Current trend

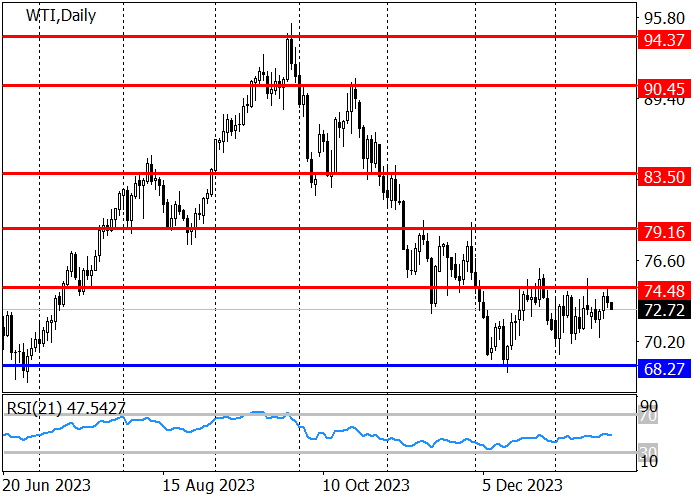

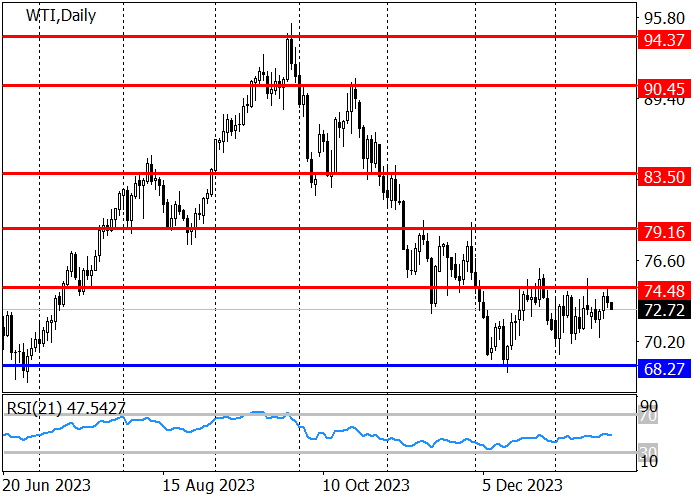

WTI Crude Oil is trading below the resistance level of 74.50 due to the stabilization of the market situation.

Thus, more and more tankers bypass the Red Sea, although tensions in the Middle East remain. The asset is also supported by a higher fuel demand forecast for this year. According to revised data from the International Energy Agency (IEA), consumption will increase by 1.24M barrels per day, significantly lower than the 2.25M barrels per day increase OPEC expected. Yesterday’s report on oil reserves from the US Department of Energy’s Energy Information Administration (EIA) reflected a correction of the indicator by –2.494M barrels, which exceeds preliminary estimates of –0.313M barrels, although gasoline reserves increased by 3.083M barrels, and distillates – by 2.3760M barrels.

Thus, the asset maintains a long-term downward trend, the goal of which is to update last year’s low of 64.00. Last month and early January, buyers unsuccessfully tried to reverse the trend by testing the resistance level of 74.50. The negative dynamics may reach the first target at 68.27. However, in case of oil supply disruptions, the quotes may break through 74.48 and reach 79.16.

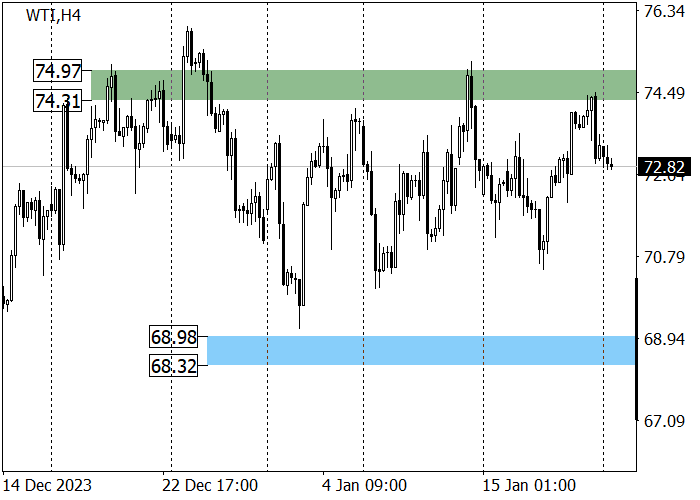

The medium-term trend is downward: for five weeks, the price has been trying to overcome the area of key trend resistance 74.97–74.31 but was unable to consolidate above it and began to decline with a likely target in zone 4 (68.98–68.32), after breaking through which the quotes will head to zone 5 (62.38–61.72). An alternative scenario may develop if the trend border 74.97–74.31 is broken upwards, and then long positions with the target in zone 2 (81.57–80.91) are relevant.

Support and resistance

Resistance levels: 74.48, 79.16.

Support levels: 68.27, 64.01.

Trading tips

Short positions may be opened from 74.48 with the target at 68.27 and stop loss around 76.00. Implementation time: 9–12 days.

Long positions may be opened above 76.00 with the target at 79.16 and stop loss around 74.51.

Hot

No comment on record. Start new comment.