Current trend

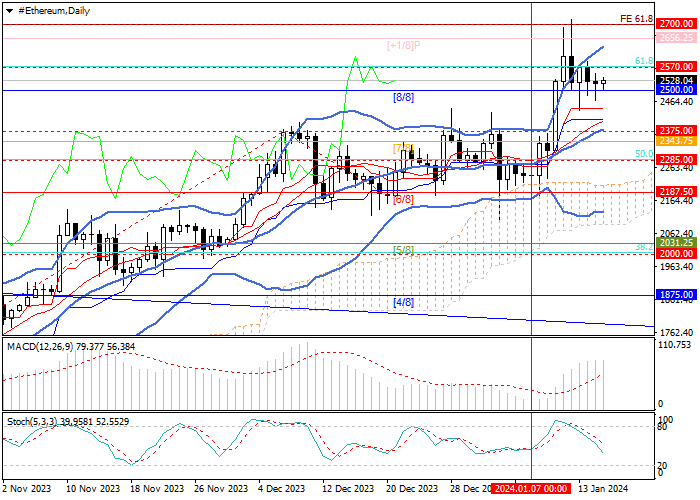

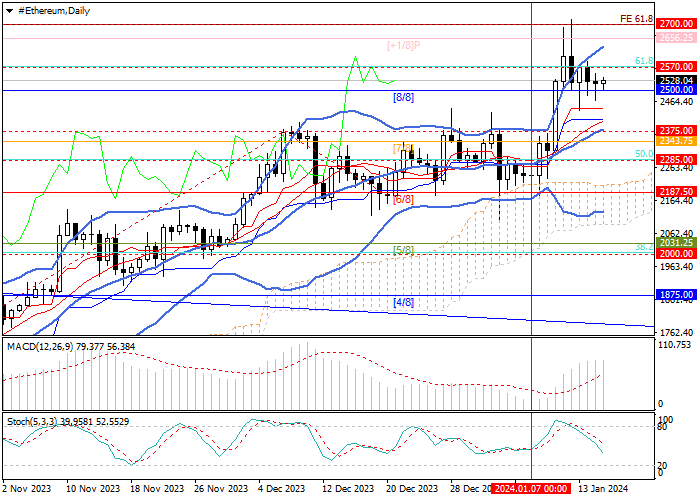

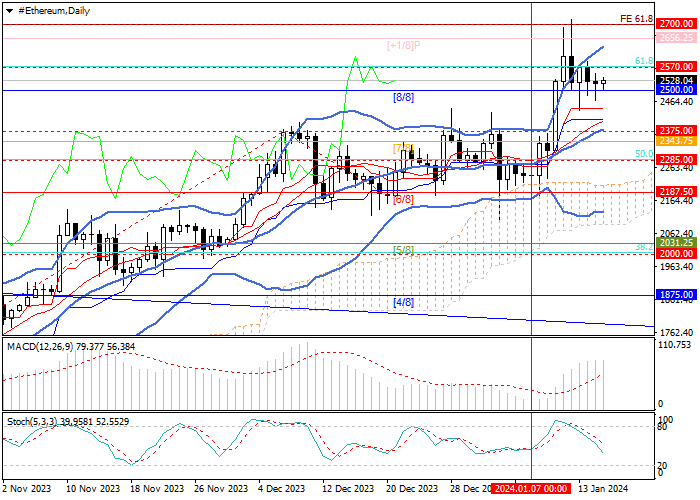

Last week, the ETH/USD pair became one of the growth leaders: amid the approval of bitcoin ETFs in the United States, quotes reached three-year highs around 2715.00, however, after partial profit-taking by investors, the price dropped to around 2500.00 (Murrey level [8/8]), where it is now.

The uptrend is primarily due to the market's confidence that the approval of exchange-traded funds based on BTC by the U.S. Securities and Exchange Commission (SEC) will be followed by a similar decision on ETH-based ETFs. Currently, several large companies have already submitted applications for the launch of such tools – BlackRock Inc., Invesco Ltd., Ark Invest, VanEck, and Grayscale Investments. Voting on the first of them is due to take place in May. However, experts believe that in this case, ETH should be recognized as a commodity, and SEC officials consider all cryptocurrencies except BTC as securities. The same position was recently confirmed by the head of the regulator, Gary Gensler, who said that allowing the launch of bitcoin ETFs would not change the opinion of the authorities regarding digital assets. The probability of approval of another spot exchange-traded fund in May is now estimated at only 50.0%, but positive market sentiment remains.

Support and resistance

The instrument is located at 2500.00 (Murrey level [8/8]), consolidating below which will allow it to continue its decline to the levels of 2375.00 (the central line of Bollinger Bands) and 2187.50 (Murrey level [6/8]). After the breakout of the 2570.00 mark (61.8% Fibonacci retracement), growth will resume towards the targets of 2700.00 (61.8% Fibonacci extension) and 2812.50 (Murrey level [ 2/8]).

Technical indicators confirm the continuation of the uptrend: Bollinger Bands are reversing up, MACD is increasing in the positive zone, while Stochastic's reversal down does not exclude the development of a downward correction, but its potential is seen to be limited.

Resistance levels: 2570.00, 2700.00, 2812.50.

Support levels: 2500.00, 2375.00, 2187.50.

Trading tips

Long positions can be opened above the 2570.00 mark with targets at 2700.00, 2187.50 and stop-loss in the area of 2490.00. Implementation period: 5–7 days.

Short positions can be opened below the level of 2500.00 with targets at 2375.00, 2187.50 and stop-loss around 2460.00.

Hot

No comment on record. Start new comment.