Current trend

One of the leading US indices, the NQ 100, shows corrective dynamics at around 17431.0 against the backdrop of positive quarterly reports from component companies, as well as dynamics in the bond market.

Payment system American Express Co. reported revenue of 15.80 billion dollars, topping the 15.38 billion dollars reported in the previous quarter against estimates of 16.0 billion dollars. Earnings per share fell from 3.30 dollars to 2.62 dollars, missing the 2.64 dollars that analysts had expected.

In turn, hygiene products manufacturer Colgate-Palmolive Co. posted revenue of 4.95 billion dollars, up from 4.92 billion dollars in the previous quarter and better than prior estimates of 4.89 billion dollars. In addition, the company managed to record earnings per share of 0.87 dollars, which beat the 0.86 dollars in the prior quarter and the 0.85 dollars estimate.

In turn, positive dynamics remain on the bond market: 10-year bonds are trading at a rate of 4.134%, which exceeds the low of January 12 at 3.922%, the yield on 20-year bonds is 4.480%, which is higher than the local January low at 4.281%, and the 30-year bonds are close to their January 24 peak of 4.400%.

The growth leaders in the index are Airbnb Inc. ( 5.28%), MercadoLibre Inc. ( 3.28%), Comcast Corp. ( 2.19%), Charter Communications Inc. ( 2.17%).

Among the leaders of the decline are Intel Corp. (-11.91%), KLA Corp. (-6.60%), GlobalFoundries Inc. (-4.77%).

Support and resistance

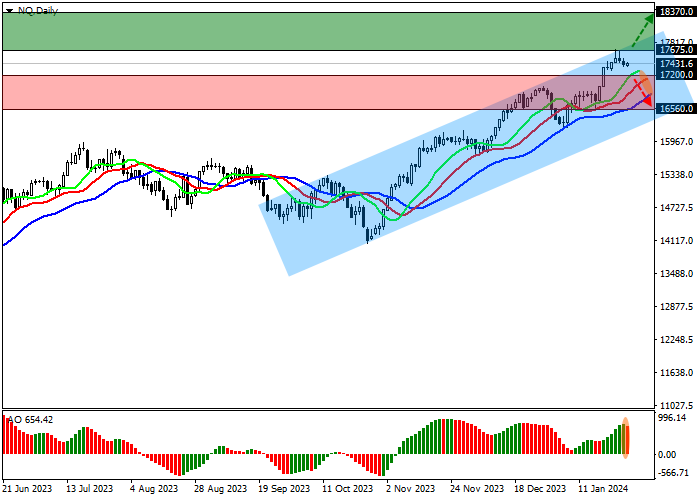

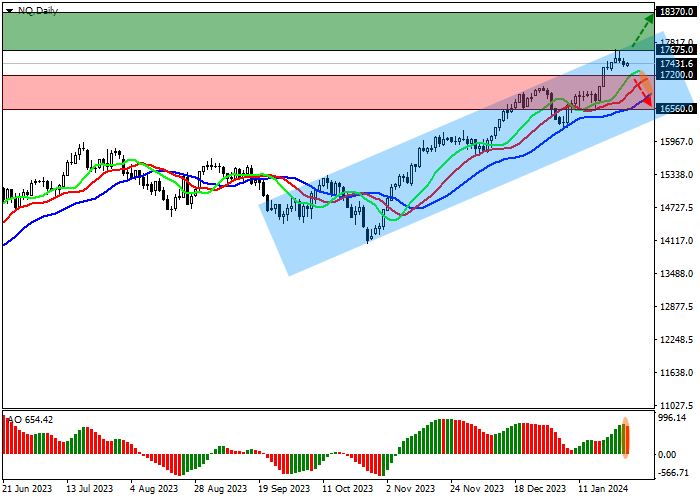

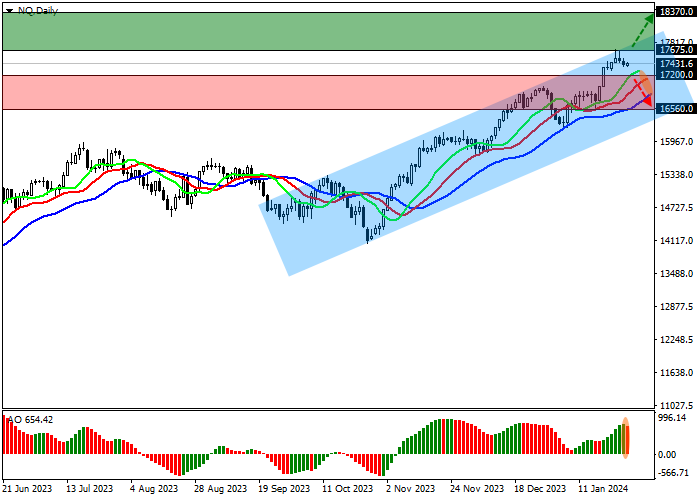

On the daily chart, the index quotes continue their global correction, which is developing within an ascending corridor with boundaries of 17400.0–16300.0.

Technical indicators hold a buy signal, which remains quite stable: fast EMAs on the Alligator indicator are above the signal line, and the AO histogram is forming new corrective bars, holding in the buy zone.

Support levels: 17200.0, 16560.0.

Resistance levels: 17675.0, 18370.0.

Trading tips

If the asset continues growing locally and consolidates above 17675.0, long positions with the target at 18370.0 will be relevant. Stop-loss — 17400.0. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 17200.0, short positions can be opened with the target at 16560.0. Stop-loss — 17400.0.

Hot

No comment on record. Start new comment.