Current trend

The leading index of the Frankfurt Stock Exchange DAX 40 is corrected at around 16689.0: the dynamics of the trading instrument still depends on the situation on the bond market and macroeconomic reports. Last week's statistics did not support the position of the DAX 40, as the German Producer Price Index in December fell by 1.2% against the forecast of -0.5%, and on an annualized basis the figure fell by 8.6%, while analysts expected -8.0%.

Meanwhile, the bond market has seen a prolonged upward correction, with the 10-year bonds yield rising to 2.301% from its January 12 low of 2.165%, the 20-year bonds trading at 2.543%, up from the previous 2.446%, and the 30-year bonds yield is 2.489%, up from 2.407% recorded mid-month.

The growth leaders in the index are RWE AG ( 1.54%), E.ON SE ( 1.22%), SAP SE ( 1.10%), Siemens Energy AG ( 0.94%).

Among the leaders of the decline are Porsche Automobil Holding SE (-1.79%), Commerzbank AG (-1.73%), Siemens Healthineers AG (-1.55%).

Support and resistance

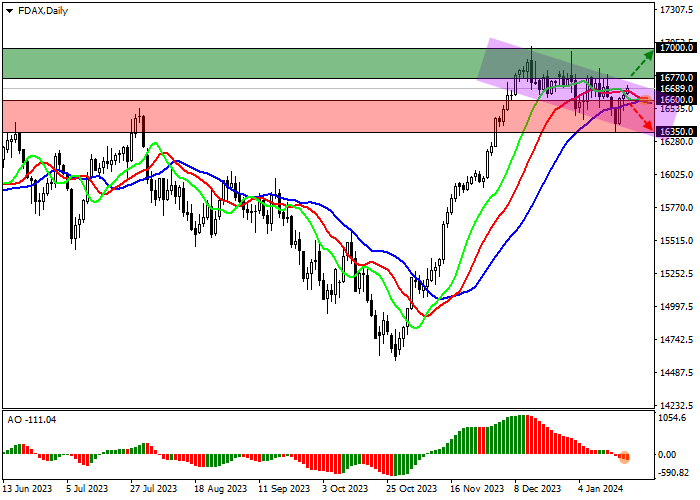

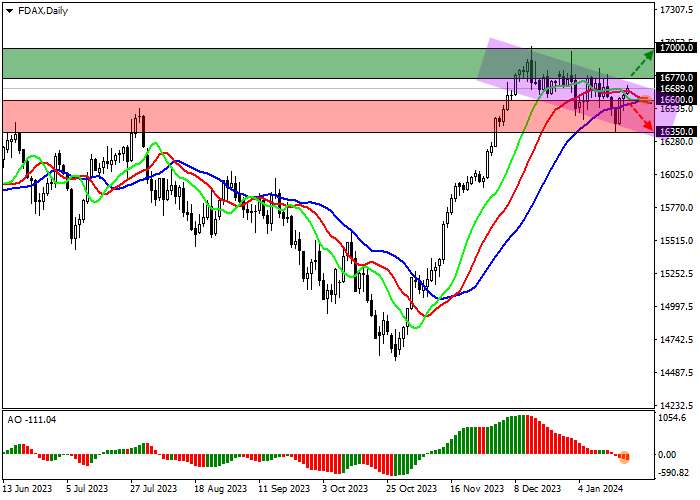

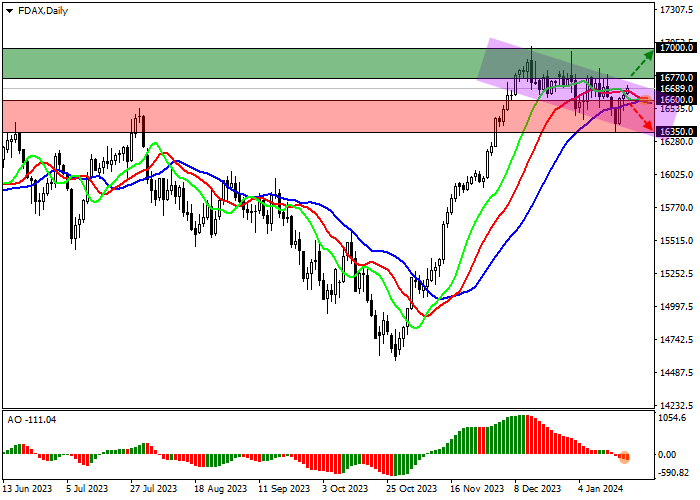

On the daily chart, the price is trading in a corrective trend, preparing to continue growing towards the global high at 17000.0.

Technical indicators still maintain a weak sell signal, but are ready to begin to reverse in the direction of growth: fast EMAs on the Alligator indicator are held close to the signal line, and the AO histogram is forming corrective bars being in the sale zone.

Support levels: 16600.0, 16350.0.

Resistance levels: 16770.0, 17000.0.

Trading tips

If the asset continues growing locally and the price consolidates above the local resistance level of 16770.0, long positions will be relevant with target at 17000.0. Stop-loss — 16600.0. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 16600.0, short positions can be opened with the target at 16350.0. Stop-loss — 16800.0.

Hot

No comment on record. Start new comment.