Current trend

During the Asian session, the NZD/USD pair declines slightly, remaining close to 0.6100: this week, the trading was quite active but today, the price has returned to Monday’s opening levels.

New Zealand’s Service Performance Index (PSI) in December fell short of experts’ expectations of 51.5 points and amounted to 48.8 points, and its composite value was 46.8 points, below the forecast of 49.6 points. The final impact on the national currency was exerted by statistics on consumer prices: the indicator slowed down from 1.8% to 0.5% QoQ and from 5.6% to 4.7% YoY. Thus, the negative dynamics of the New Zealand dollar are likely to continue if the US currency strengthens after the publication of data on the dynamics of personal consumption expenditures at 15:30 (GMT 2): the core indicator in December, according to preliminary estimates, will increase from 0.1% to 0.2% MoM and will slow down from 3.2% to 3.0% YoY. This indicator is actively used by the US Federal Reserve when assessing inflation in the country, and therefore, a lot of attention is paid to publications.

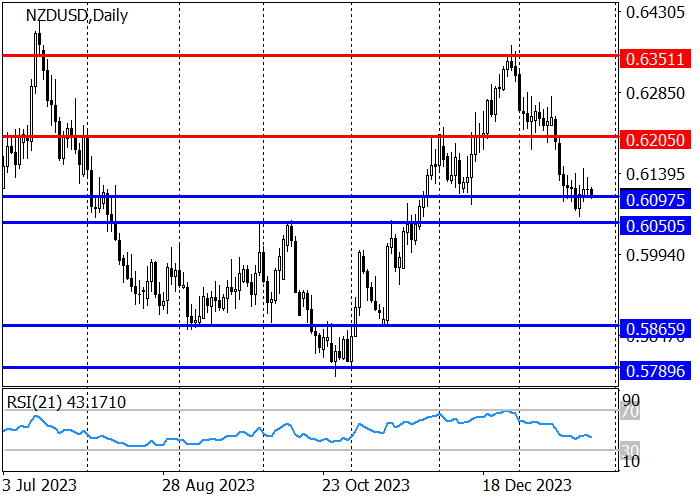

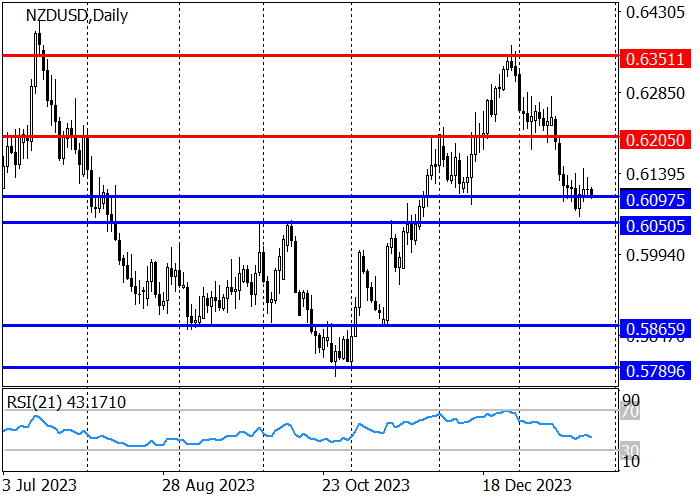

The long-term trend is upwards but now, the price is correcting, having reached the support area of 0.6097–0.6050, from which long positions with the target at 0.6351 are relevant but, to open them, it is necessary to fix an impulse upward movement. Otherwise, the quotes may continue to fall, breaking through the area of 0.6097–0.6050, after which they may reach the key trend support level of 0.5865.

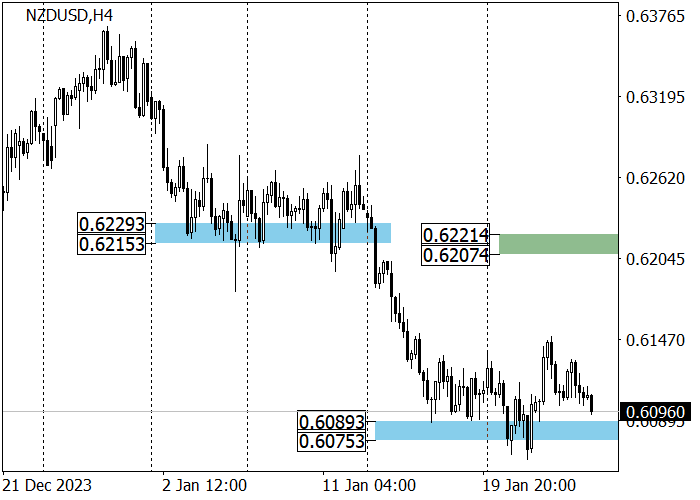

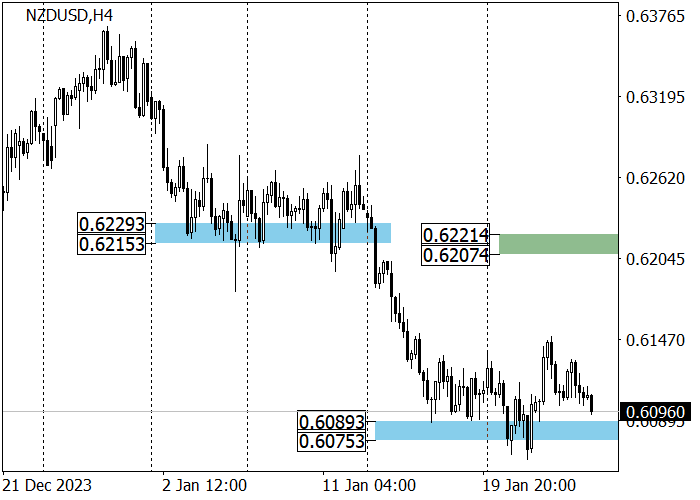

The medium-term trend is downwards: this week, the asset tested zone 2 (0.6089–0.6075), corrected, and began to approach it again. From this area, long positions with the target in the key trend resistance area of 0.6221–0.6207 are relevant. After a breakdown of zone 2, the next sales target will be 0.5949–0.5935.

Support and resistance

Resistance levels: 0.6205, 0.6351.

Support levels: 0.6097, 0.6050, 0.5865.

Trading tips

Long positions may be opened from 0.6050 with the target at 0.6205 and stop loss around 0.6000. Implementation time: 9–12 days.

Short positions may be opened below 0.6000 with the target at 0.5865 and stop loss around 0.6060.

Hot

No comment on record. Start new comment.