Current trend

The USD/JPY pair is correcting at 140.02, renewed the lows of January 16, amid the stabilization of the American currency, which ended Friday trading with a slight decline.

Bank of Japan officials are waiting for an appropriate moment to switch to the “hawkish” rhetoric, and the key parameter preventing it is inflation: in January, the core consumer price index in the Tokyo metropolitan area corrected to –0.4% after 0.1% MoM and by 1.6% relative to 2.1% YoY. The consumer price index dropped from 2.4% to 1.6%, while the rate for the entire country was 2.2%, down from 2.7% previously.

The American currency consolidated at 103.200 in USDX against positive macroeconomic reports: the price index of personal consumption expenditures in December increased by 0.2% after –0.1% earlier and amounted to 2.6% YoY, without affecting the national currency, and the core value adjusted by 0.2% and slowed to 2.9% from 3.2% YoY, reaching the January low of 2021. Note that the Fed uses these statistics when calculating average inflation, and therefore it can significantly affect the results of the first monetary policy meeting this year.

Support and resistance

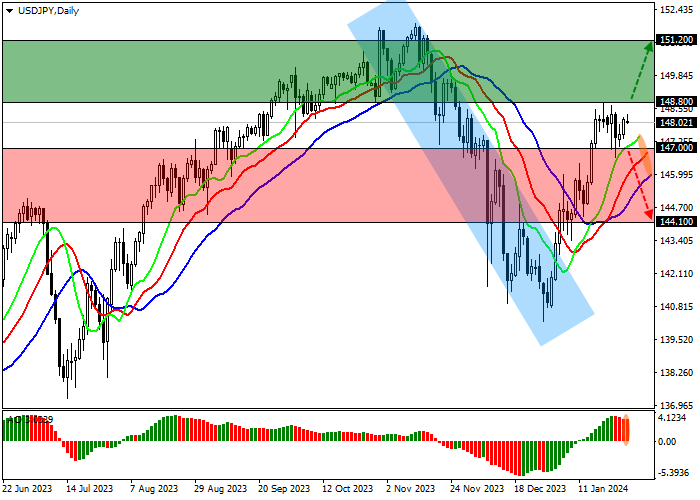

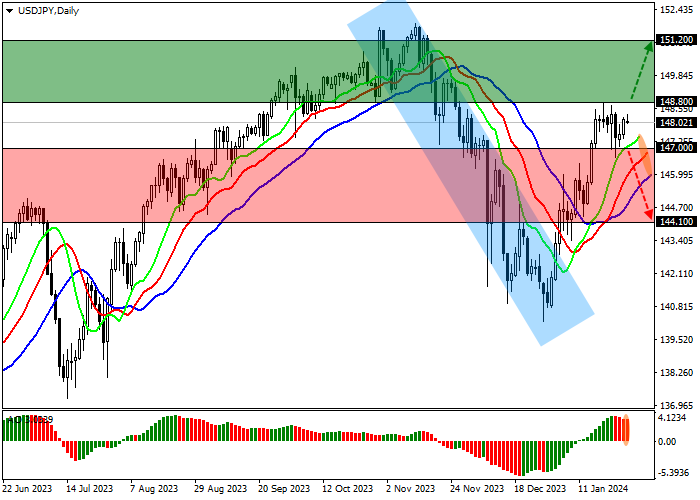

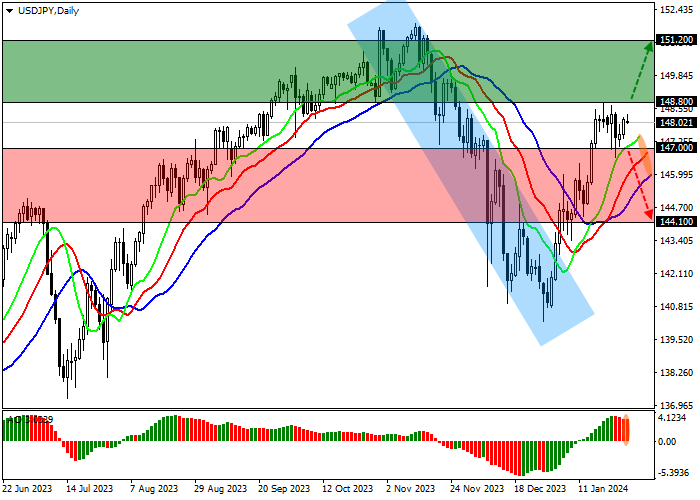

On the daily chart of the asset, the price is growing after leaving the local downward corridor of 144.10–142.10, approaching last year’s high of 151.50.

Technical indicators issued a buy signal: fast EMAs on the Alligator indicator stay above the signal line, expanding the range of fluctuations, and the AO histogram forms corrective bars in the buy zone.

Resistance levels: 148.80, 151.20.

Support levels: 147.00, 144.10.

Trading tips

Long positions may be opened after the price rises and consolidates above 148.80 with the target at 151.20. Stop loss – 148.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 147.00 with the target at 144.10. Stop loss – 148.00.

Hot

No comment on record. Start new comment.