Current trend

Shares of Hewlett-Packard Co., an American information technology giant, are moving in a corrective trend and are around 29.80.

Yesterday it became known that the American investment company Berkshire Hathaway Inc. sold about 45.0 million shares of the emitter: thus, only 5.2% remained from the position of 12.0% or 121.0 million shares in 2022. According to representatives of the Warren Buffett's fund, the growth potential after a successful Q4 has almost exhausted itself, and the company is entering a downward correction cycle. Analysts at Evercore ISI also agree with these estimates and predict that the company will return to annual earnings of 4.0 dollars per share only by 2025, while the profit structure itself will largely depend on the volume of the new share buyback program.

The financial report for Q1 2024 will be published on February 26: Hewlett-Packard Co. forecasts earnings per share (EPS) in the range of 0.76–0.86 dollars, while analysts expect 0.81 dollars. Revenue is expected to be in the range of 13.55 billion dollars, which is slightly lower than 13.8 billion dollars in the previous period.

Support and resistance

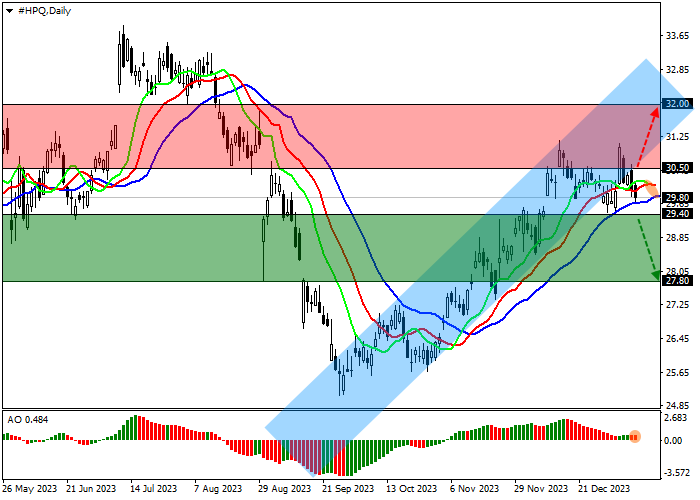

On the D1 chart, the instrument is trading in a corrective downtrend after exiting the local ascending channel with the borders of 31.20–29.50.

Technical indicators are showing da buy signal, which has begun to weaken actively: the fast EMAa of the Alligator indicator are above the signal line, and the AO histogram is in the buy zone, forming new descending bars.

Support levels: 29.40, 27.80.

Resistance levels: 30.50, 32.00.

Trading tips

In the event of a reversal and the continued decline of the asset and price consolidation below the local support level at 29.40, one can open short positions with the target at 27.80 and stop-loss at 30.00. Implementation time: 7 days and more.

If the local growth of the asset continues and the price consolidates above the local resistance level of 30.50, one may open long positions with the target at 32.00 and stop-loss at 29.80.

Hot

No comment on record. Start new comment.