Current trend

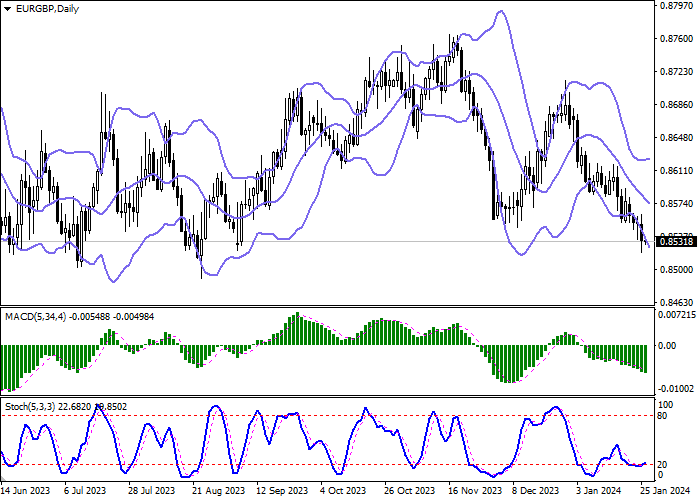

The EUR/GBP pair is correcting downwards, holding near 0.8530 and preparing to end the trading week with a noticeable decline, which led to the update of local lows from August 23 the day before.

The position of the single currency was put under pressure the day before by the results of the meeting of the European Central Bank (ECB): as expected, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 4.50%, 4.75% and 4.00% respectively. Officials noted weak economic growth in the region and ongoing risks to financial stability, although statistics record positive changes in inflation dynamics. In addition, the President of the ECB, Christine Lagarde, emphasized that at the moment she considers it premature to discuss reducing the cost of borrowing. In addition, the day before, investors assessed German data on Business Climate from the Institute for Economic Research (IFO): in January, the indicator fell from 86.3 points to 85.2 points, while analysts expected 86.7 points, and the index of Economic Expectations - from 84 .2 points to 83.5 points with a forecast of 84.8 points.

In turn, the pound is strengthening its position, as experts are confident that the Bank of England will launch a program to reduce interest rates later than the US Federal Reserve and the ECB. Inflation in the UK remains noticeably higher than the American and European indicators, but the trends towards easing price pressure are still quite significant. The British currency was also supported by January data on business activity, published on Wednesday, January 24: the Manufacturing PMI from S&P Global rose from 46.2 points to 47.3 points, while experts expected 46.7 points, and the Services PMI strengthened from 53.4 points to 53.8 points, with preliminary estimates of 53.2 points.

Support and resistance

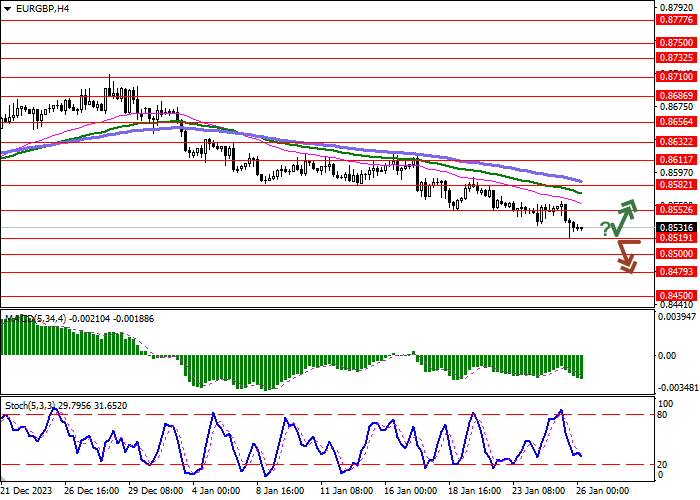

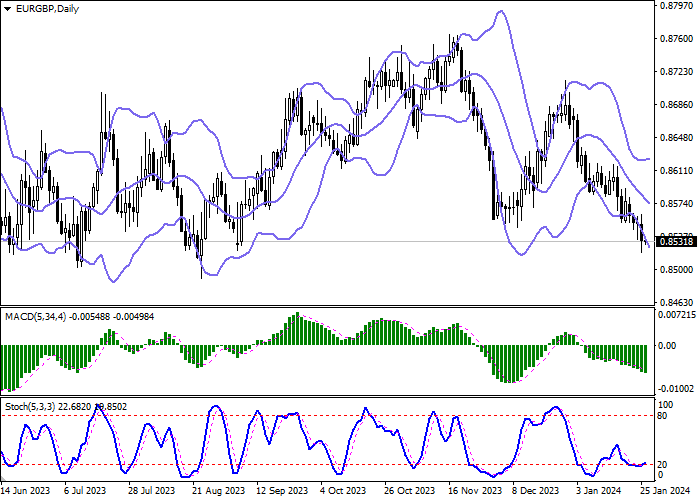

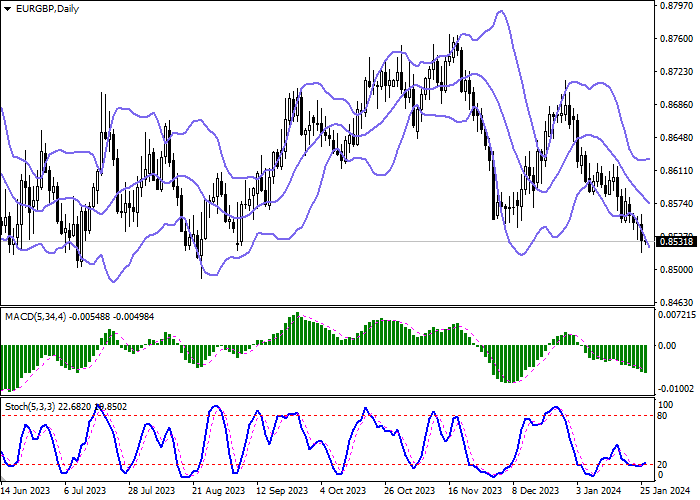

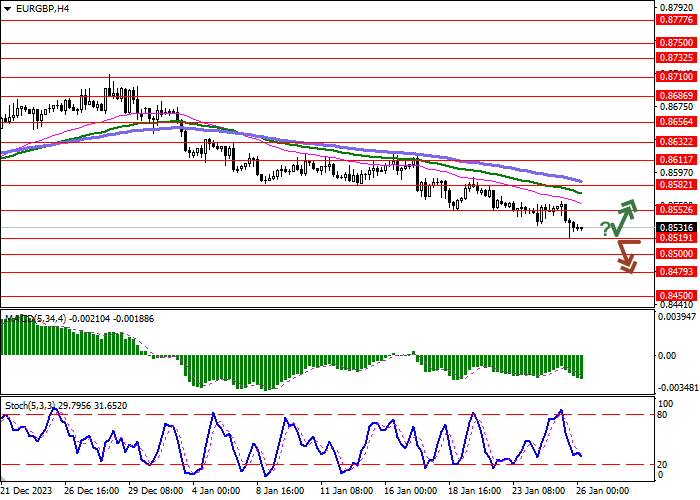

Bollinger Bands on the daily chart show a steady decline. The price range is expanding, but at the moment it is not keeping up with the surge of "bearish" sentiment. MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic, approaching the level of "20", is trying to reverse into an upward plane, signaling significant risks of the single currency being oversold in the ultra-short term.

Resistance levels: 0.8552, 0.8582, 0.8611, 0.8632.

Support levels: 0.8519, 0.8500, 0.8479, 0.8450.

Trading tips

Short positions may be opened after a breakdown of 0.8519 with the target at 0.8465. Stop-loss — 0.8552. Implementation time: 2-3 days.

A rebound from 0.8519 as from support followed by a breakout of 0.8552 may become a signal for opening new long positions with the target at 0.8611. Stop-loss — 0.8519.

Hot

No comment on record. Start new comment.