Current trend

The Dow Jones index is correcting in the local trend at around 37930.0.

The day before, the financial results of several large component companies were published. Despite negative analyst forecasts, beauty and hygiene products maker Johnson & Johnson was able to record revenue of 21.4 billion dollars, repeating the previous quarter, while earnings per share were 2.29 dollars, up from 2.28 dollars, which were assumed by experts.

Consumer goods holding company Procter & Gamble Co. reported revenue of 21.40 billion dollars, which fell slightly short of the 21.47 billion dollars that analysts had expected, and earnings per share reached 1.84 dollars versus expectations of 1.70 dollars.

Industrial giant General Electric Co. also reported much better than expected, recording revenue of 19.4 billion dollars, the highest since January 2023. Earnings per share were 1.03 dollars, also the highest level for the current fiscal year.

In turn, the telecommunications company Verizon Communications Inc. showed revenue of 35.1 billion dollars, which exceeded both the forecast of 34.56 billion dollars and the previous quarter's figure of 33.3 billion dollars. Earnings per share came in at 1.08 dollars, beating analysts' expectations.

The growth leaders in the index are Verizon Communications Inc. ( 6.72%), Procter & Gamble Co. ( 4.13%), Intel Corp. ( 1.39%).

Among the leaders of the decline are 3M Co. (-10.93%), Johnson & Johnson (-1.67%), Home Depot Inc. (-1.65%).

Support and resistance

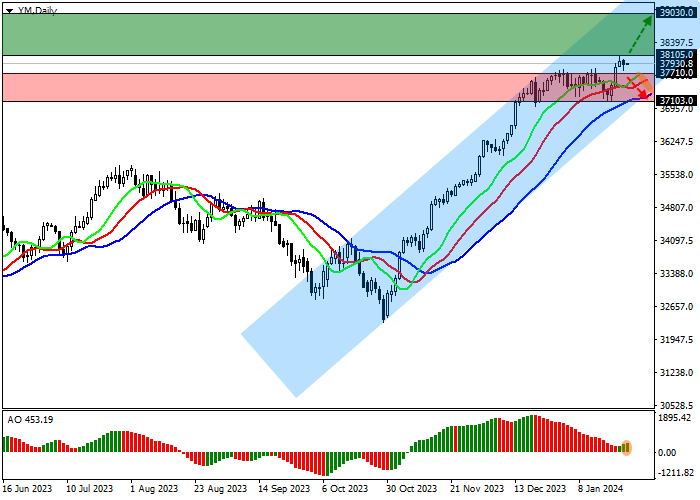

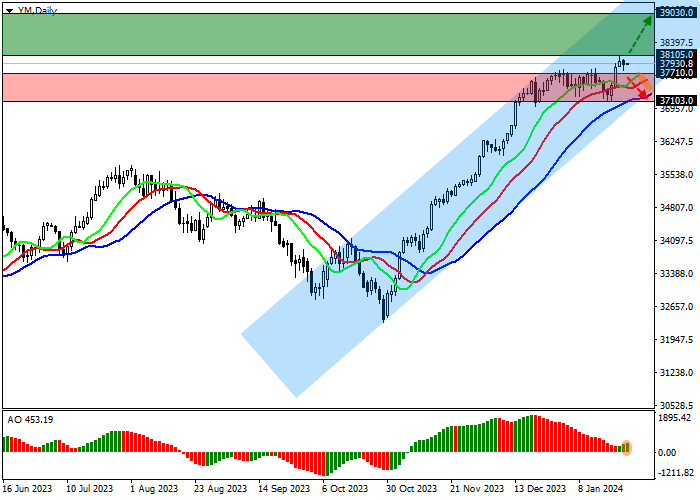

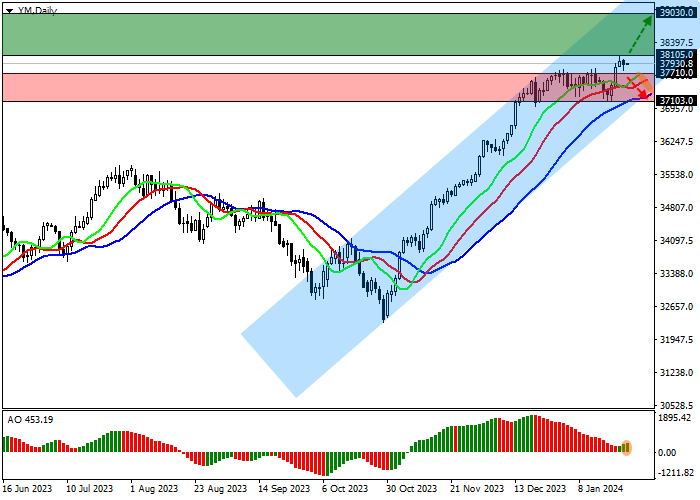

On the daily chart, the index quotes continue their upward trend, having updated the next high of the year at around 37740.0 the day before.

Technical indicators maintain a stable buy signal, which began to strengthen after a local correction: the range of EMA fluctuations on the Alligator indicator stays wide, and the AO histogram is forming new corrective bars, being above the transition level.

Support levels: 37710.0, 37103.0.

Resistance levels: 38105.0, 39030.0.

Trading tips

If the local growth continues, long positions that can be opened if the price overcomes the channel resistance at 38105.0 with a target at 39030.0 and stop-loss at 38000.0 will be relevant. Implementation time: 7 days and more.

If the asset reverses and continues declining and the price consolidates below the local support level of 37710.0, short positions can be opened with the target at 37103.0. Stop-loss — 37800.0.

Hot

No comment on record. Start new comment.