Current trend

The USD/CHF pair is correcting around 0.8656, retreating from the local highs of December 18, updated on Friday. Market activity remains low ahead of the publication of macroeconomic statistics. At the same time, investors continue to evaluate Friday's publications from Switzerland and the United States.

The Swiss Producer and Import Prices index fell by 0.6% in December after -0.9% in the previous month, fully meeting market expectations, and in annual terms, producer inflation fell by 1.1% compared to -1.3% in November. Such a slowdown in the rate of weakening inflation is unlikely to have a significant impact on the future monetary policy of the Swiss National Bank.

In turn, the American Consumer Confidence Index from the University of Michigan rose from 69.7 points to 78.8 points in January, while the market expected an increase to 70.0 points. At the same time, Existing Home Sales showed negative dynamics at the level of -1.0% after an increase of 0.8% in the previous month.

On Wednesday, the US will publish January data on business activity in the manufacturing and services sectors from S&P for January. Forecasts suggest a decline in the Services PMI from 51.4 points to 51.0 points, while the Manufacturing PMI is expected to remain unchanged at 47.9 points. On Thursday, investors will evaluate fourth-quarter Gross Domestic Product (GDP) statistics, followed by the Personal Consumption Expenditure index on Friday. Both indicators can have a significant impact on the position of US Federal Reserve officials regarding the timing of the start of the monetary easing cycle. According to forecasts, the growth of the American economy in both annual and quarterly terms will slow down to 2.2% and 2.0%, respectively, but will remain sufficient for sustainable economic growth, despite tight monetary conditions. The Core Personal Consumption Expenditures - Price Index in December may adjust from 0.1% to 0.2% on a monthly basis and from 3.2% to 3.0% on an annual basis.

Support and resistance

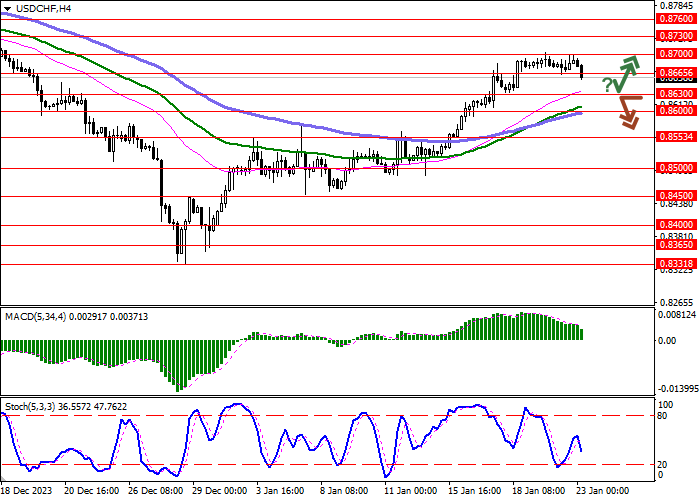

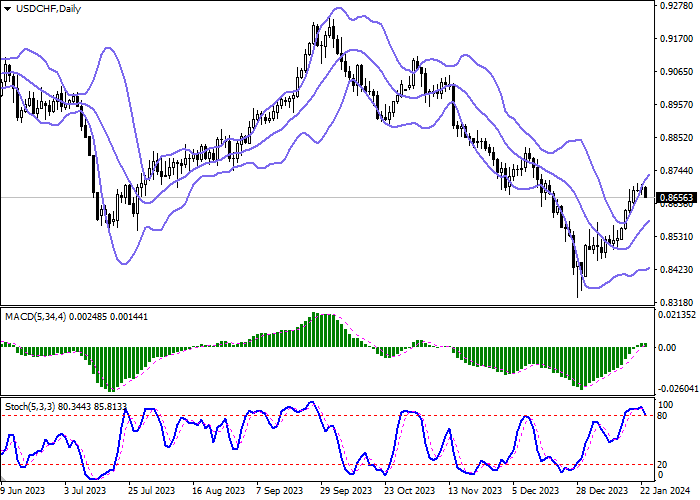

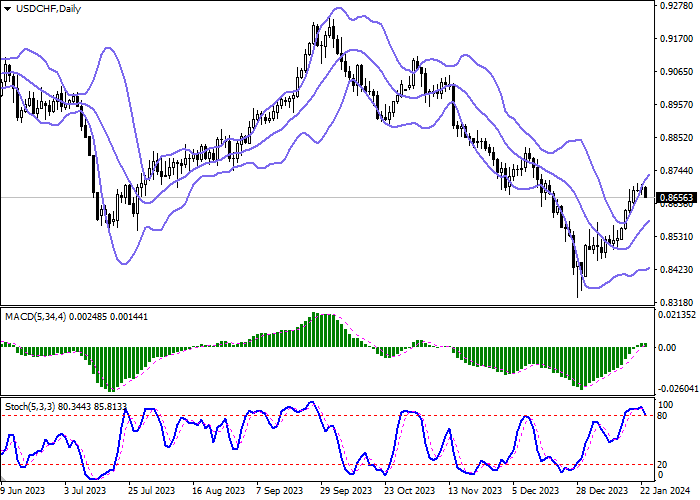

Bollinger Bands on the daily chart show a steady increase. The price range expands, freeing a path to new local highs for the "bulls". MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). The indicator is also trying to consolidate above the zero level. Stochastic is retreating from its highs, signaling in favor of the development of a corrective decline in the near future.

Resistance levels: 0.8700, 0.8730, 0.8760, 0.8800.

Support levels: 0.8665, 0.8630, 0.8600, 0.8553.

Trading tips

Short positions may be opened after a breakdown of 0.8630 with the target at 0.8553. Stop-loss — 0.8665. Implementation time: 1-2 days.

A rebound from 0.8630 as from support followed by a breakout of 0.8665 may become a signal for opening new long positions with the target at 0.8730. Stop-loss — 0.8630.

Hot

No comment on record. Start new comment.