Current trend

The USD/JPY pair is falling to 147.77 due to the strengthening of the yen against positive macroeconomic statistics.

Thus, yesterday, the Bank of Japan maintained the parameters of monetary policy, causing a downward movement of yen, which managed to restore its positions, as investors heard signals for the imminent completion of the “ultra-dovish” course: the head of the regulator, Kazuo Ueda, noted that inflation is confidently moving towards the 2.0% target. Today, data on business activity in January was published: the manufacturing PMI increased from 47.9 points to 48.0 points, slightly below the forecast of 48.2 points, and the services PMI – from 51.5 points to 52.7 points, exceeding expectations of 51.0 points, and the composite PMI reached 51.1 points, higher than the estimated 49.5 points and 50.0 points previously. Additionally, January imports adjusted to –6.8% YoY from early estimates of –5.3% but exports rose to 9.8% from the 9.1% forecast, resulting in a trade surplus amounted to 62.1B yen, supporting the national currency.

The five-year US index of consumer inflation expectations from the University of Michigan fell from 2.9% to 2.8% in January, although analysts had expected growth to 3.0%, which contributes to a decline in the dollar as the US Federal Reserve may move towards monetary easing credit policy in the first or second quarter.

Support and resistance

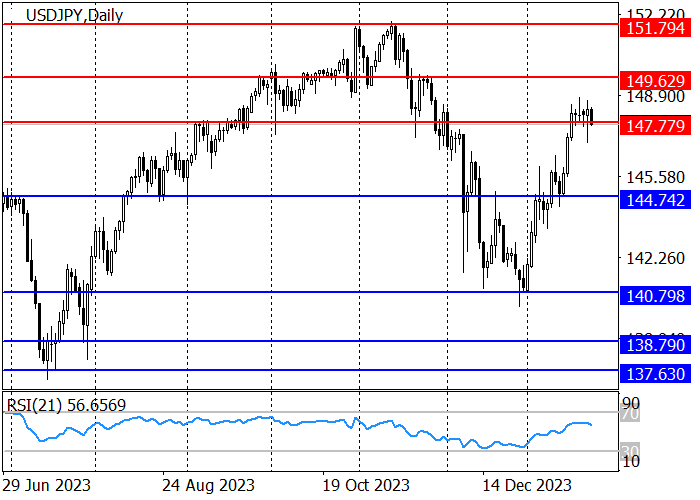

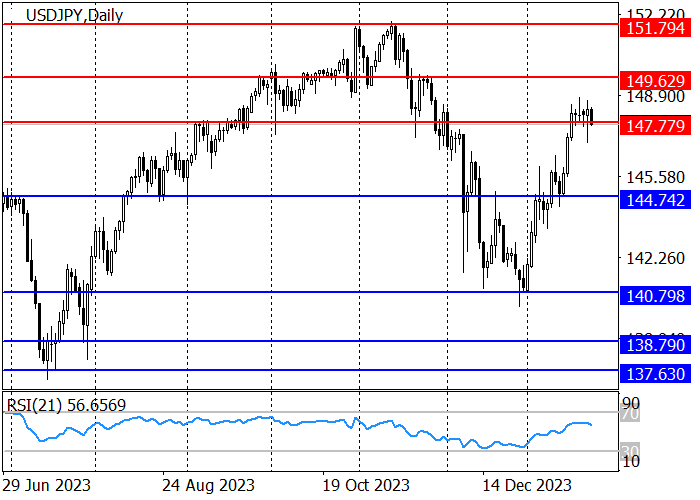

The long-term trend is downward: in January, an upward correction developed, within which the price reached the resistance level of 147.77 but could not consolidate above it. Now, the quotes are below 147.77, and when a downward impulse is formed, short positions with the target at the support level of 144.74 are relevant, after the breakdown of which a decline to 140.80 is possible.

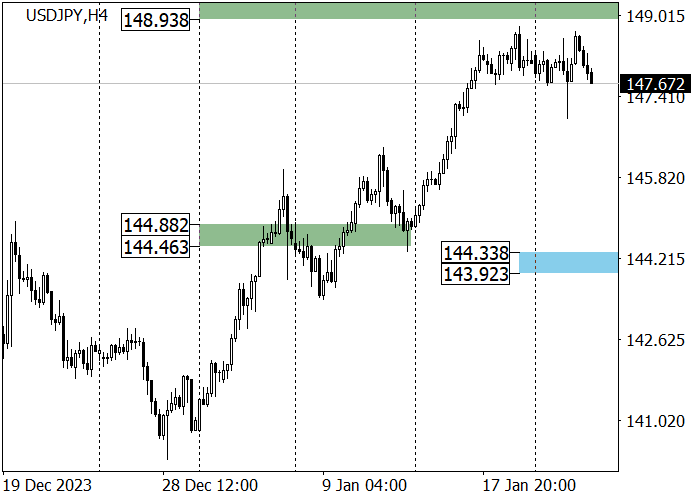

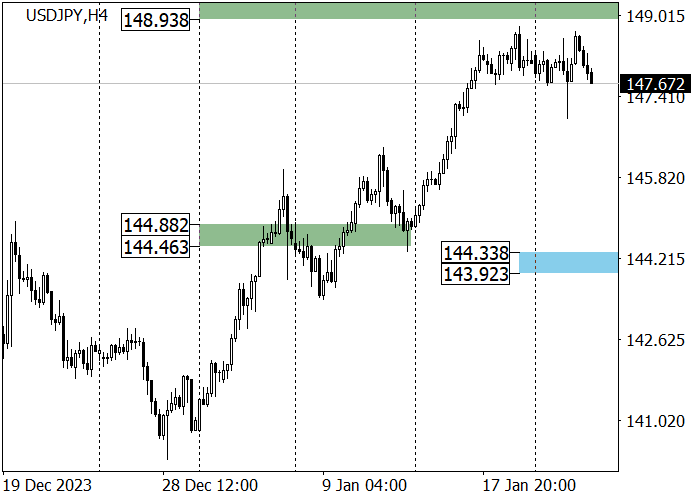

The medium-term trend is upward, and after reaching zone 2 (149.38–148.93), considering errors, a correction to the key trend support area of 144.33–143.92 began, after which long positions with the target at last week’s high of 148.72 are relevant.

Resistance levels: 147.77, 149.62, 151.79.

Support levels: 144.74, 140.80.

Trading tips

Short positions may be opened from the current level with the target at 144.74 and stop loss around 148.91. Implementation time: 9–12 days.

Long positions may be opened above 148.91 with the target at 151.79 and stop loss around 147.63.

Hot

No comment on record. Start new comment.