Current trend

Shares of Johnson & Johnson, one of the world’s leading retail holdings, rose to the area of 163.50 but corrected sharply down to 156.92, having now won back some of the losses.

The negative trend continued after the financial report was released: in the fourth quarter, the company’s revenue increased 7.3% to 21.40B dollars, above the 21.01B dollars average expected, net income was 4.13B dollars, and adjusted earnings per share – 2.29 dollars. The growth was driven by increased sales of pharmaceutical products and medical equipment. However, investors were disappointed that the financial forecast for 2024 was not revised upward: the corporation’s management confirmed the expectation that operating sales would grow by 5.0–6.0% to 88.2B–89.0B dollars. Adjusted earnings per share could be 10.55 dollars to 10.75 dollars.

Additional pressure on the quotes was exerted by reports of significant amounts of fines in recently completed legal proceedings: the pharmaceutical giant will have to pay 700.0M dollars to citizens affected by Johnson & Johnson baby powder, which could cause cancer, and another 149.5M dollars will be sent to settle a lawsuit with Washington state authorities over the opioid crisis.

Despite the current correction, market participants remain optimistic about the issuer’s securities.

Support and resistance

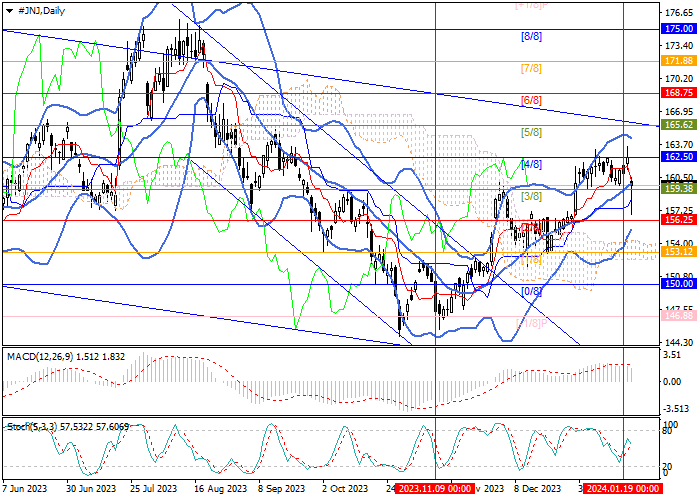

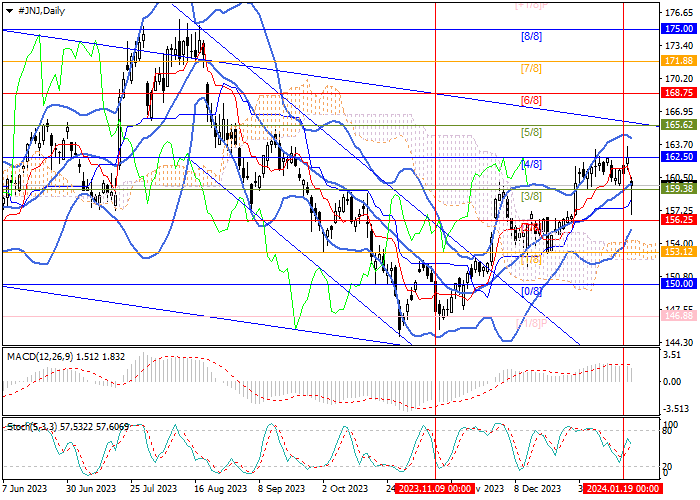

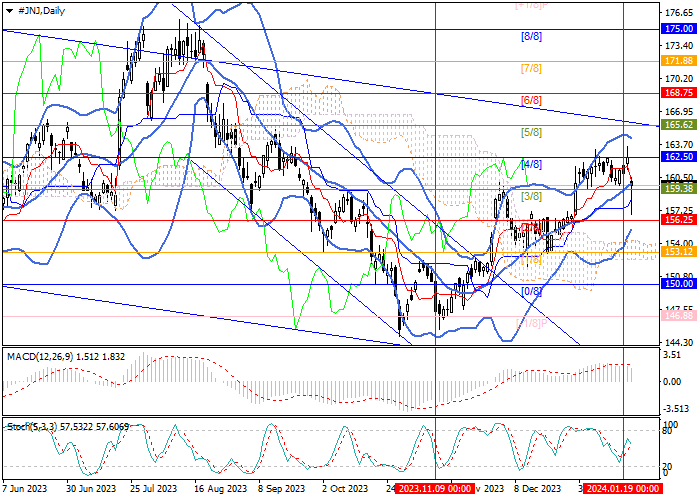

The trading instrument has returned to the middle line of Bollinger bands and is preparing to continue growing: if it consolidates above 162.50 (Murrey level [4/8]), its targets will be the area of 165.62 (Murrey level [5/8], the upper limit of the downwards channel) and 168.75 (level Murrey [6/8]). The key level for the bears is 156.25 (Murrey level [2/8]), in which case it is possible to reach 150.00 (Murrey level [0/8]).

Technical indicators confirm the possibility of further growth: Bollinger Bands and Stochastic are directed upward, and the MACD histogram is decreasing in the positive zone.

Resistance levels: 162.50, 165.62, 168.75.

Support levels: 156.25, 150.00.

Trading tips

Long positions may be opened above 162.50 with the targets at 165.62, 168.75 and stop loss around 160.70. Implementation time: 5–7 days.

Short positions may be opened below 156.25 with the target at 150.00 and stop loss 158.40.

Hot

No comment on record. Start new comment.