Current trend

The USD/JPY pair shows moderate growth, developing the "bullish" impetus formed the day before and testing 147.75 for a breakout, while investors evaluate statistics from Japan.

In January, the Consumer Price Index in the Tokyo region slowed down from 2.4% to 1.6%, and the CPI excluding Food and Energy went from 3.5% to 3.1%. Such a significant weakening of inflationary pressure could lead to the Bank of Japan continuing to maintain an accommodative monetary policy. Despite expectations that the regulator will soon abandon negative interest rates, the likelihood of an increase in borrowing costs decreases along with the Consumer Price Index.

The Japanese government's monthly economic report was published yesterday, assessing the impact of the strong earthquake on the Noto Peninsula in Ishikawa Prefecture, as well as setting out short-term forecasts for exports, production and consumption. Officials noted that the aftermath of the disaster will require additional attention from the authorities: Ishikawa Prefecture, which suffered the greatest damage, accounts for only 0.8% of the country's Gross Domestic Product (GDP), but is home to important equipment and semiconductor manufacturing plants that have not resumed operations.

Meanwhile, the US currency is supported by evidence of the stability of the national economy, which allows the US Federal Reserve not to rush to begin easing its rhetoric. Data released yesterday showed Gross Domestic Product (GDP) rising 3.3% in the fourth quarter of 2023, following a 4.9% rise in the previous period and expectations of 2.0%. At the same time, labor market statistics reflected a noticeable increase in the number of Initial Jobless Claims for the week ended January 19 from 189.0 thousand to 214.0 thousand with a forecast of 200.0 thousand, and Continuing Jobless Claims for the week ended January 12 increased from 1.806 million to 1.833 million, while analysts were expecting 1.828 million.

Support and resistance

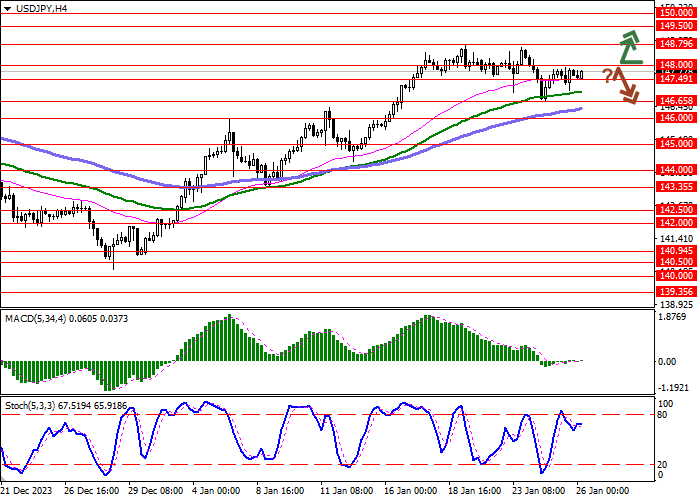

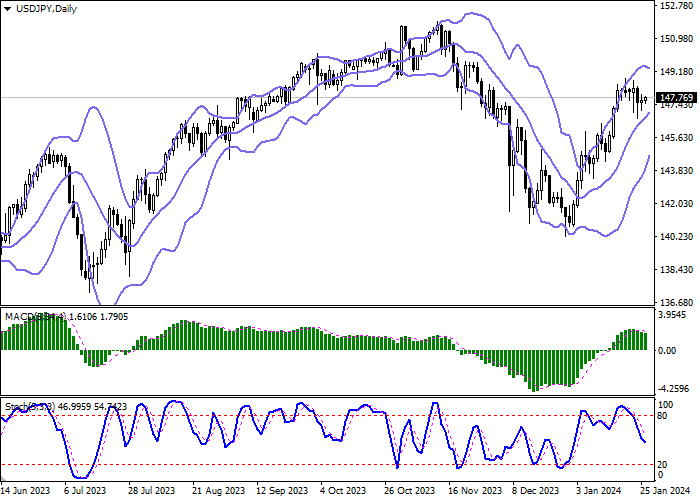

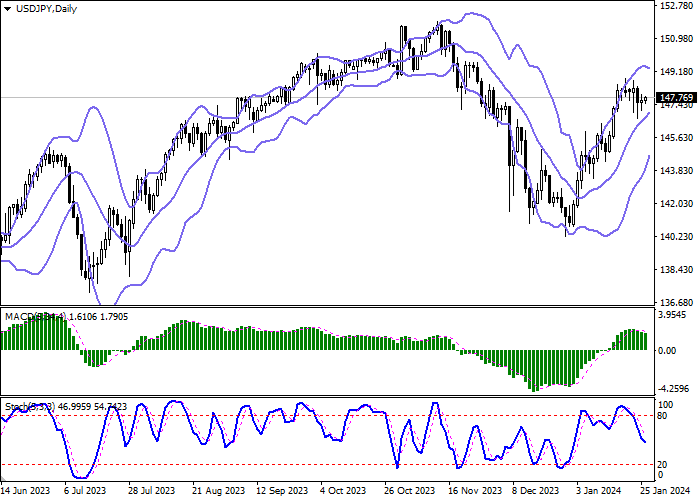

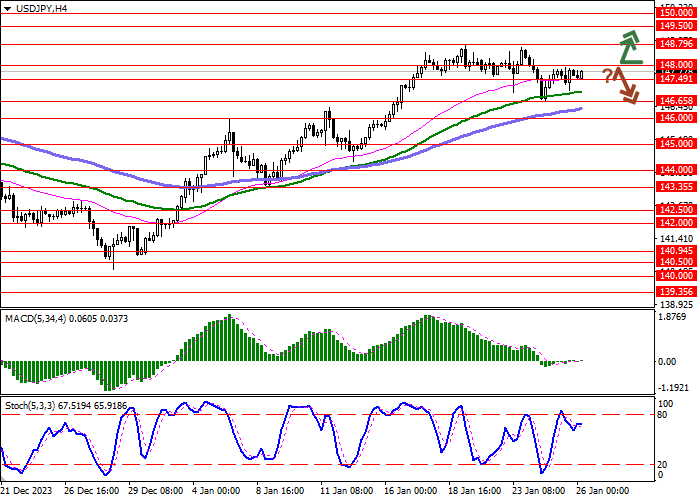

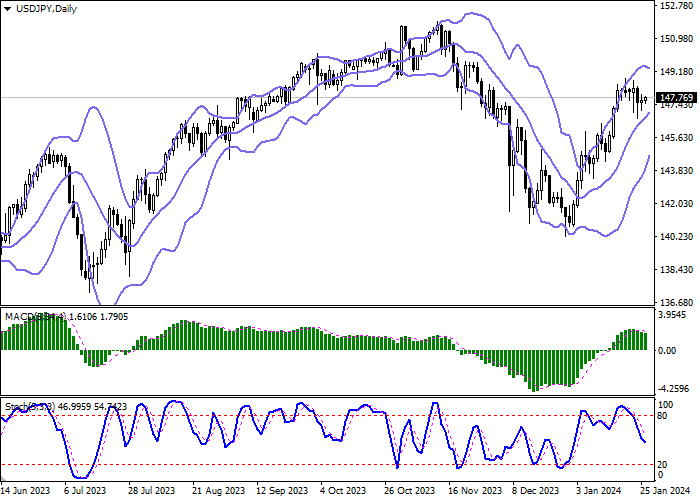

Bollinger Bands on the daily chart show a steady increase. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic is showing more stable decline and is located in the middle of its area.

Resistance levels: 148.00, 148.79, 149.50, 150.00.

Support levels: 147.49, 146.65, 146.00, 145.00.

Trading tips

Long positions can be opened after a breakout of 148.00 with the target of 149.50. Stop-loss — 147.35. Implementation time: 2-3 days.

A rebound from 148.00 as from resistance, followed by a breakdown of 147.49 may become a signal for opening of new short positions with the target at 146.00. Stop-loss — 148.20.

Hot

No comment on record. Start new comment.