Current trend

Against the stabilization of the American dollar and poor statistics from New Zealand, the NZD/USD pair is correcting at 0.6114.

Thus, according to the National Statistics Service of New Zealand (Stats.nz), food prices in December were 4.8% higher than the figure a year ago, and the most expensive items for ready meals in restaurants ( 7.1%), non-alcoholic drinks ( 5.5%), food products ( 5.4%), meat and poultry ( 2.3%), and vegetables ( 1.5%). However, compared to November, the decrease in the indicator was 0.1%, amid a fall in the cost of lamb and alcoholic beverages. In turn, manufacturing PMI fell from 46.5 points to 43.1 points, reflecting the weakness of the national economy.

The American dollar remains the main driver of the asset and today is trading at 103.000 in USDX, not reacting to Friday’s real estate market data: sales on the secondary housing market decreased from 3.82M to 3.78M, the lowest on record. The volume of new home construction adjusted from 1.467M to 1.460M, confirming the weakness of the industry against the long-term “hawkish” monetary policy by the US Federal Reserve.

Support and resistance

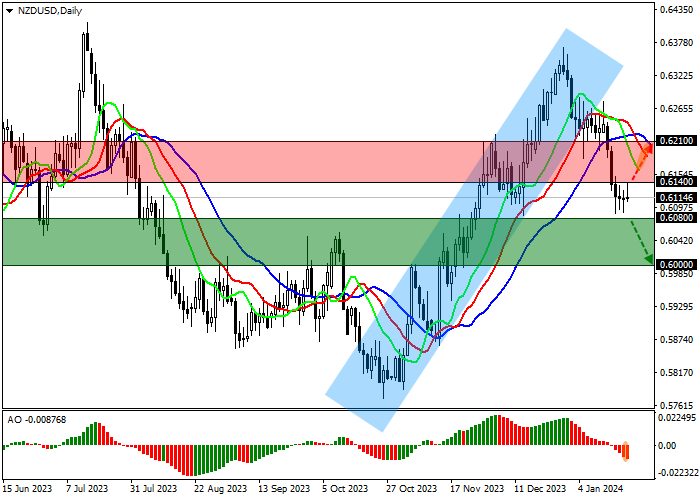

The trading instrument is correcting against the upward trend, holding below the support line of a narrow ascending channel with dynamic boundaries of 0.6320–0.6250.

Technical indicators are strengthening the sell signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming corrective bars, declining in the negative zone.

Resistance levels: 0.6140, 0.6210.

Support levels: 0.6080, 0.6000.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.6080 with the target at 0.6000. Stop loss – 0.6120. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 0.6140 with the target at 0.6210. Stop loss – 0.6100.

Hot

No comment on record. Start new comment.