Current trend

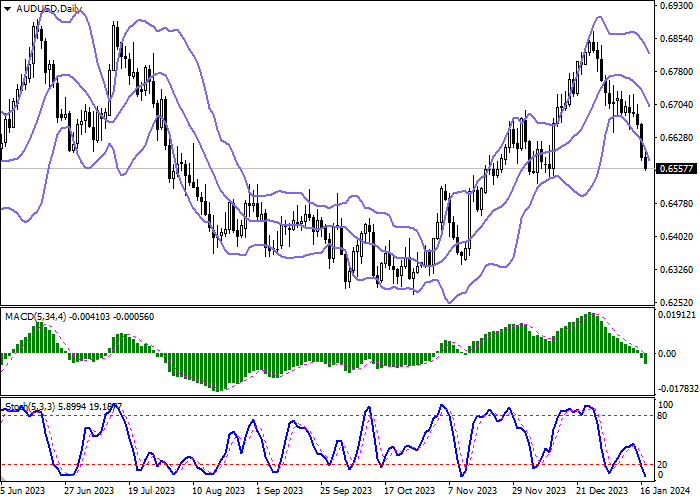

During the Asian session, the AUD/USD pair develops the “bearish” trend formed on December 28 and tests the level of 0.6560 for a breakdown, renewing the lows of December 13.

The quotes are under pressure by waning expectations of a quick transition to the “dovish” rhetoric of the US Fed. Thus, yesterday, the regulator representative, Christopher Waller, noted that it was necessary to ensure a sustainable decline in inflation to the target level of 2.0%. At the same time, markets focus on the January Federal Reserve Bank of New York manufacturing PMI sharp decline from –14.5 points to –43.7 points, worse than analysts’ forecasts of –5.0 points. On Wednesday, retail sales statistics will be published: according to the forecasts, in December, the figure will increase from 0.3% to 0.4%, and excluding cars, it will remain at 0.2%. In addition, preliminary estimates suggest that industrial output will decline from 0.2% to 0.0%. Finally, investors will pay attention to the monthly economic review from the US Fed, the Beige Book, and several speeches by representatives of the regulator.

The position of the Australian dollar is under pressure from macroeconomic statistics. Thus, the Westpac consumer confidence index corrected by –1.3% in January after 2.7% earlier. On Thursday, December labor market data will be published: experts expect that the employment level will decrease from 61.5K to 17.6K, and unemployment will remain at 3.9%. Investors believe Reserve Bank of Australia (RBA) interest rates have peaked but expect only a 50 basis point cut this year, likely starting in August.

Support and resistance

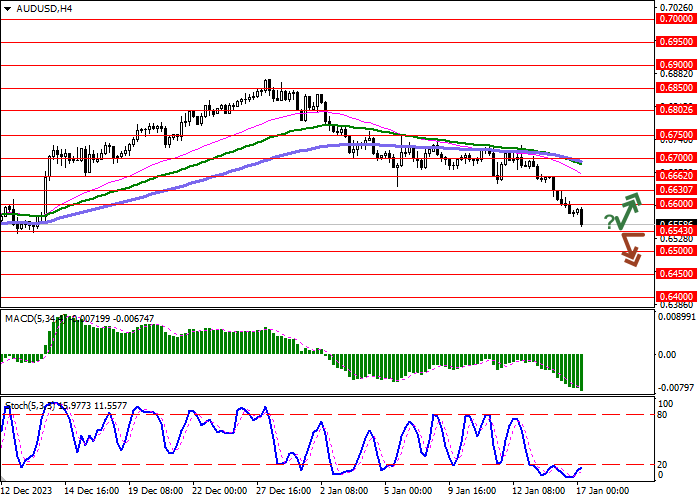

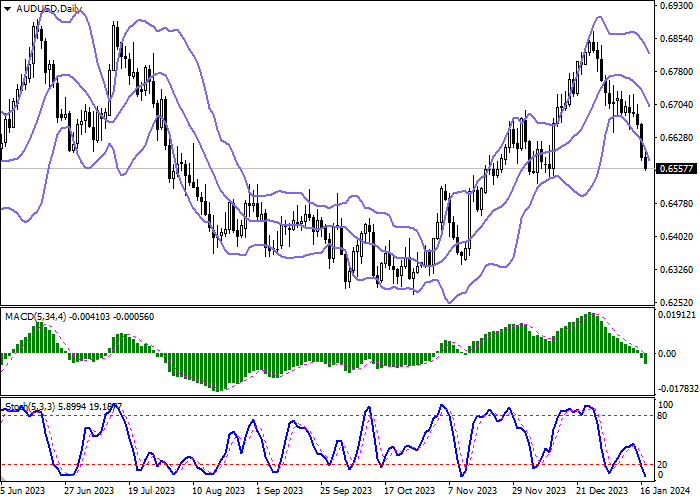

On the daily chart, Bollinger bands are steadily declining: the price range is expanding but not fast as the “bearish” sentiment develops. The MACD indicator is declining, maintaining a strong sell signal (the histogram is below the signal line) and trying to consolidate below the zero level. Stochastic falls but is near zero, signaling that the instrument may become oversold in the ultra-short term.

Resistance levels: 0.6600, 0.6630, 0.6662, 0.6700.

Support levels: 0.6543, 0.6500, 0.6450, 0.6400.

Trading tips

Short positions may be opened after a breakdown of 0.6543 with the target at 0.6450. Stop loss – 0.6600. Implementation time: 1–2 days.

Long positions may be opened after a rebound from 0.6543 and a breakout of 0.6600 with the target at 0.6700. Stop loss – 0.6543.

Hot

No comment on record. Start new comment.