Current trend

During the Asian session, the USD/CAD pair develops the “bearish” impulse formed at the end of last week and tests the level of 1.3445 for a breakdown.

On Wednesday, trading participants wait for the results of a two-day meeting of the US Federal Reserve on monetary policy: no changes in the interest rate are predicted, but official comments will be important. In addition, at the end of the week, the January report on the American labor market will be published, which may affect the regulator’s plans regarding the expected transition to the “dovish” rhetoric in the first half of the year: according to preliminary estimates, January nonfarm payrolls may decrease from 216.0K to 173.0K, the unemployment rate may adjust from 3.7% to 3.8%, and the average hourly wage — from 0.4% to 0.3%.

Last Friday, analysts received confirmation of a further decline in inflation in the country: the core price index for personal consumption expenditures in December strengthened from 0.1% to 0.2% MoM but slowed from 3.2% to 2.9% – YoY, below expectations of 3.0%, allowing US Federal Reserve officials to begin reducing borrowing costs in June if geopolitical factors do not cause a new rise in consumer prices.

The Canadian labor market report will not appear until next week, therefore, the focus of investors’ attention will only be the publication of gross domestic product (GDP) data on Wednesday: forecasts suggest an acceleration of the national economy in November by 0.1% after zero dynamics earlier.

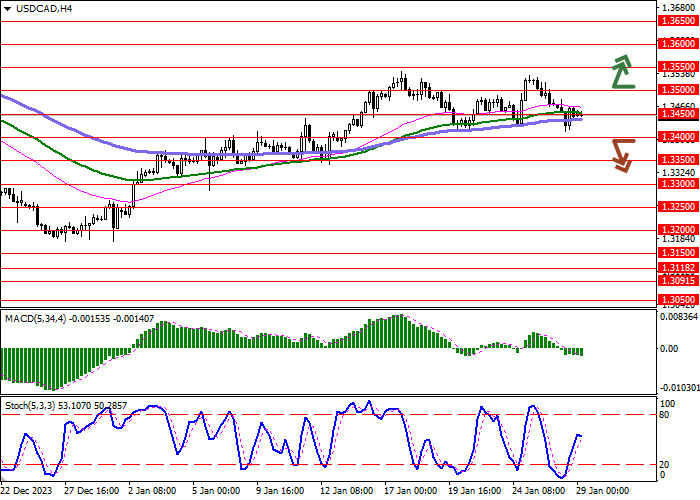

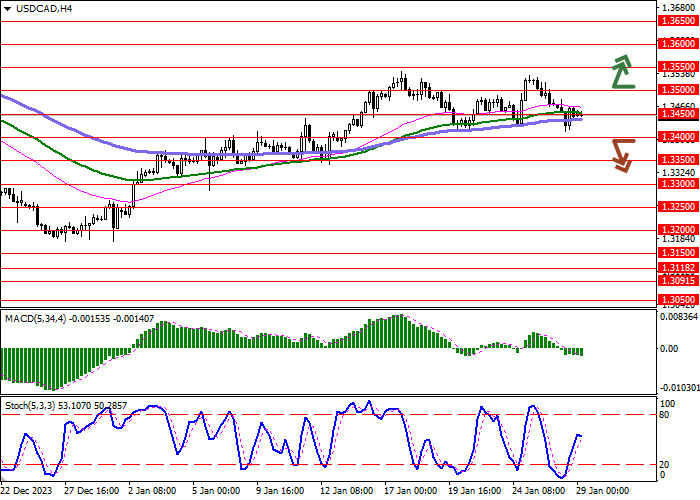

Support and resistance

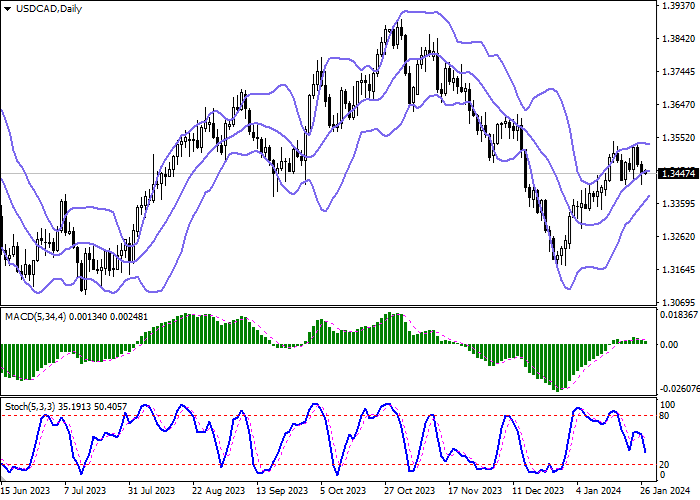

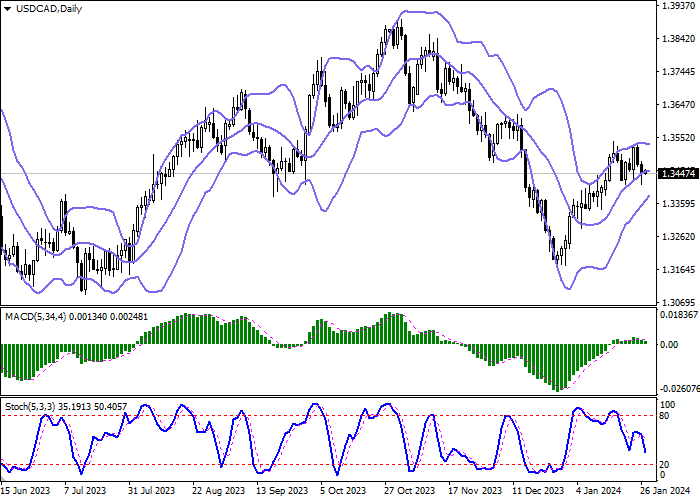

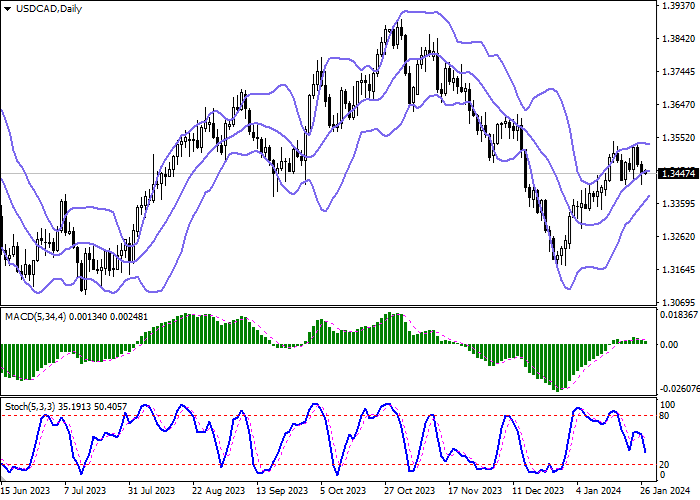

On the daily chart, Bollinger bands reverse horizontally: the price range is narrowing, reflecting the ambiguous nature of trading in the short term. The MACD indicator reversed downwards, forming a new sell signal (the histogram is below the signal line), and is trying to consolidate below the zero level. Stochastic shows similar dynamics but the indicator line is quickly approaching its lows, indicating that the American dollar may become oversold in the ultra-short term.

Resistance levels: 1.3500, 1.3550, 1.3600, 1.3650.

Support levels: 1.3450, 1.3400, 1.3350, 1.3300.

Trading tips

Short positions may be opened after a breakdown of 1.3400 downwards with the target at 1.3300. Stop loss – 1.3450. Implementation time: 2–3 days.

Long positions may be opened after 1.3500 is broken upward with the target at 1.3600. Stop loss – 1.3450.

Hot

No comment on record. Start new comment.