Major analytical companies support positive assessments of the emitter's shares: experts from Deutsche Bank and Stifel Financial Corp. confirmed the "buy" rating, increasing the target price from 415.0 dollars to 450.0 dollars and from 390.0 dollars to 430.0 dollars, respectively.

Despite the positive forecasts, problems are beginning to appear in the gaming division of Activision Blizzard Inc., which was acquired by Microsoft Corp. in the summer for 69.0 billion dollars: last week, the technology giant announced a reduction in the staff of the division by 1.9 thousand people, including President Mike Ybarra and chief designer Allen Adham.

Support and resistance

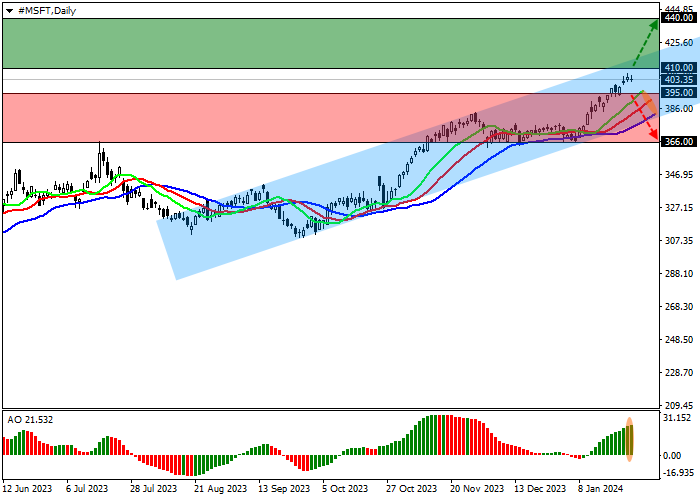

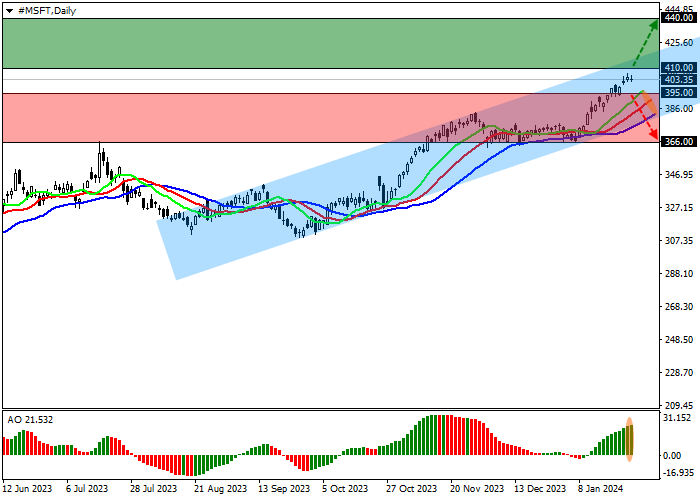

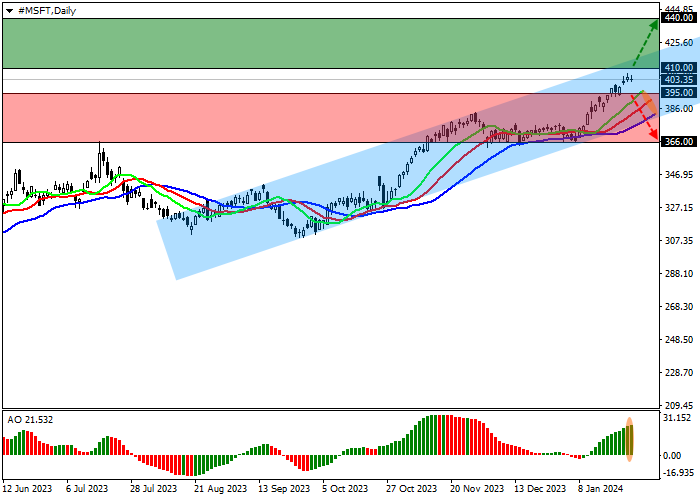

On the D1 chart, the price updates the annual highs and yesterday confidently consolidated above the 400.00 mark.

Technical indicators are still showing a stable buy signal and are ready to continue strengthening it: the range of fluctuations of the EMAs of the Alligator indicator is directed upwards, and AO histogram forms ascending bars.

Support levels: 395.00, 366.00.

Resistance levels: 410.00, 440.00.

Trading tips

If the global growth of the asset continues and the price consolidates above the local resistance level at 410.00, long positions with the target of 440.00 and stop-loss of 400.00 may be opened. Implementation time: 7 days and more.

If the asset continues to decline and the price consolidates below the support level at 395.00, one can open short positions with the target of 366.00 and stop-loss of 410.00.

Hot

No comment on record. Start new comment.