Current trend

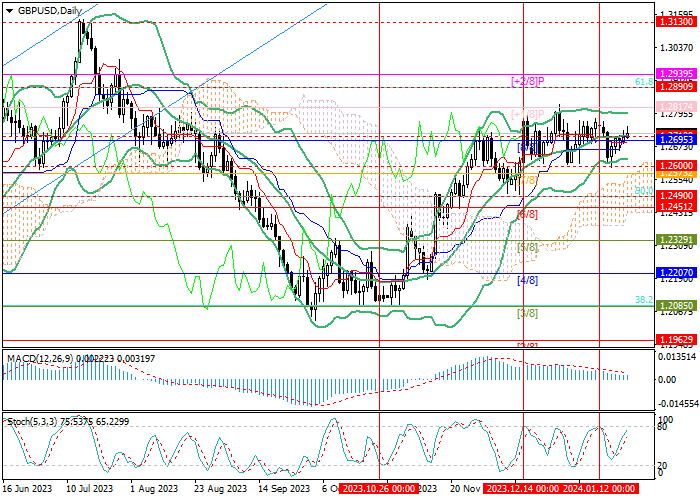

Last week, the GBP/USD pair had ambiguous dynamics: quotes fell to the 1.2595 mark, but then managed to recover and are currently trying to consolidate above the central line of Bollinger Bands around 1.2710.

The pound is supported by the publication of data on the UK budget: in December, its deficit amounted to only 7.77 billion pounds, which turned out to be significantly less than the forecast of 14.0 billion pounds. Total borrowings in the first 9 months of the fiscal year (from April to December) amounted to 119.1 billion pounds, which is 11.1 billion pounds less than in the same period of 2022. Experts believe that improving these indicators will allow the Ministry of Finance to reduce taxes, supporting economic growth.

Nevertheless, the overall market situation still looks uncertain due to the lack of clear data on the next steps of the US Federal Reserve and the Bank of England. Investors are confident that both regulators will switch to "dovish" rhetoric during the year, but the timing of monetary policy easing has not yet been announced, which led to the movement of quotes within the main lateral range of 1.2600–1.2800 for seven weeks. Most analysts are inclined to believe that the US Fed will start cutting rates earlier than the British regulator, which may provide pressure on the US currency in the long term.

Support and resistance

Quotes are trying to consolidate above the central line of Bollinger Bands at 1.2710 in order to continue rising to 1.2817 (Murrey level [ 1/8]) and 1.2939 (Murrey level [ 2/8]). The key for the "bears" is the 1.2600 mark, the breakdown of which will open the way for the development of a decline towards the targets of 1.2451 (Murrey level [6/8]), 1.2329 (Murrey level [5/8]).

Technical indicators do not give a clear signal: Bollinger Bands are horizontal, MACD is stable in the negative zone, while Stochastic is directed upwards.

Resistance levels: 1.2817, 1.2939.

Support levels: 1.2600, 1.2451, 1.2329.

Trading tips

Long positions can be opened from the level of 1.2740 with targets at 1.2817, 1.2939 and stop-loss around 1.2700. Implementation period: 5–7 days.

Short positions can be opened below the 1.2600 mark with targets at 1.2451, 1.2329 and stop-loss around 1.2680.

Hot

No comment on record. Start new comment.