Current trend

This week, the SOL/USD pair is making a moderate attempt to grow, which is not typical for most leading cryptocurrency assets that have begun to consolidate.

Today, quotes rose to around 130.30 amid the announcement of the release of a new Web3 smartphone from Solana Mobile called Saga Chapter2. This is a new version of the Saga device introduced last year, retaining all its features, but at a lower cost. The smartphone will be adapted to the Solana ecosystem, have a built-in cryptocurrency wallet and access to a number of decentralized applications. One of the main advantages of the new device is the ability to target token distribution among its owners, which provided increased interest around the first Saga model when it airdropped 30.0 million BONK coins.

However, the significant growth of the SOL/USD pair is constrained by the monetary factor. Macroeconomic statistics coming to the market indicate the likelihood that the US Federal Reserve will begin to lower interest rates later than investors expected. Increasing inflation rates, a significant increase in employment and retail sales are the reason why officials are in no hurry to move on to easing monetary policy. In addition, according to Christopher Waller, a member of the US Federal Reserve Board of Governors, if a reduction in borrowing costs does begin this year, it will be slow and careful in order to avoid economic shocks. This allows the US currency to maintain positions against alternative assets, including digital ones.

Support and resistance

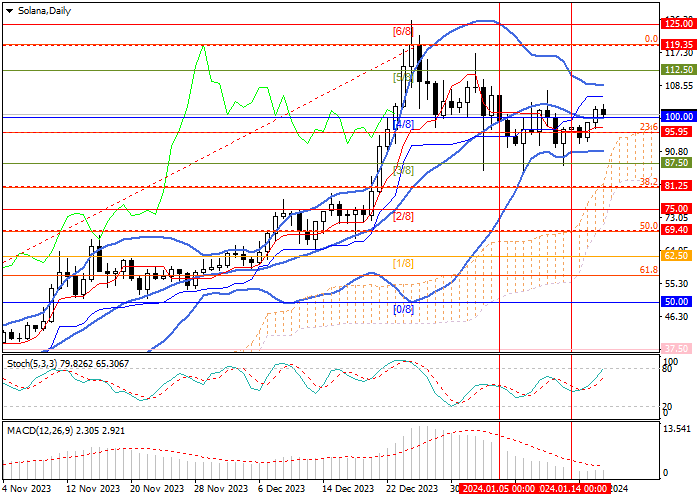

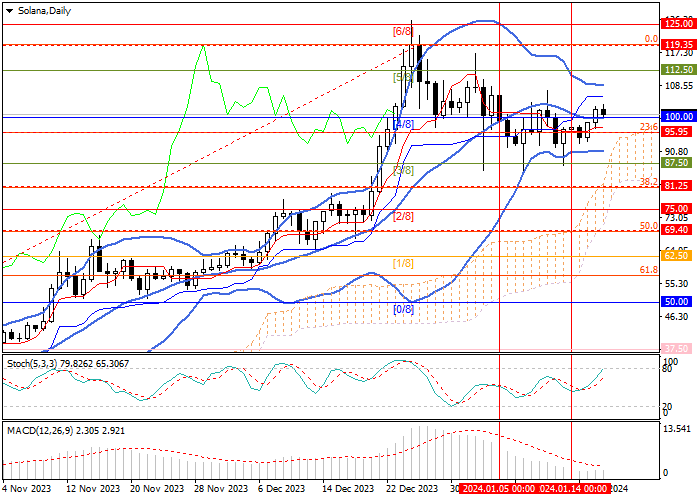

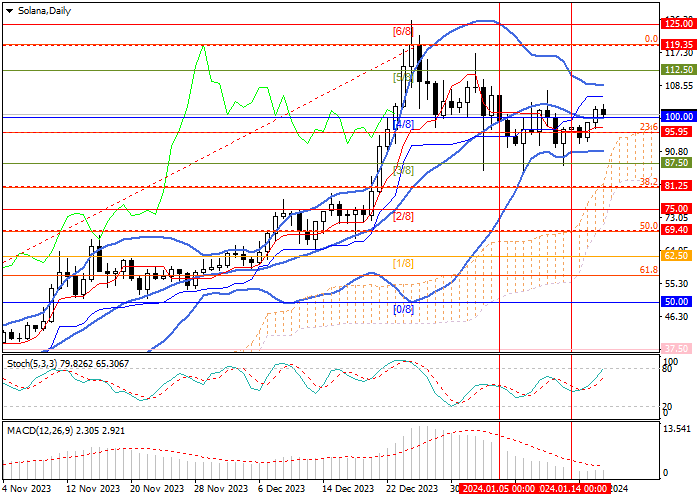

The token price is trying to consolidate above 100.00 (Murrey level [4/8]) and if successful, the growth of quotes will continue to the targets of 119.35 (Fibonacci retracement 0.0%) and 125.00 (Murrey level [6/8]). The key level for the "bears" remains 81.25 (Fibonacci retracement 38.2%), a breakdown of which will lead to a change in the current upward trend and a decrease in quotes to the levels of 69.40 (Fibonacci retracement 50.0%) and 50.00 (Murrey level [0/8]).

Technical indicators don't provide a clear signal: Bollinger Bands are horizontal, MACD is stable in the positive zone, and Stochastic is directed upwards.

Support and resistance

Resistance levels: 100.00, 119.35, 125.00.

Support levels: 81.25, 69.40, 50.00.

Trading tips

Long positions may be opened above 103.80 with targets at 119.35, 125.00 and stop-loss at 94.00. Implementation period: 5-7 days.

Short positions may be opened below 81.25 with targets at 69.40, 50.00 and stop-loss at 90.00.

Hot

No comment on record. Start new comment.