Current trend

Against the stable dynamics of the American currency, the USD/CHF pair is trading in a corrective trend at 0.8682.

Macroeconomic statistics from Switzerland support the franc: the producer price index in December decreased by 0.6% to 107.2 points, as analysts expected, and by 1.1% compared to the same period a year earlier due to cheaper petroleum products, the main metals, and semi-finished products, while construction materials, carpentry, and scrap metal became more expensive. Thus, the indicator remained within the forecasts without affecting the franc.

The American dollar is holding at 103.000 in USDX, unresponsive to the December decline in existing home sales from 3.82M to 3.78M, the lowest on record, confirming a poor state of the real estate sector under pressure from high interest rates. Meanwhile, forecasts from the Michigan Institute were quite positive: analysts raised the consumer sentiment index from 69.7 points to 78.8 points previously and the current conditions indicator from 73.3 points to 83.3 points.

Support and resistance

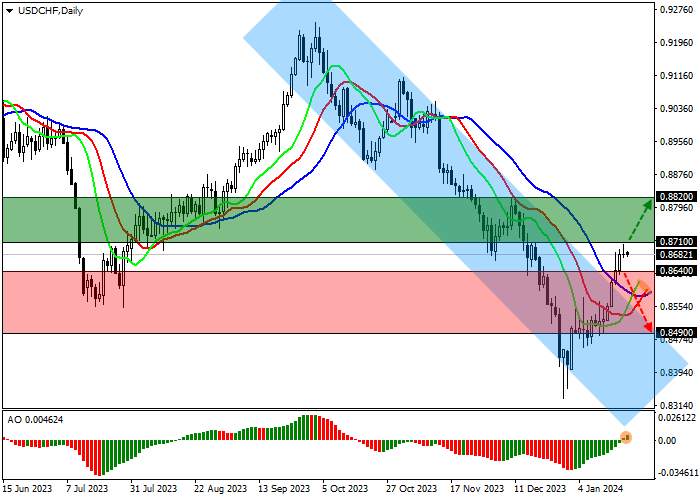

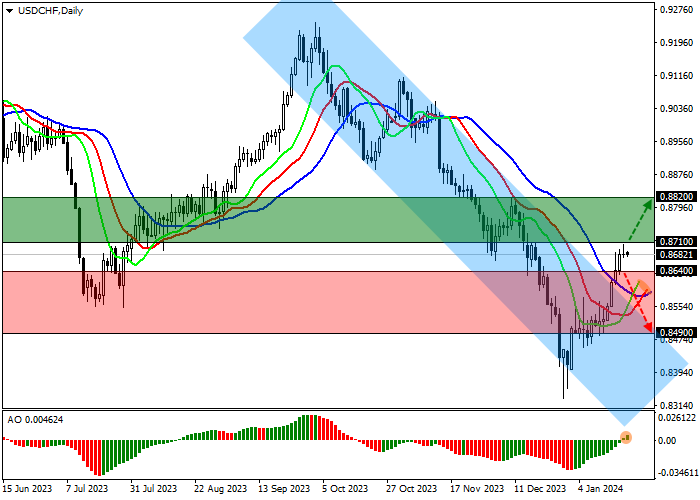

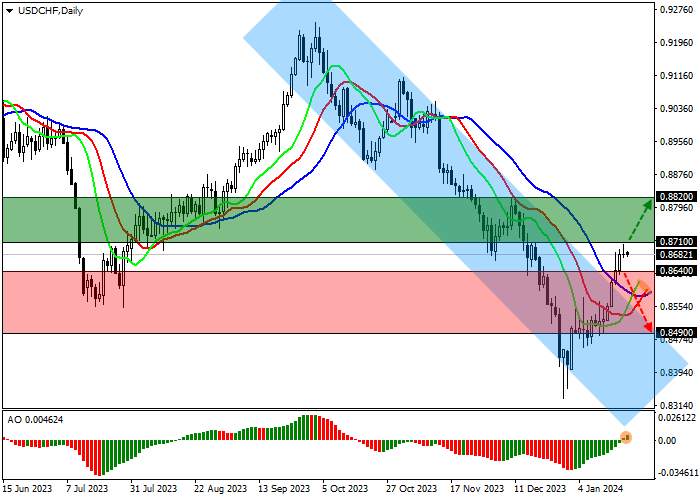

On the daily chart, the trading instrument is correcting, trying to retreat from the resistance line of the local downward channel with dynamic boundaries of 0.8650–0.8430.

Technical indicators gave a buy signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram forms ascending bars in the buy zone.

Resistance levels: 0.8710, 0.8820.

Support levels: 0.8640, 0.8490.

Trading tips

Long positions may be opened after the price rises and consolidates above 0.8710 with the target at 0.8820. Stop loss is around 0.8640. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 0.8640 with the target at 0.8490. Stop loss – 0.8710.

Hot

No comment on record. Start new comment.