Current trend

The price of North American light oil, WTI Crude Oil, is correcting in an upward trend, trading at 74.25. The quotes are recovering after reports of the lifting of the state of emergency at Libya’s largest field, Sharara: according to the National Oil Corporation (NOC), after more than two weeks of blocking, the situation has stabilized, and production has been restored in full, ensuring the supply of an additional 300.0K barrels of oil per day to the market.

In addition, the asset was supported by a report from the American Petroleum Institute (API), which reflected a decrease in crude inventories over the week by 6.674M barrels after an increase of 0.483M barrels. Today, the Energy Information Administration of the US Department of Energy (EIA) will publish the relevant statistics: the indicator may correct by –2.150M barrels after –2.492M, supporting the local upward trend.

Demand for oil from investors has remained at peak values for the second week: according to data from the Chicago Mercantile Exchange (CME Group), yesterday, the trading volume amounted to 895.0K contracts, corresponding to the average for the last two weeks of 879.0K contracts and having decreased slightly relative to last week when it reached 1.3M contracts amid concern among market participants about the possible complete blocking of the oil transit through the Red Sea.

Support and resistance

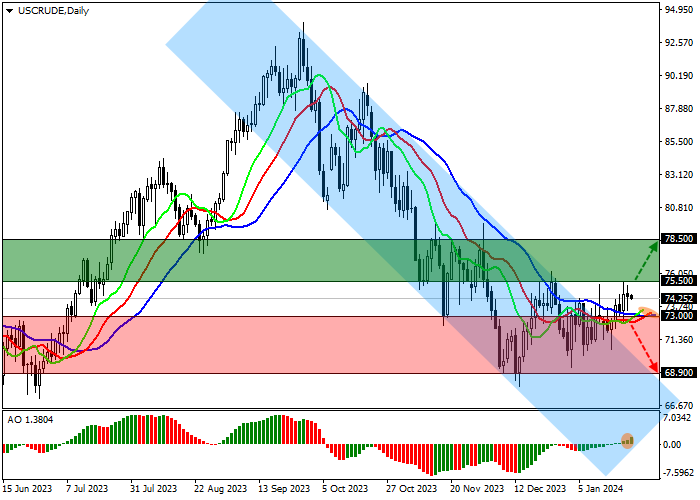

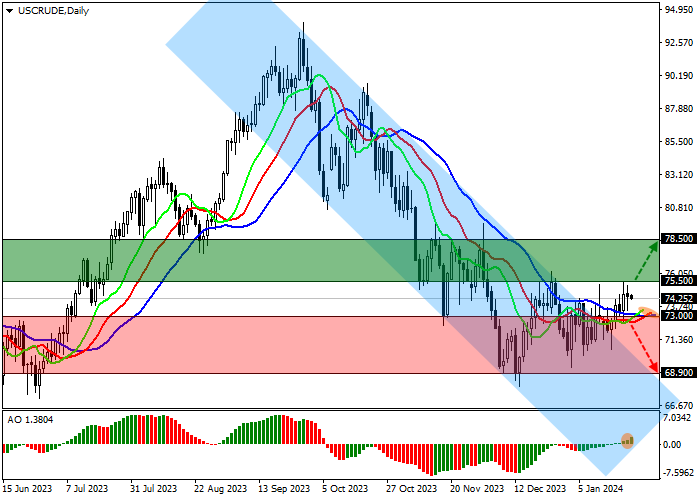

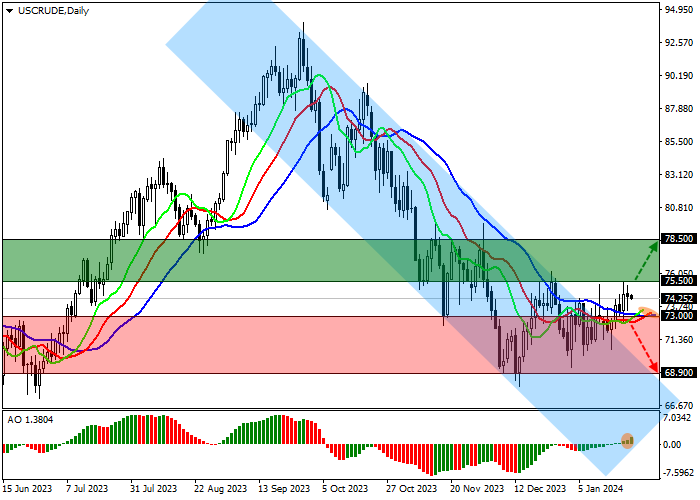

On the daily chart, the trading instrument tries to consolidate above the resistance line of the global downward channel 74.00–69.00, approaching the local high of 75.50.

Technical indicators gave a buy signal: fast EMA on the Alligator indicator crossed the signal line upward, expanding the range of fluctuations, and the AO histogram is forming corrective bars above the transition level.

Resistance levels: 75.50, 78.50.

Support levels: 73.00, 68.90.

Trading tips

Long positions may be opened after the price rises and consolidates above 75.50 with the target at 78.50. Stop loss – 74.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 73.00 with the target at 68.90. Stop loss – 75.00.

Hot

No comment on record. Start new comment.