We present a medium-term investment review of the GBP/USD currency pair.

The UK remains one of the few developed world economies where the consumer price index exceeds 4.0%, and all the steps of the Bank of England and the Ministry of Finance to reduce the indicator do not bring a significant effect: the current weakening of inflation is developing solely against falling stock prices for fuel and electricity. The interest rate consolidated at 5.25%, and almost no one doubts its preservation at the meeting on February 1 but the consumer price index in December amounted to 4.0%, increasing from a low value of 3.9% earlier, and the core indicator excluding food and fuel prices remains at 5.1%. In addition, the pound is under pressure from the consumption sector: according to the December report, the core retail sales index corrected by –3.3% after 1.5% MoM and by –2.1% from 0.5% YoY in November, and their volume is –3.2% MoM from 1.4% previously and –2.4% YoY.

The American dollar has been trading in a narrow range for two weeks now at an average level of 103.000 in USDX under the pressure of macroeconomic data: thus, sales on the secondary housing market have renewed a historical low of 3.78M compared to 3.82M previously. On the other hand, the labor sector began to recover: initial jobless claims decreased to 187.0K, significantly better than the average of 210.0K–220.0K applications at the end of autumn. In addition, the core retail sales index in December increased by 0.4%, and their volume increased by 0.6%, significantly exceeding the British indicators.

As a result, with all the weakness and instability of the American economy, the situation in the UK seems uncertain, and the weakening of the pound may cause a continuation of the downward trend in the GBP/USD pair in the next quarter.

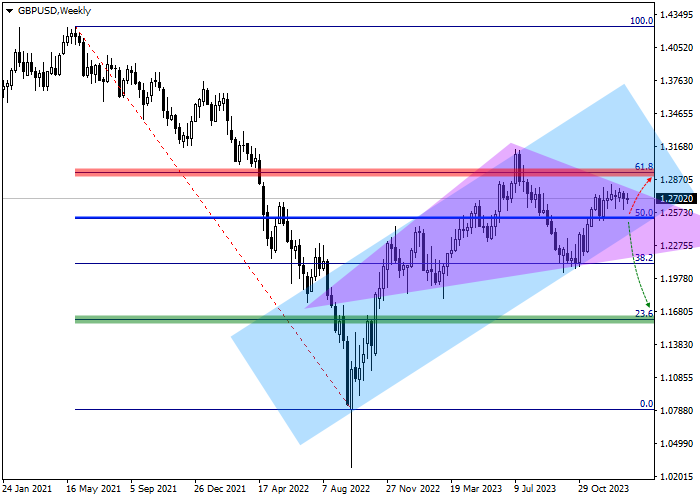

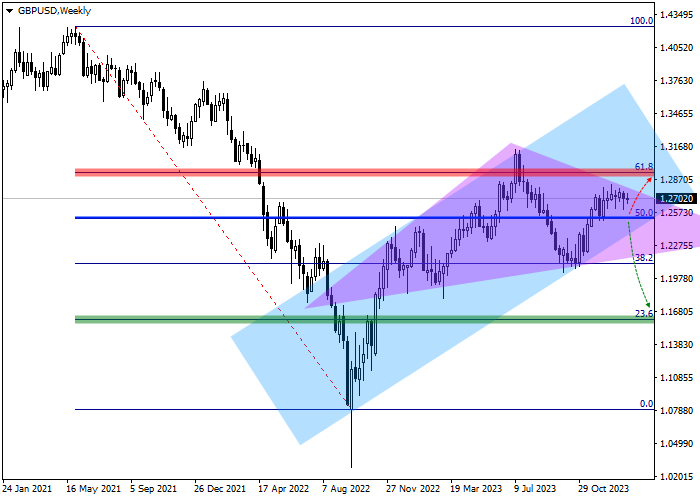

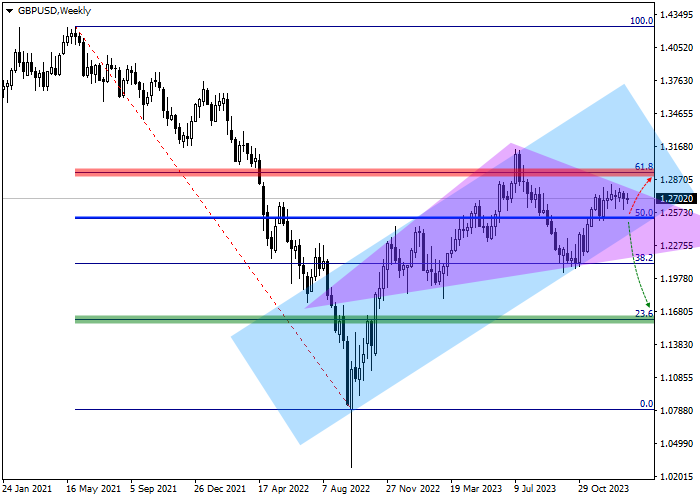

In addition to the underlying fundamental factors, the continuation of negative dynamics is also confirmed by technical indicators: on the weekly chart, the price is moving within the global ascending corridor of 1.3420–1.2300, approaching its support line.

The formation of a global Head and shoulders reversal pattern is becoming clear, the Neckline of which coincides with the basic 38.2% Fibonacci correction at 1.2110. Let’s consider the key levels on the daily chart.

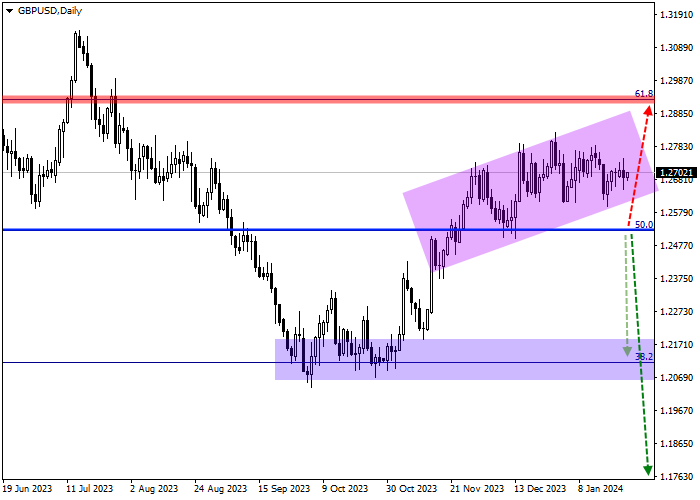

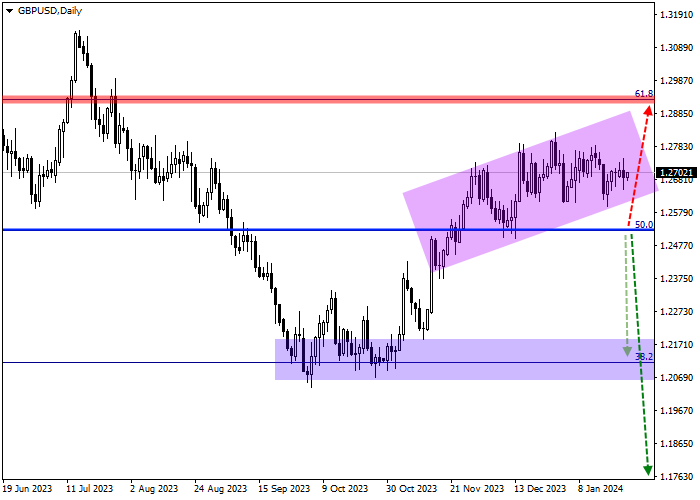

On the daily chart, the price is consolidating above the resistance line of the global ascending corridor, in which it has been moving since the fall of 2022, preparing to test the 50.0% Fibonacci level at 1.2520. If 1.2920 is reached, which coincides with the 61.8% Fibonacci full correction level, the global downward scenario will be canceled, and it is better to liquidate sell positions. The target zone is around the initial correction level of 23.6% Fibonacci at 1.1610, after reaching which it is better to take profit on open sell positions.

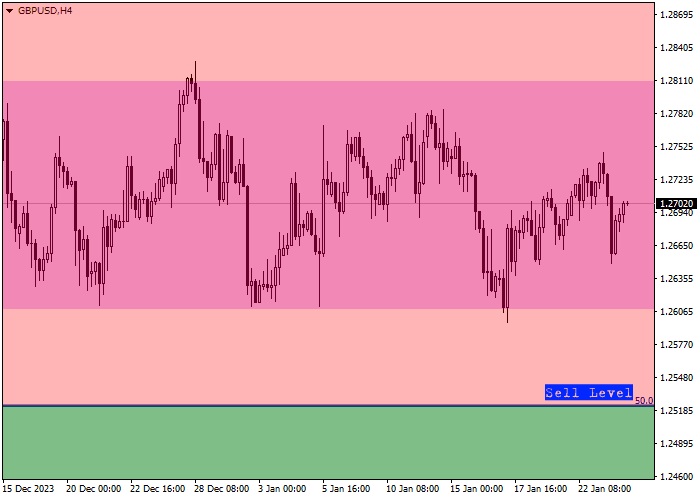

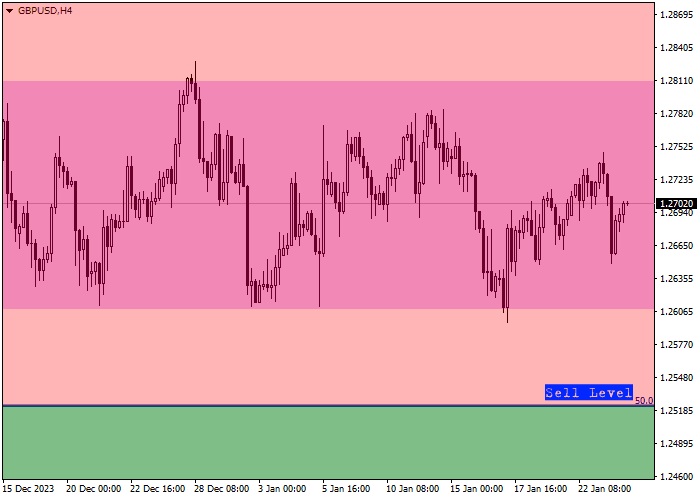

Let’s assess entry levels in more detail on the four-hour chart.

The entry level for sell transactions is at 1.2520, which coincides with the 50.0% Fibonacci intermediate correction, and a local signal can be received as early as this week, when the quotes overcome last week’s local high, confirming the formation of global sell positions.

Considering the average daily volatility of a trading instrument over the last month, which is the pair’s average of 54.7 points, the price movement to the target level of 1.1610 may take approximately 49 trading sessions but if volatility increases, the time may reduce to 42 days.

Hot

No comment on record. Start new comment.