Current trend

Against the stabilization of the American dollar and poor macroeconomic statistics from New Zealand, the NZD/USD pair is correcting at 0.6094.

Thus, the volume of exports in December decreased from 5.95B New Zealand dollars to 5.94B New Zealand dollars, and imports from 7.20B New Zealand dollars to 6.26B New Zealand dollars, as a result of which the trade balance adjusted from –1.25B New Zealand dollars to –0.323B New Zealand dollars, which resulted in a reduction in the deficit from –13.90B New Zealand dollars to –13.57B New Zealand dollars YoY. Minimal imports since February could cause shortages of some goods, causing consumer prices to rise.

The American dollar reacted neutrally to Friday’s macroeconomic data, trading at 103.200 in USDX, with household spending up 0.7% after rising 0.4% earlier, although their income rose 0.3% from 0.4% previously. In addition, the core price index of personal consumption expenditures adjusted by 0.2% in December, reducting it from 3.2% to 2.9% YoY. In general, the situation in the US economy is improving, supporting the national currency.

Support and resistance

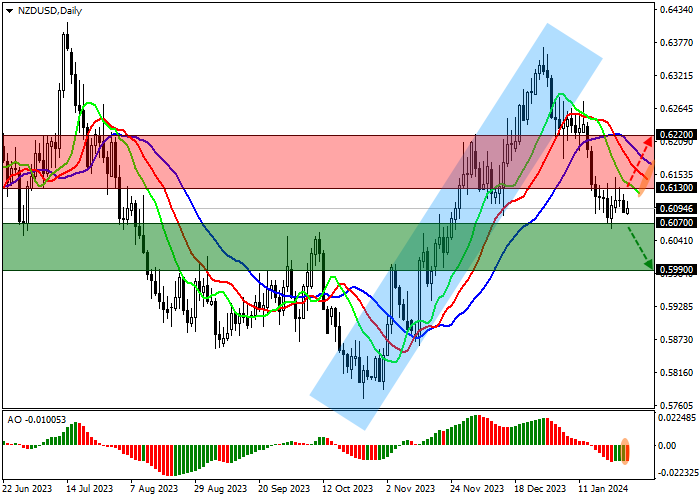

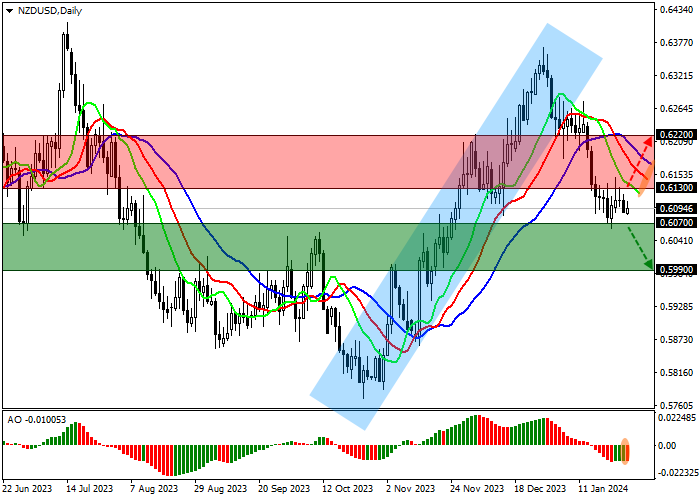

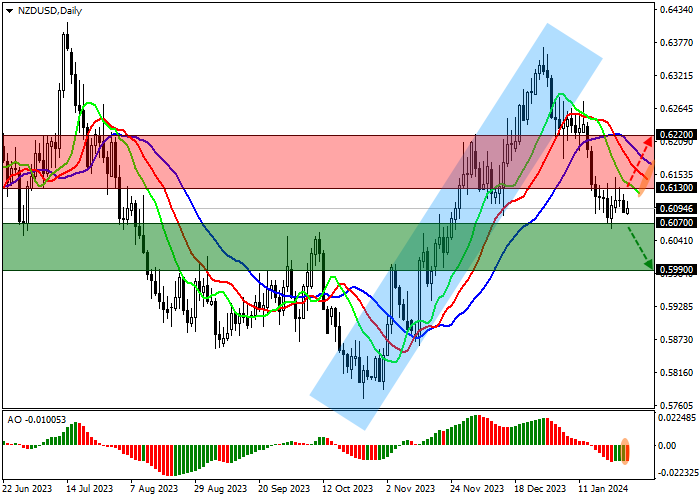

The trading instrument is correcting against the previous upward trend, holding below the support line of a narrow ascending channel with dynamic boundaries of 0.6320–0.6250.

Technical indicators are strengthening the sell signal: fast EMA on the Alligator indicator are moving away from the signal line, and the AO histogram is forming corrective bars, declining in the negative zone.

Resistance levels: 0.6130, 0.6220.

Support levels: 0.6070, 0.5990.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.6070 with the target at 0.5990. Stop loss – 0.6110. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 0.6130 with the target at 0.6220. Stop loss – 0.6080.

Hot

No comment on record. Start new comment.