Current trend

During the Asian session, the American dollar is correcting after yesterday’s renewal of December 13 highs, holding near 103.00 in USDX against a neutral macroeconomic and news background.

The asset is supported by weakening expectations regarding a quick transition to the “dovish” rhetoric of the US Federal Reserve. Earlier, the regulator representative, Christopher Waller, noted that inflation in the country is approaching the upper limit of the target range, and now it was better not to rush to reduce interest rates to ensure that the downward trend in the consumer price index will be stable. In addition, in December, the dynamics of retail sales increased from 0.3% to 0.6%, while analysts expected an increase to 0.4% but the US Federal Reserve monthly financial report, Beige Book, was poor and reflected only a poor increase in activity in three of the twelve districts, and in one of them, a decrease was recorded.

By the end of the week, statistics on the housing market and data on the number of applications for unemployment benefits will be published in the United States; in addition, investors will pay attention to the consumer confidence index from the University of Michigan, which, according to preliminary estimates, will rise from 69.7 points to 70.0 points.

Support and resistance

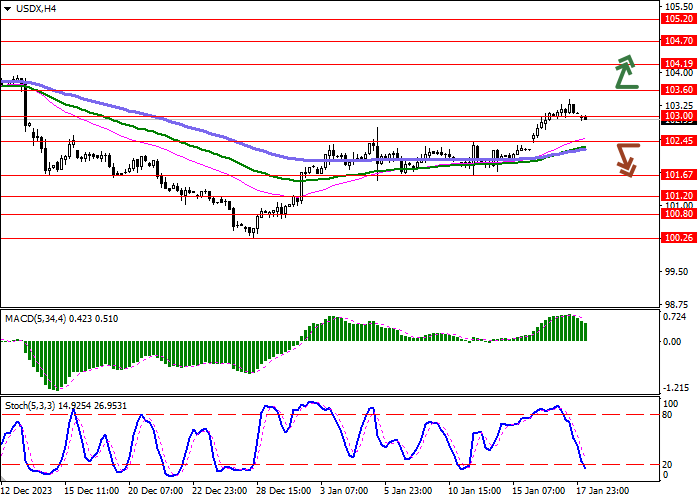

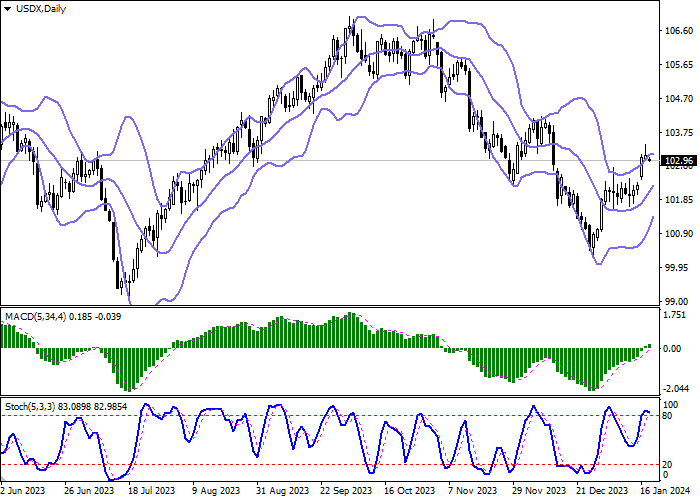

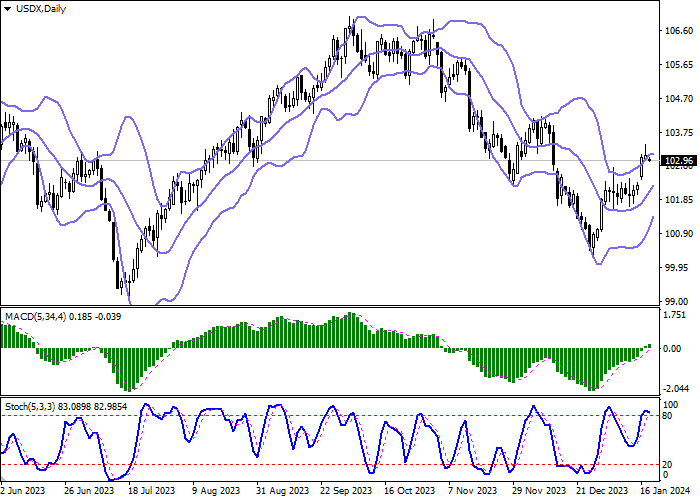

On the daily chart, Bollinger Bands are actively growing: the price range is narrowing, reflecting the ambiguous nature of trading in the ultra-short term. The MACD indicator is rising, maintaining a buy signal (the histogram is above the signal line), and is trying to consolidate above the zero level. Stochastic, approaching the highs, reversed a downward plane, indicating the imminent development of a downward correction.

Resistance levels: 103.60, 104.19, 104.70, 105.20.

Support levels: 103.00, 102.45, 101.67, 101.20.

Trading tips

Short positions may be opened after 102.45 is broken with the target at 101.67. Stop loss – 103.00. Implementation time: 2–3 days.

Long positions may be opened after 103.60 is broken upward with the target at 104.70. Stop loss – 103.00.

Hot

No comment on record. Start new comment.