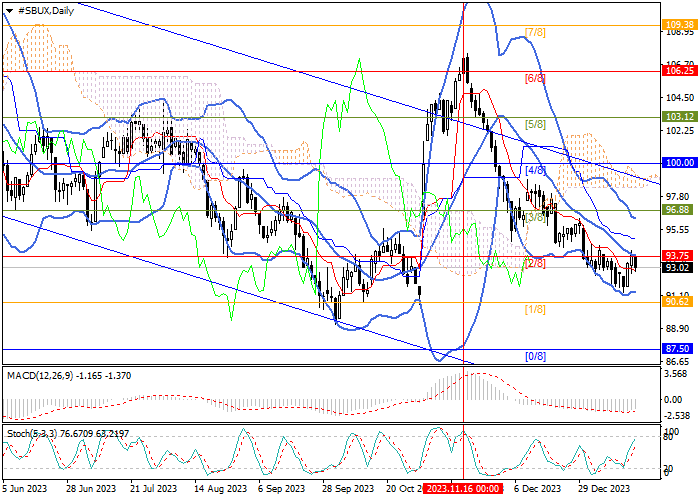

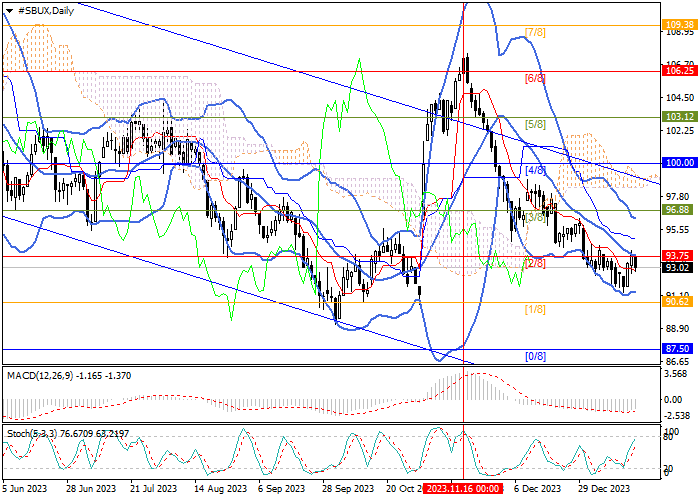

Current trend

Shares of Starbucks Corp., one of the largest companies that owns the coffee chain of the same name, resumed their decline since mid-November last year: the price changed direction at the turning point of 106.25 (Murrey level [6/8]), moved into the negative part of Murrey’s main trading range and consolidated below the reversal level of 93.75 (Murrey level [2/8]), supported by the middle line of Bollinger bands. This week, the quotes tried to break this level upwards but were unsuccessful, as a result of which a decline is expected to the area of 90.62 (Murrey level [1/8]) and 87.50 (Murrey level [0/8]). The upward dynamics within the central Murrey channel to 100.00 (Murrey level [4/8]) and 103.12 (Murrey level [5/8]) may resume after breaking through the key level for the bulls at 96.88 (Murrey level [3/8], top line of Bollinger Bands), which is less likely.

Technical indicators reflect a continuation of the downward trend: Bollinger bands are directed downwards, the MACD histogram is stable in the negative zone, and Stochastic is directed upwards but is approaching the overbought zone, signaling the possibility of a reversal.

Support and resistance

Resistance levels: 96.88, 100.00, 103.12.

Support levels: 90.62, 87.50.

Trading tips

Short positions may be opened from 93.00 with the targets at 90.62, 87.50 and stop loss 94.40. Implementation time: 5–7 days.

Long positions may be opened above 96.88 with the targets at 100.00, 103.12 and stop loss around 95.00.

Hot

No comment on record. Start new comment.