Current trend

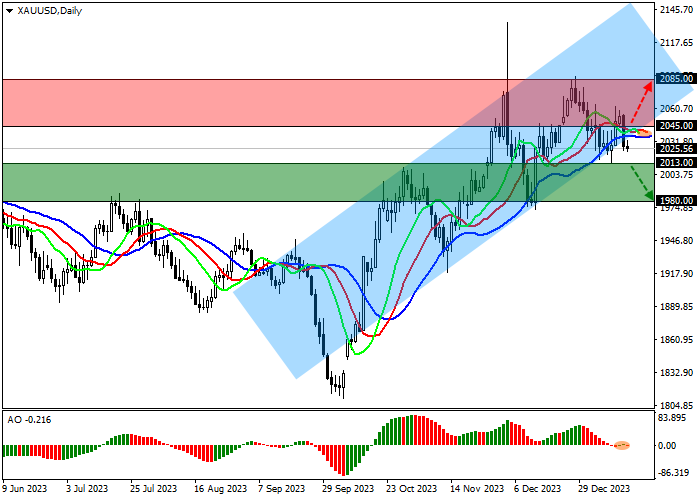

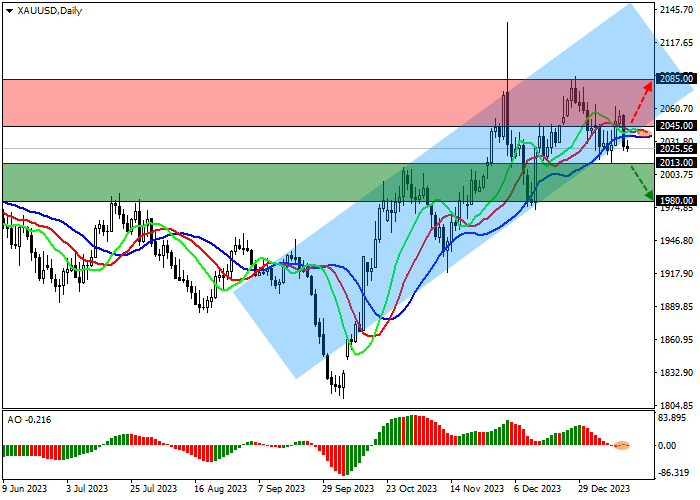

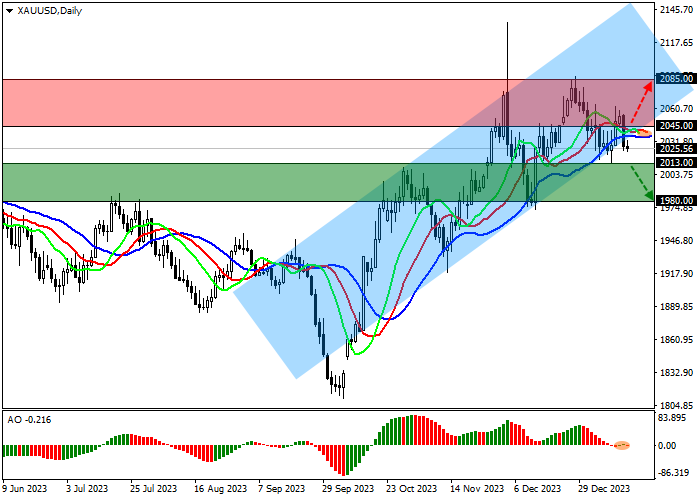

The XAU/USD pair is moving sideways at 2025.0, developing a technical correction as part of the global uptrend.

Yesterday, the World Gold Council published its final report for 2023, paying the greatest attention to the key factors in the pricing of the precious metal, which allowed annual growth to reach 15.1%: the quotes were most influenced by demand from central banks (10.0%–15.0%) and increased geopolitical risks (5.0%), as well as high interest rates, which put pressure on the asset (–3.0%). According to the department, demand from regulators will continue to increase this year as the global trend toward de-dollarization in favor of gold continues, and ongoing tensions in the Middle East may cause an outflow of investor capital to safe assets. On the other hand, after the spring meetings of leading central banks, interest rates are expected to decrease and given these factors, the XAU/USD pair will continue its upward trend.

Commodity exchanges are showing signs of continued strong demand, and open interest from investors has increased significantly: according to the Chicago Mercantile Exchange (CME Group), average daily trading volume reached 436.0K items, while from December 27 to January 4, it was 247.0K transactions.

Support and resistance

On the daily chart, the price is correcting, trying to leave the local ascending channel with boundaries of 2085.0–2025.0.

Technical indicators have almost completely slowed down the buy signal: fast EMAs on the Alligator indicator remain slightly above the signal line, narrowing the range of fluctuations, and the AO histogram forms corrective bars very close to the transition level.

Resistance levels: 2045.0, 2085.0.

Support levels: 2013.0, 1980.0.

Trading tips

Short positions may be opened after the price declines and consolidates below 2013.0 with the target at 1980.0. Stop loss – 2020.0. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 2045.0 with the target at 2085.0. Stop loss – 2035.0.

Hot

No comment on record. Start new comment.