Current trend

Prices for benchmark Brent Crude Oil are adjusted at 77.93.

Yesterday’s OPEC report on the situation in the energy market had almost no impact on the dynamics of the oil quotes and, pending new reports from the Middle East, volatility remains low. Thus, the document notes that oil consumption in 2023 increased by 2.5M barrels per day, reaching 102.11M barrels in daily terms: the main increase in the indicator was provided by countries outside the Organization for Economic Co-operation and Development (OECD), whose demand increased by 2.4M barrels per day. In 2024, the figure will be adjusted by another 2.2M barrels per day to 104.3M barrels per day. In December, OPEC member countries increased production by 79.0K barrels to 21.594M barrels per day thanks to increased production in Nigeria and Iraq. In turn, experts believe that the need for gasoline will continue to be supported by the active use of private cars in major consumer countries such as China, the Middle East, India, and the United States.

This morning, the American Petroleum Institute (API) reported a correction in inventories of 0.483M barrels after –5.215M barrels earlier, and in the evening data from the US Department of Energy’s Energy Information Administration (EIA) will be published, which is expected to reflect a decrease of 0.313M barrels, which did not affect the quotes.

Support and resistance

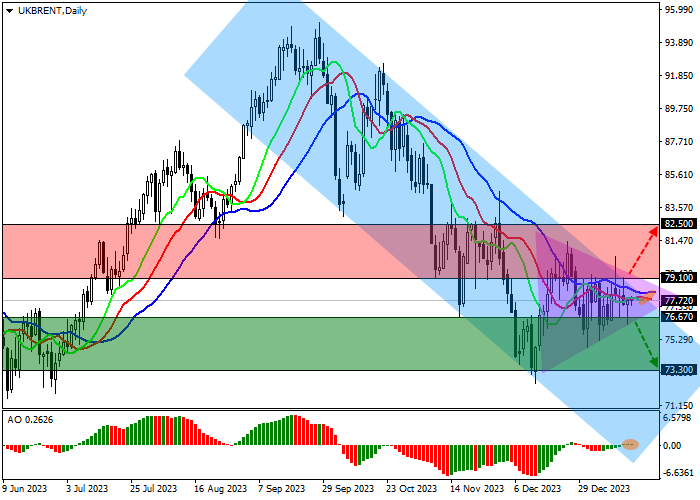

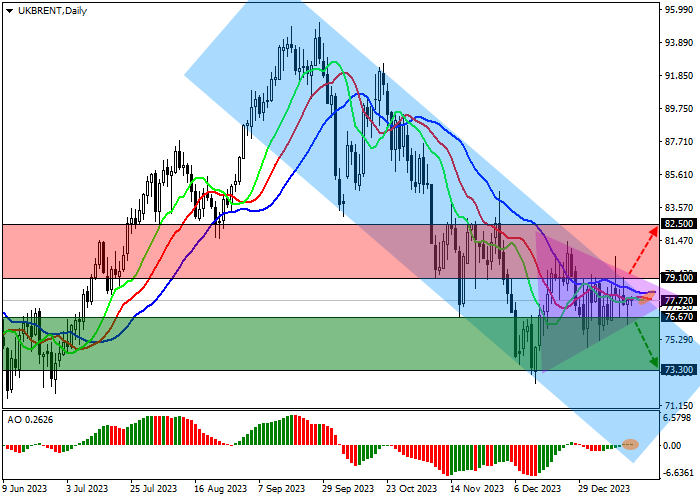

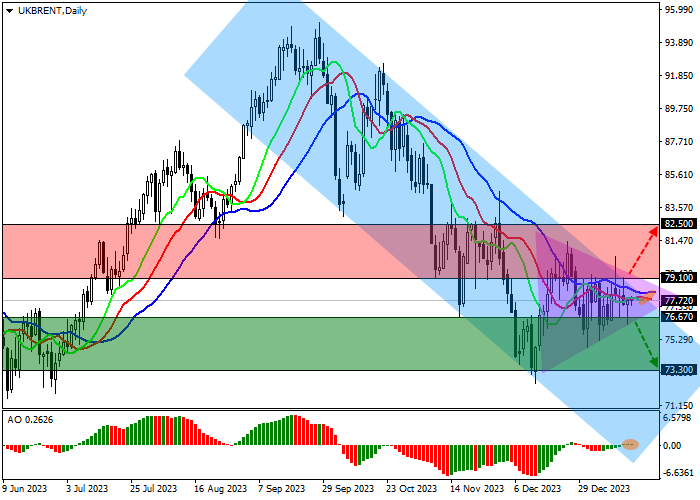

On the daily chart, the trading instrument is moving in a global downward trend, holding in the local channel of 79.00–73.00 and preparing to continue its decline.

Technical indicators hold a global sell signal, supporting a local correction: fast EMA of the Alligator indicator are below the signal line, and the AO histogram forms downward bars in the sales zone.

Resistance levels: 79.10, 82.50.

Support levels: 76.67, 73.30.

Trading tips

Short positions may be opened after the price declines and consolidates below 76.67 with the target at 73.30. Stop loss – 78.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 79.10 with the target at 82.50. Stop loss – 78.00.

Hot

No comment on record. Start new comment.