Current trend

The price of North American light oil WTI Crude Oil is correcting in a downward trend at 71.26.

This week, two large companies reported problems with transporting fuel through the Red Sea: thus, the management of Shell Plc. said that after the corporation’s tanker was attacked by an armed drone last month, all supplies in the region will be suspended indefinitely, and the head of Chevron Corp. Mike Wirth noted that the increasing Houthi attacks on merchant ships create serious risks for the oil transportation and could lead to their complete cessation if the threat intensifies. Now, the Red Sea accounts for up to 12.0% of all maritime oil transport, and their blocking will significantly affect the quotes.

Demand for oil from investors is actively increasing: according to data from the Chicago Mercantile Exchange (CME Group), yesterday, the trading volume amounted to 1.26M contracts compared to the average of the first week of January of 879.0K contracts. The possibility of a complete blockage of transit through the Red Sea is causing increased attention from market participants to the asset, and the current demand indicator is the highest since the beginning of last fall.

Support and resistance

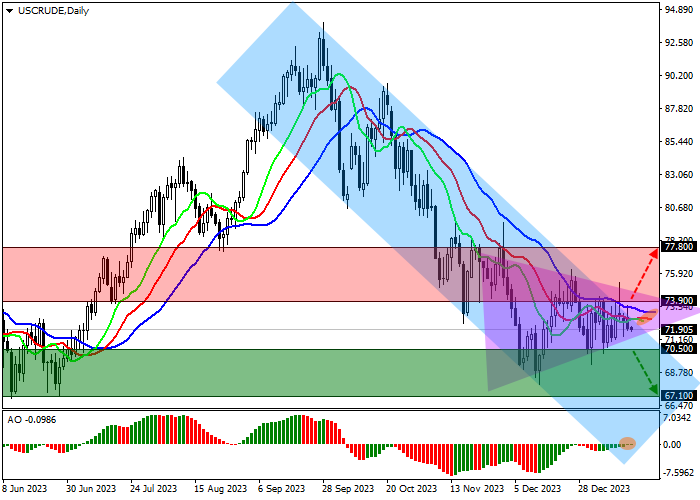

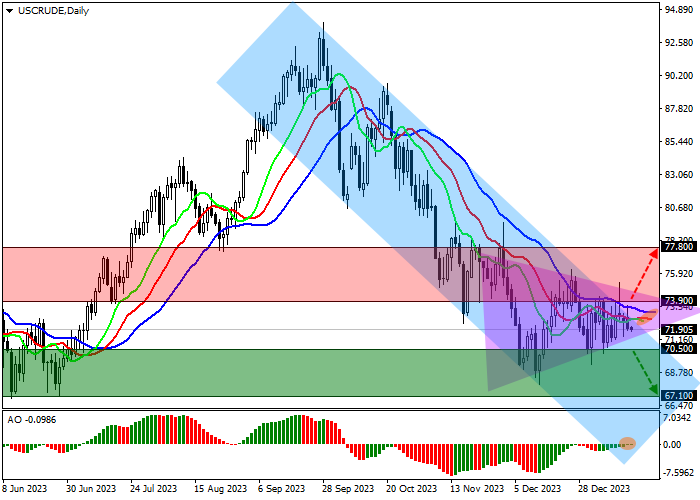

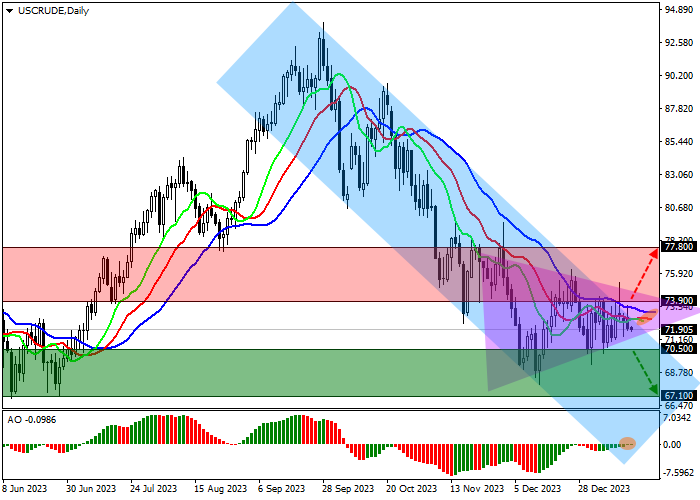

On the daily chart, the price is correcting within the global downward channel of 74.00–69.00, testing the resistance level of 72.00.

Technical indicators are holding a sell signal: fast EMA on the Alligator indicator are below the signal line, and the AO histogram is forming corrective bars below the transition level.

Resistance levels: 73.90, 77.80.

Support levels: 70.50, 67.10.

Trading tips

Short positions may be opened after the price declines and consolidates below 70.50 with the target at 67.10. Stop loss – 72.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 73.90 with the target at 77.80. Stop loss – 72.00.

Hot

No comment on record. Start new comment.