Current trend

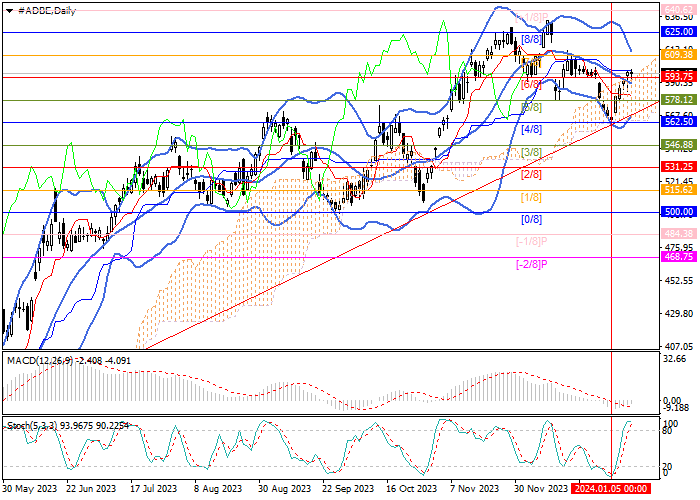

Shares of Adobe Inc., a leading American software developer, resumed growth as part of a long-term upward trend: the price reversed from the center mark of Murrey’s trading range 562.50 (Murrey level [4/8]) and consolidated above the reversal level 593.75 (Murrey level [6/8]), supported by the middle line of Bollinger Bands, which will allow the quotes to reach the area of 625.00 (Murrey level [8/8]) and 640.62 (Murrey level [ 1/8]). The key “bearish” level is 562.50, and if it breaks down, a decline to the area of 546.88 (Murrey level [3/8]) and 531.25 (Murrey level [2/8]) is expected.

Technical indicators do not give a single signal: Bollinger Bands are directed downwards, Stochastic reversed upwards and entered the overbought zone, and the MACD histogram is preparing to enter the positive zone. However, further growth soon looks more likely.

Support and resistance

Resistance levels: 625.00, 640.62.

Support levels: 562.50, 546.88, 531.25.

Trading tips

Long positions may be opened from 600.50 with the targets at 625.00, 640.62 and stop loss around 587.00. Implementation time: 5–7 days.

Short positions may be opened below 562.50 with the targets at 546.88, 531.25 and stop loss around 573.00.

Hot

No comment on record. Start new comment.