Current trend

Brent Crude Oil prices are rising moderately, preparing to test the key resistance level of 80.00.

The positive dynamics are developing against increasing tensions in the Red Sea, as fuel carriers continue to be forced to find alternate routes due to the risk of attack from Yemen’s Houthis, which increases the logistics cost and can also lead to disruptions in supply chains. The United States and allies are trying to solve the problem, including using force but this has not yet led to an increase in security, and the risks of further escalation of the conflict in the Middle East are increasing.

In addition, the quotes are supported by a reduction in the number of American active rigs: according to a Baker Hughes report, for the week of January 19, the figure adjusted from 499 units to 497 units, which has not yet affected the oil production volumes. On Wednesday, analysts wait for the statistics from the US Department of Energy’s Energy Information Administration (EIA): forecasts suggest that energy inventories will fall by 3.0M barrels after falling by 2.492M barrels earlier.

Meanwhile, the period of global correction in the oil market continues. According to the US Commodity Futures Trading Commission (CFTC), last week, the net speculative positions in WTI Crude Oil decreased from 169.7K to 162.0K. As for the dynamics, a sideways trend is clearly visible without a clear advantage of any of the parties: the “bullish” balance with swap dealers amounted to 20.340K against 50.266K for the “bears”, while last week buyers increased the number of contracts by 1.768K, and sellers – by 1.532K.

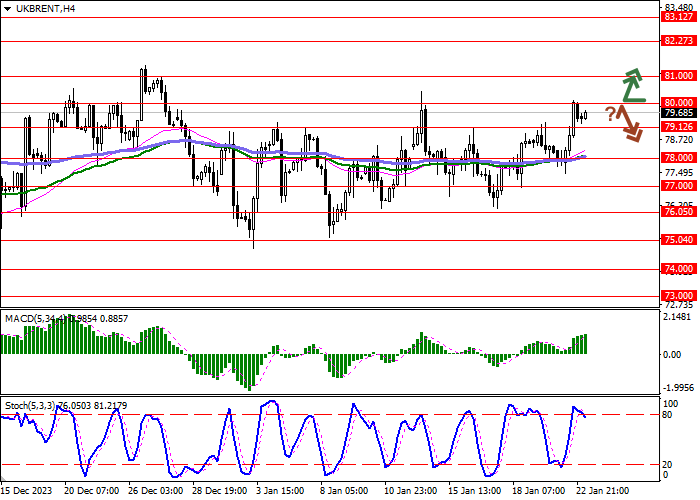

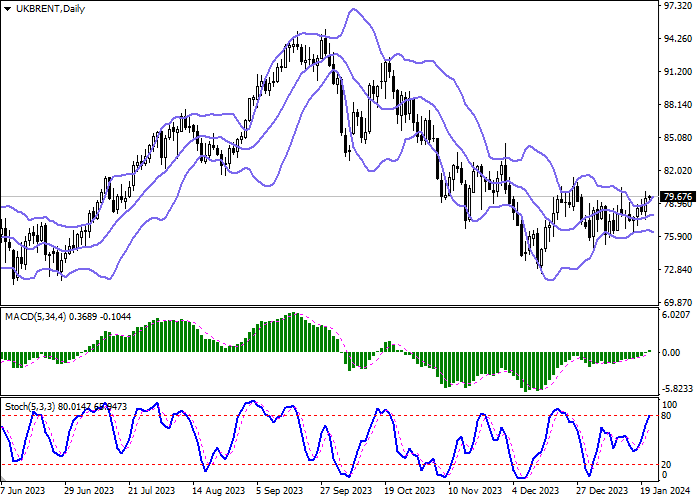

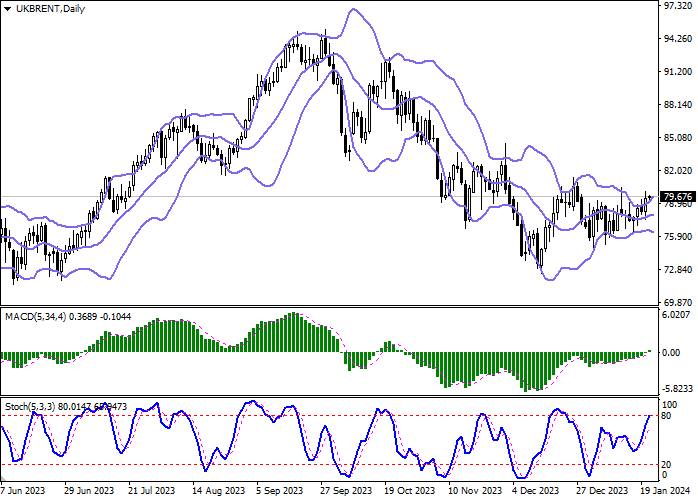

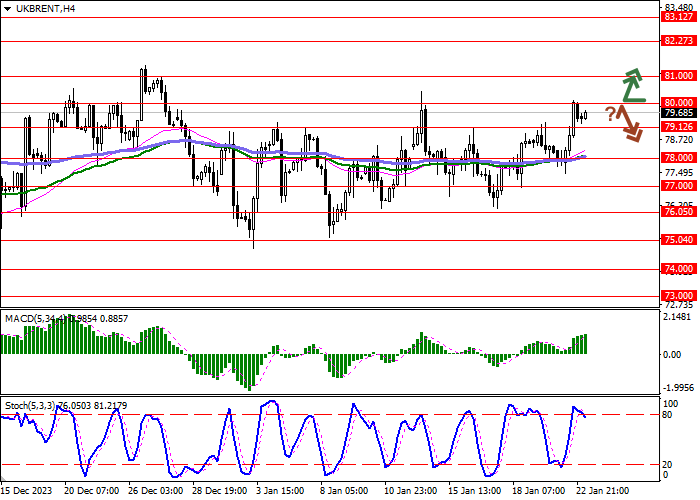

Support and resistance

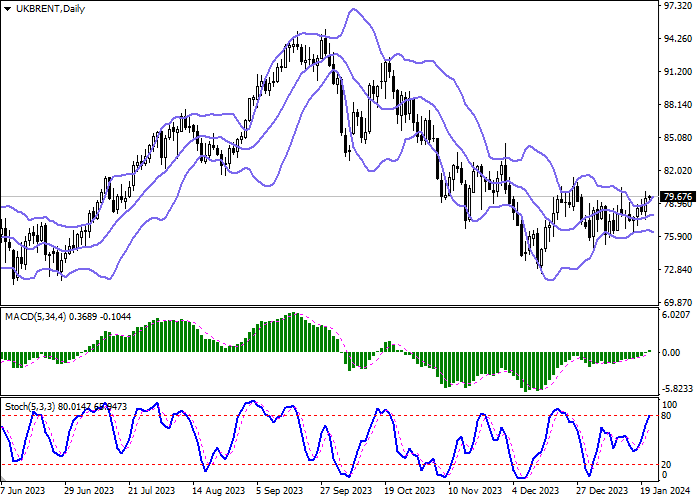

On the daily chart, Bollinger Bands are growing uncertainly: the price range is expanding but not as fast as the “bullish” sentiment develops. The MACD indicator is growing, maintaining a buy signal (the histogram is above the signal line), and is trying to consolidate above the zero level. Stochastic shows more confident growth but is close to the “80” mark, indicating that the instrument may become overbought in the ultra-short term.

Resistance levels: 80.00, 81.00, 82.27, 83.12

Support levels: 79.12, 78.00, 77.00, 76.05.

Trading tips

Long positions may be opened after 80.00 is broken upward with the target at 82.27. Stop loss – 79.12. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 80.00 and a breakdown of 79.12 downwards with the target at 78.00. Stop loss – 80.00.

Hot

No comment on record. Start new comment.