Current trend

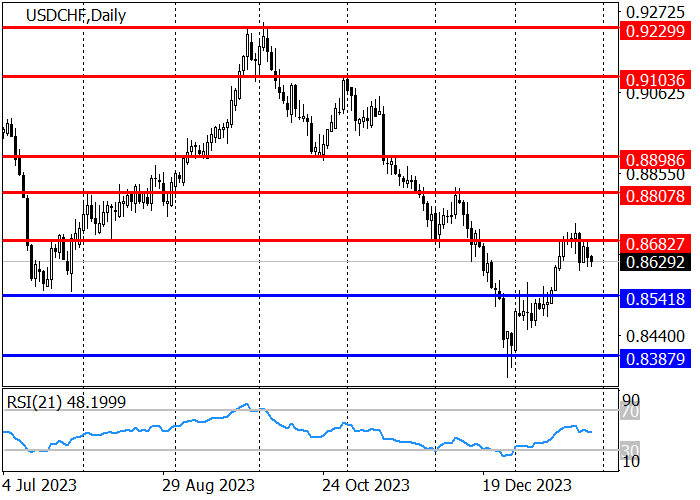

Last week, the USD/CHF pair returned below the resistance level of 0.8682, preparing to continue its decline if the American dollar weakens.

Market participants are awaiting the publication of the index of leading economic indicators from the Swiss Economic Institute (KOF) for January, which considers twelve indicators related to consumer confidence, production, new orders, and the real estate market, and also reflects economic prospects for the next six months: according to forecasts, the indicator will be 98.2 points, better than the previous value of 97.8 points, supporting the franc, however, statistics on the trade balance, which in December, according to preliminary estimates, will decrease from 3.707B francs to 2.550B francs, can put pressure on the positive dynamics.

On Wednesday, the US Federal Reserve will hold a meeting on monetary policy: experts do not expect any changes in it, while the regulator may signal in favor of a quick easing of rhetoric if downward trends in consumer inflation continue. On Friday, markets received further evidence of the negative dynamics of the indicator: the core price index for personal consumption expenditures in December slowed from 3.2% to 2.9%, exceeding estimates of 3.0% but the indicator strengthened from 0.1% to 0.2% MoM. If during the subsequent press conference, the head of the department, Jerome Powell, gives the market signals regarding the timing of interest rate cuts, then the USD/CHF pair will drop to around 0.8541.

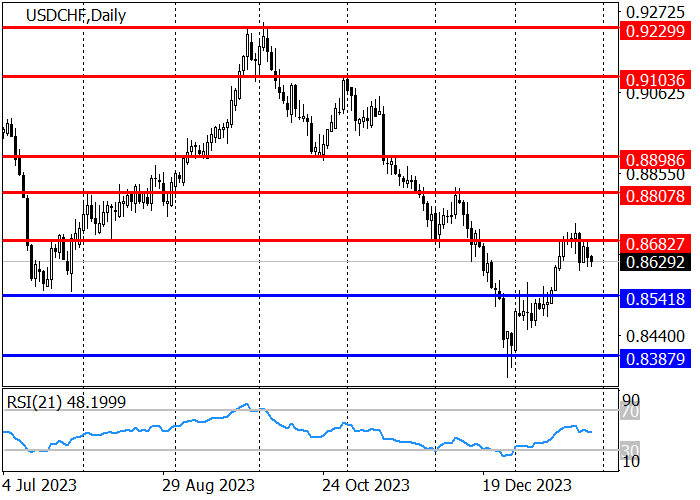

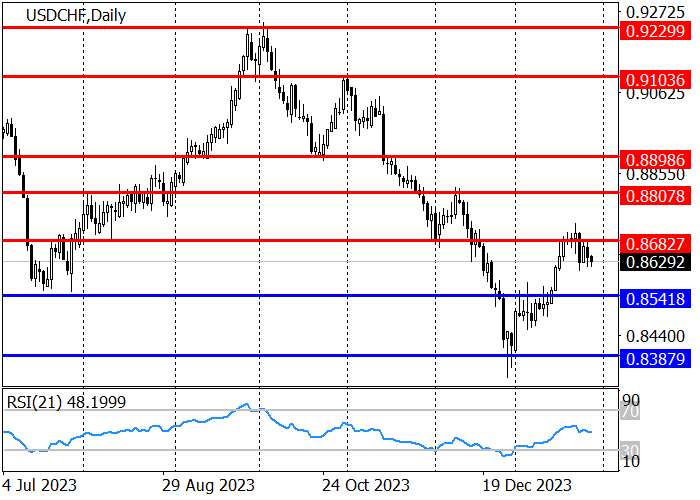

The long-term trend is downwards: the key resistance is at 0.8682, from which short positions can be considered with the target at 0.8541, after overcoming which the decline will continue to 0.8387. If the American dollar strengthens, the asset may overcome 0.8682, changing the trend upwards, after which long positions with the target at 0.8807 are relevant.

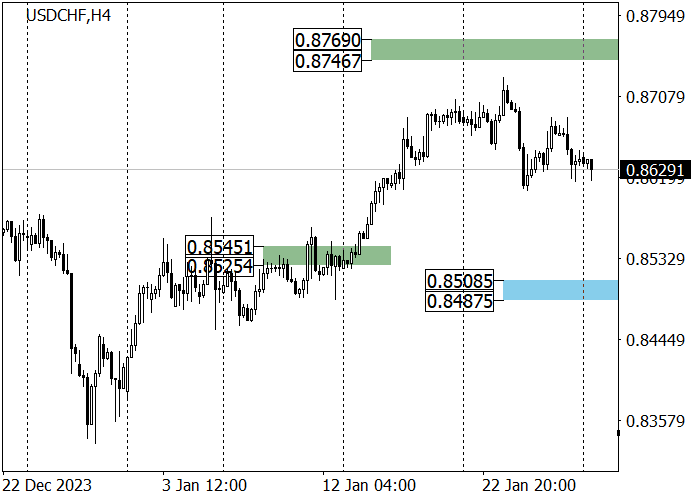

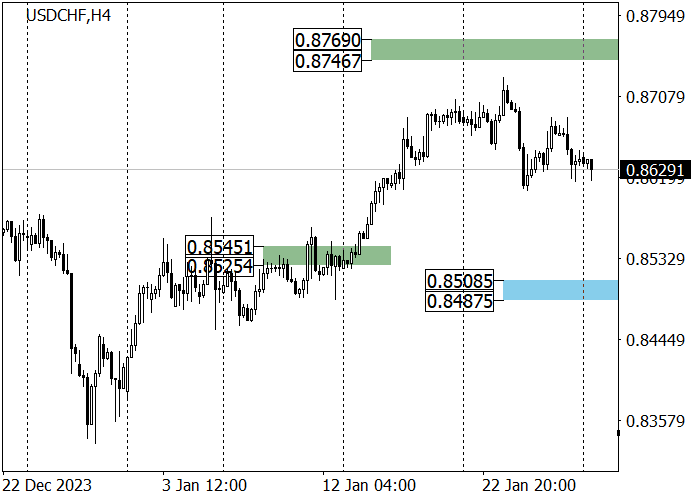

The medium-term trend is upwards: last week, the price approached zone 2 (0.8769–0.8746) but then began a downward correction. If it continues, the quotes may reach the key trend support area of 0.8508–0.8487, from where long positions with the target at the previous week’s high of 0.8721 are relevant.

Support and resistance

Resistance levels: 0.8682, 0.8807, 0.8898.

Support levels: 0.8541, 0.8387.

Trading tips

Short positions may be opened from 0.8682 with the target at 0.8541 and stop loss around 0.8725. Implementation time: 9–12 days.

Long positions may be opened above 0.8725 with the target at 0.8807 and stop loss around 0.8685.

Hot

No comment on record. Start new comment.