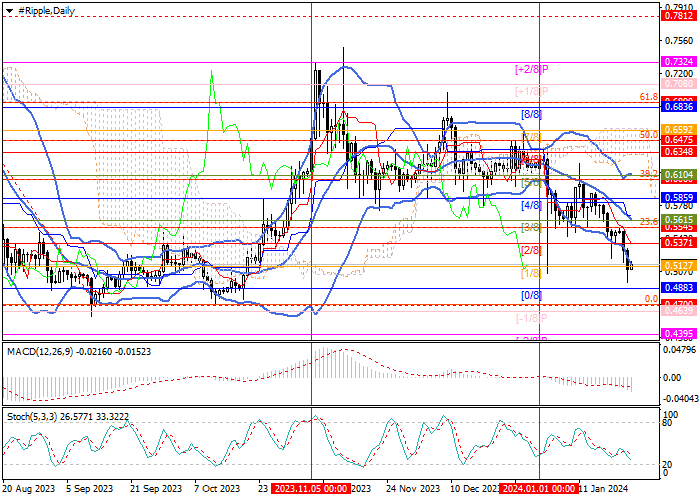

Current trend

The XRP/USD pair has continued to decline since the beginning of this month, gradually losing ground gained last year, amid a court decision not recognizing the XRP token as a security. Currently, two market-wide factors are putting pressure on quotes: investors taking profits after the approval of the Bitcoin ETF by the US Securities and Exchange Commission (SEC) and the likelihood of postponing the start of easing of monetary policy by the US Federal Reserve.

This week the price reached 0.5127 (Murrey level [1/8]), which it is now actively testing. Consolidation below it will allow quotes to continue declining towards targets 0.4700 (Fibonacci retracement 0.0%) and 0.4395 (Murrey level [-2/8]). The key level for the "bulls" seems to be 0.5615 (Murrey level [3/8], Fibonacci retracement 23.6%), supported by the center line of Bollinger Bands. If it is broken out, the growth of quotes can resume to the levels of 0.6104 (Murrey level [5/8], Fibonacci retracement 38.2%) and 0.6592 (Murrey level [7/8]).

The short-term downward trend in the market continues, which is confirmed by technical indicators: Bollinger Bands and Stochastic are directed downward, and MACD is increasing in the negative zone.

Support and resistance

Resistance levels: 0.5615, 0.6104, 0.6592.

Support levels: 0.5127, 0.4700, 0.4395.

Trading tips

Short positions could be opened below 0.5127 with targets at 0.4700, 0.4395 and stop-loss at 0.5340. Implementation period: 5-7 days.

Long positions may be opened above 0.5615 with targets at 0.6104, 0.6592 and stop-loss at 0.5280.

Hot

No comment on record. Start new comment.