Current trend

Against positive macroeconomic statistics, the AUD/USD pair reached 0.6608.

Thus, the National Australia Bank (NBA) business confidence index, which is one of four sources that the country’s Reserve Bank (RBA) considers when making decisions on monetary policy, amounted to –1.0 points in December, better than the previous value, revised from –9.0 points to –8.0 points, and the business conditions indicator decreased from 9.0 points to 7.0 points. Expectations for consumer inflation in January remained at 4.5%. After the publication of these data, the national currency strengthened its position, and the AUD/USD pair tested 0.6608, which, if overcome, could reach 0.6675.

On the other hand, leading indicators showed ambiguous dynamics, with forward orders rising 1.0 points to –3.0 points, despite significant falls in the transport and utilities, retail, and mining sectors. Capacity utilization fell to 82.7%, remaining above average. Among the risks for the national currency, note that the growth of retail prices in December decreased from 4.9% to 4.3%, which reflects a possible slowdown in inflation at the end of the quarter, after which the RBA may begin to lower interest rates.

Support and resistance

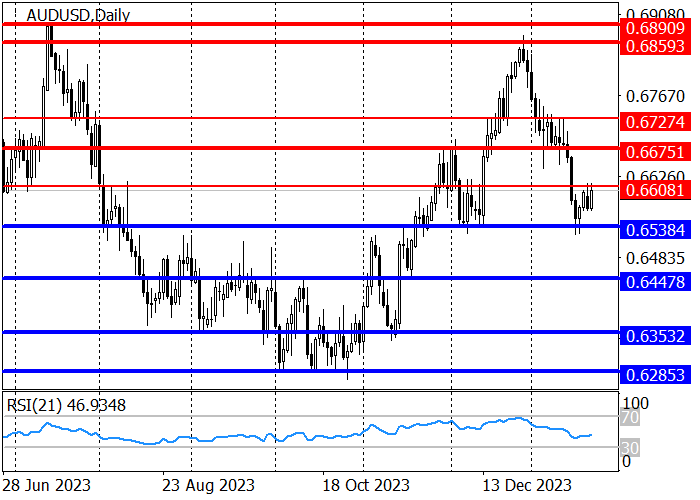

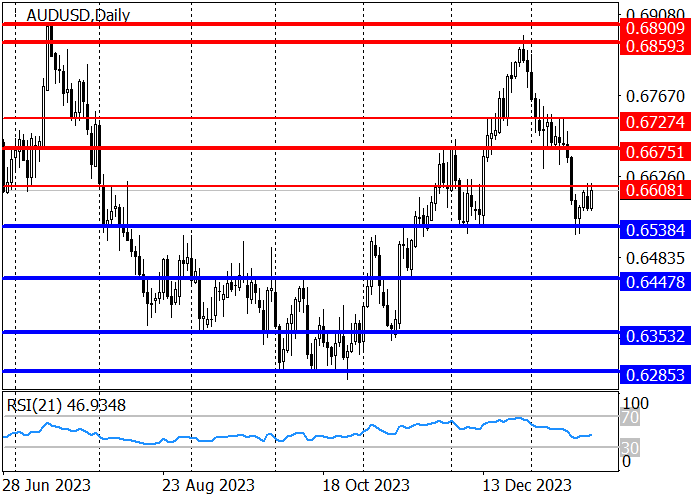

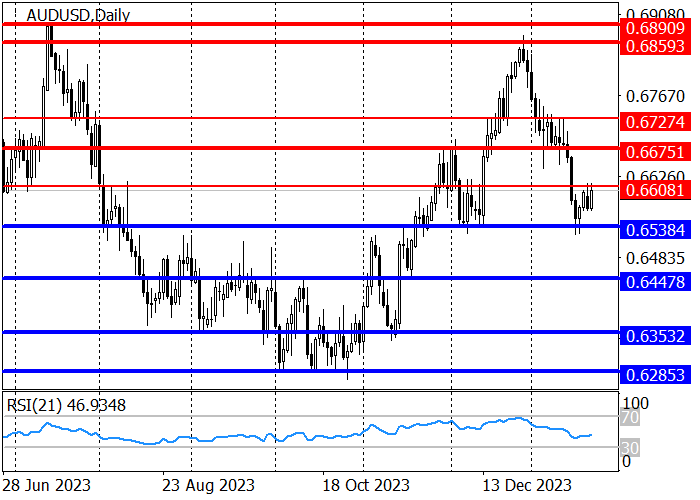

The long-term trend is upward: as part of the correction, the price reached the support level of 0.6538 and is trying to continue growing, reaching the resistance level of 0.6608, after breaking through which an increase to the key level of 0.6675 is expected. If this level is maintained, then a reversal and decline is possible, renewing the month's low.

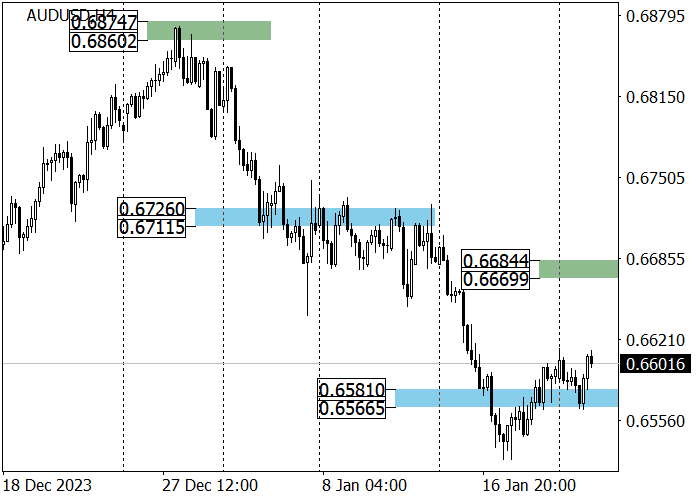

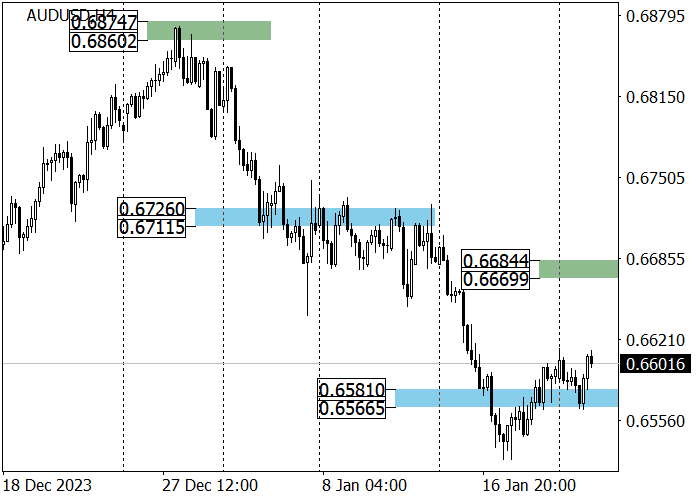

The medium-term trend remains downward: last week the quotes unsuccessfully tried to overcome target zone 2 (0.6581–0.6566), from where a correction began to the trend resistance area of 0.6684–0.6669, after reaching which a reversal is expected, and short positions with the target in zone 2 (0.6581) are relevant –0.6566).

Resistance levels: 0.6608, 0.6675, 0.6727.

Support levels: 0.6538, 0.6447.

Trading tips

Long positions may be opened above 0.6618 with the target at 0.6675 and stop loss around 0.6597. Implementation time: 9–12 days.

Short positions may be opened below 0.6519 with the target at 0.6447 and stop loss around 0.6550.

Hot

No comment on record. Start new comment.