Current trend

The leading US economy index S&P 500 is correcting around 4879.0.

Yesterday, companies in the technology sector began publishing their financial results. So, the corporation is a manufacturer of semiconductor elements Intel Corp reported revenue of 15.40 billion dollars, which exceeded analysts' forecast of 15.16 billion dollars, as well as the previous quarter's figure of 14.20 billion dollars. Earnings per share (EPS) amounted to 0.54 dollars with preliminary estimates of 0.45 dollars.

In turn, the Visa Inc. payment system recorded revenue of 8.60 billion dollars, which exceeded the 8.55 billion dollars expected by analysts and repeated the figure of the previous quarter. EPS reached 2.41 dollars, exceeding both the 2.34 dollars forecast and the 2.33 dollars shown a quarter earlier.

Chemical company Dow Inc. showed revenue of 10.62 billion dollars after 10.70 billion dollars in the previous quarter, with expectations of 10.42 billion dollars, and EPS exceeded the projected 0.40 dollars, amounting to 0.43 dollars after 0.48 dollars earlier.

The growth leaders in the index are United Rentals Inc. ( 12.96%), American Airlines Group ( 10.27%), IBM Corp. ( 9.53%), ResMed Inc. ( 8.48%).

Among the leaders of the decline are Tesla Inc. (-12.13%), Humana Inc. (-11.59%), and Northrop Grumman Corp. (-6.20%).

Support and resistance

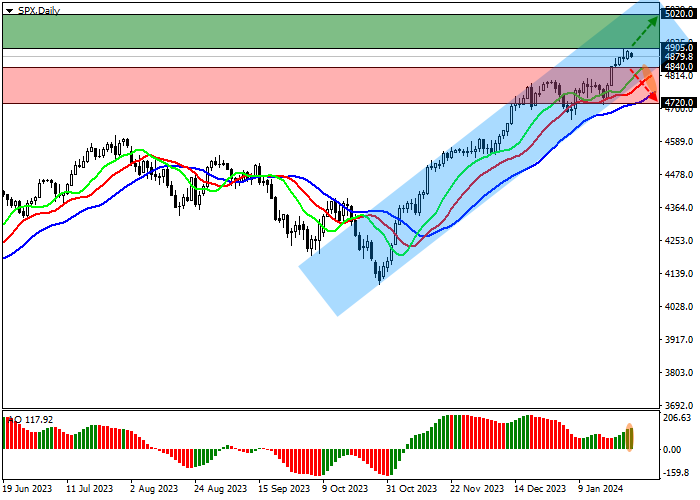

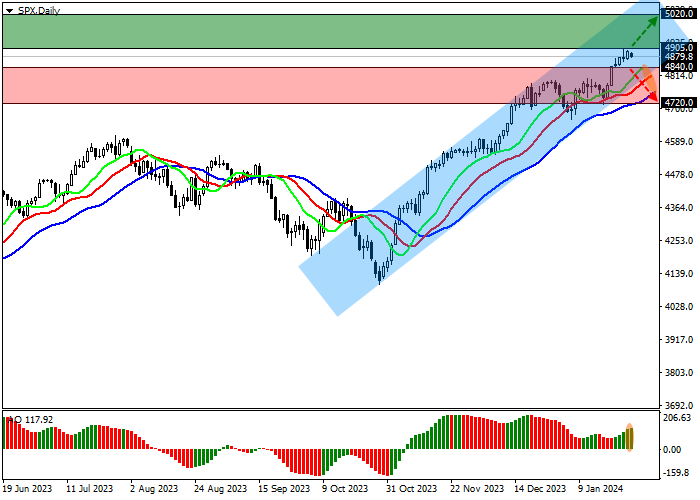

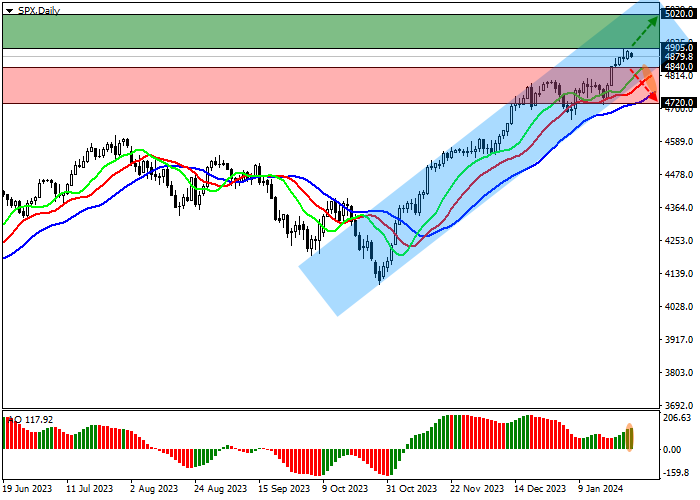

On the D1 daily chart, the index quotes continue to grow globally, moving towards the resistance line of the ascending channel with borders of 4900.0–4800.0.

Technical indicators hold the global buy signal, which continues to strengthen: the fast EMAs on the Alligator indicator continue to move away from the signal line, and the AO histogram, being in the buy zone, continues to form ascending bars.

Support levels: 4840.0, 4720.0.

Resistance levels: 4905.0, 5020.0.

Trading tips

In case of continued global growth of the asset, as well as price consolidation above the local resistance level of 4905.0, buy positions with the target of 5020.0 may be opened. Stop-loss – 4850.0. Implementation time: 7 days and more.

In the event of a reversal and decline of the asset, as well as price consolidation below the local support level of 4840.0, sell positions with the target of 4720.0 can be opened. Stop-loss – 4920.0.

Hot

No comment on record. Start new comment.