Current trend

Shares of JPMorgan Chase & Co., one of the largest transnational financial conglomerates in the United States, are moving within the corrective trend at 168.00.

Yesterday, it became known that the bank agreed to pay a civil penalty of 18.0M dollars to settle allegations of violating its whistleblower rules. The US Securities and Exchange Commission (SEC) reported that JPMorgan Securities LLC pressured hundreds of clients and brokerages into signing non-disclosure agreements for potential legal violations when obtaining loans over 1.0K dollars. The corporation agreed to all charges and agreed to cease illegal activities.

The financial report was published late last week: the asset and wealth management division expectedly improved its performance, reporting a 7.0% increase in net income to 1.217B dollars and an 11.0% increase in net revenue to 5.095B dollars but the overall net income fell 15.0% to 9.307B dollars and earnings per share fell from 4.33 dollars to 3.97 dollars. Total revenue was 39.9B dollars, down from 40.7B dollars in the previous quarter.

Support and resistance

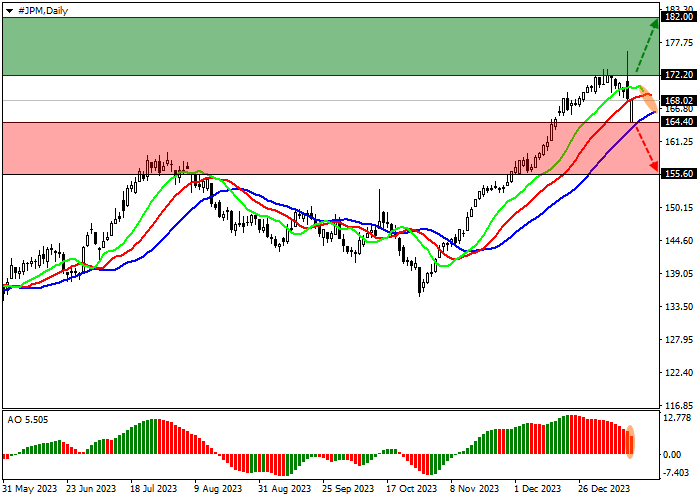

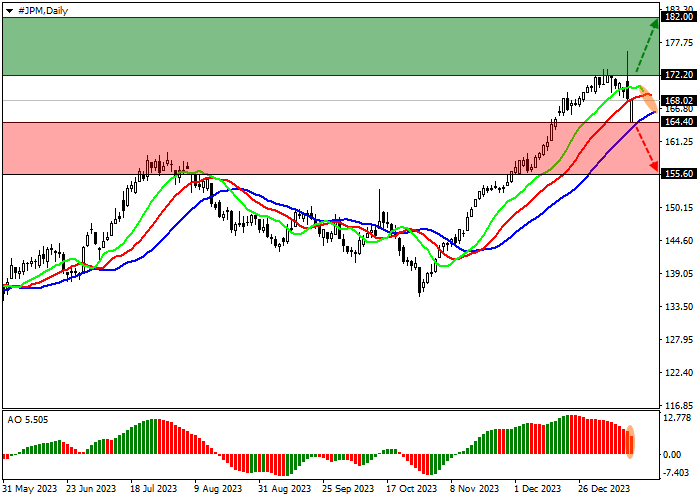

On the daily chart, the trading instrument is moving within the global ascending corridor of 175.00–139.00, approaching the resistance line.

Technical indicators maintain a stable buy signal: the EMA fluctuation range on the Alligator indicator is directed upward, fast EMAs are above the signal line, and the AO histogram forms corrective bars in the buy zone.

Resistance levels: 172.00, 182.00.

Support levels: 164.40, 155.60.

Trading tips

Long positions may be opened after the price rises and consolidates above 172.20 with the target at 182.00 and stop loss 170.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 164.40 with the target at 155.60. Stop loss – 167.00.

Hot

No comment on record. Start new comment.