Current trend

The EUR/USD pair shows a slight decline, consolidating near 1.0870 and local lows of December 13. The position of the single currency came under noticeable pressure the day before, which was the market’s reaction to the speech of US Federal Reserve Board member Christopher Waller, who advocated a more measured approach to the issue of launching a cycle of easing monetary conditions. According to the official, inflation in the country has indeed reached the upper limits of the target range of 2.0-3.0%, but at the moment it is necessary to ensure that prices remain within these limits or continue to decline in the longer term. At the same time, markets are still confident that the regulator may begin to adjust borrowing costs during the March meeting. Currently, more than 70.0% of analysts expect such a scenario, compared to 80.0% last week.

In turn, macroeconomic statistics from Germany, published the day before, did not provide significant support for the single currency. Thus, the December updated inflation data did not reflect any changes compared to November statistics, when the Consumer Price Index was 0.1% on a monthly basis and 3.7% on an annual basis. The day before, the head of the National Bank of Austria, Robert Holzmann, said that the European regulator may abandon monetary policy adjustment in 2024. This position was supported by the President of the German Bundesbank, Joachim Nagel, and the Governor of the Bank of France, François Villeroy de Galhau, who noted that it was too early for the European Central Bank (ECB) to discuss interest rate cuts, since the rate of price growth exceeds preliminary estimates. At the same time, the German index of Economic Sentiment from the Center for European Economic Research (ZEW) rose from 12.8 points to 15.2 points in January, while analysts expected 12.0 points, and the Current Situation indicator decreased from -77.1 points to -77.3 points with a forecast of -77.0 points.

Today, the focus of investors' attention will be on the December updated data on inflation in the eurozone, but a noticeable market reaction to the publication is not expected. In addition, ECB President Christine Lagarde will give a speech during the day. The US will present December statistics on Retail Sales and Industrial Production, as well as the monthly economic review from the US Federal Reserve, the so-called Beige Book.

Support and resistance

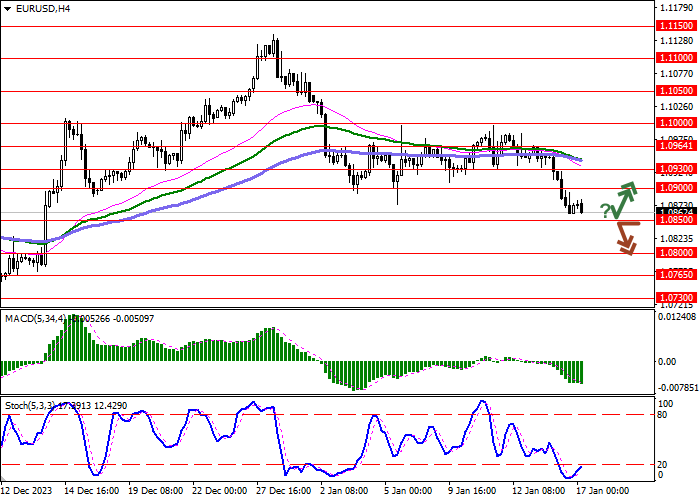

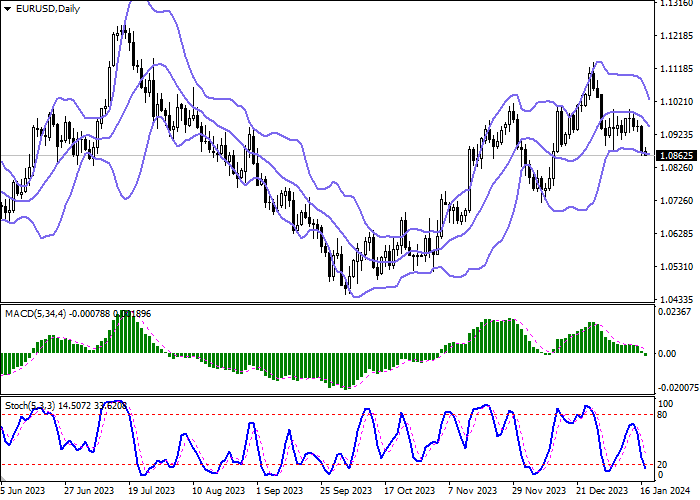

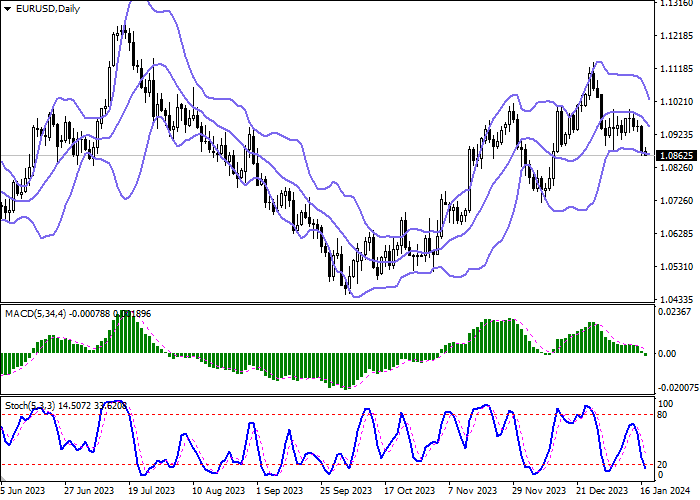

Bollinger Bands in D1 chart demonstrate active decrease. The price range narrows sharply from above, limiting the development of "bearish" dynamics in the near future. MACD is going down preserving a stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic retains a steady downtrend but is located in close proximity to its lows, which indicates the risks of oversold euro in the ultra-short term.

Resistance levels: 1.0900, 1.0930, 1.0964, 1.1000.

Support levels: 1.0850, 1.0800, 1.0765, 1.0730.

Trading tips

Short positions may be opened after a breakdown of 1.0850 with the target at 1.0765. Stop-loss — 1.0900. Implementation time: 2-3 days.

A rebound from 1.0850 as from support followed by a breakout of 1.0900 may become a signal for opening new long positions with the target at 1.0964. Stop-loss — 1.0865.

Hot

No comment on record. Start new comment.