Current trend

Against the strengthening of the American currency, the USD/CHF pair is trading in a corrective trend at 0.8582.

According to the latest report from the Swiss State Secretariat for Economic Affairs (SECO), the average consumer price index in 2023 was 2.1% YoY, only 0.1% above the upper limit of the target range outlined by the Swiss National Bank. Factors that strengthen the indicator remain high prices for electricity and rental housing but pressure comes from falling oil prices and rising prices for exported products by 2.4% YoY. Overall, inflation has a clear downward trend, supporting the franc.

The American dollar is holding at 102.500 in USDX. Tomorrow at 15:30 (GMT 2), December retail sales data will be published, and analysts expect the figure to increase by 0.40% after 0.30% earlier, which could be higher than 4.09% YoY in November. In addition, according to preliminary estimates, the export price index may adjust from –0.9% to –0.6% and the import price index from –0.4% to –0.5%.

Support and resistance

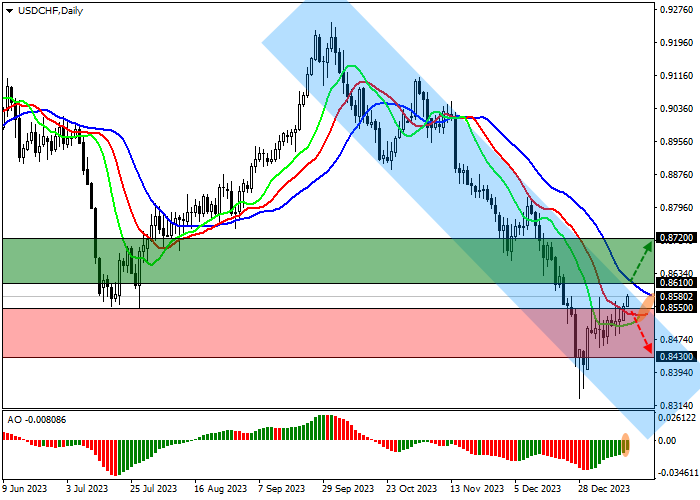

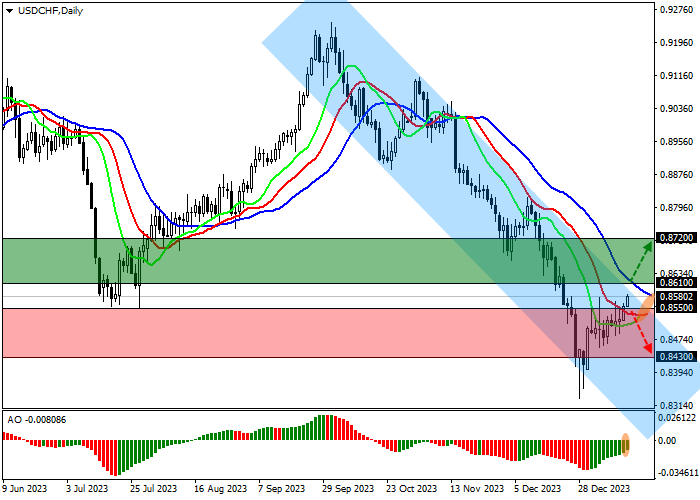

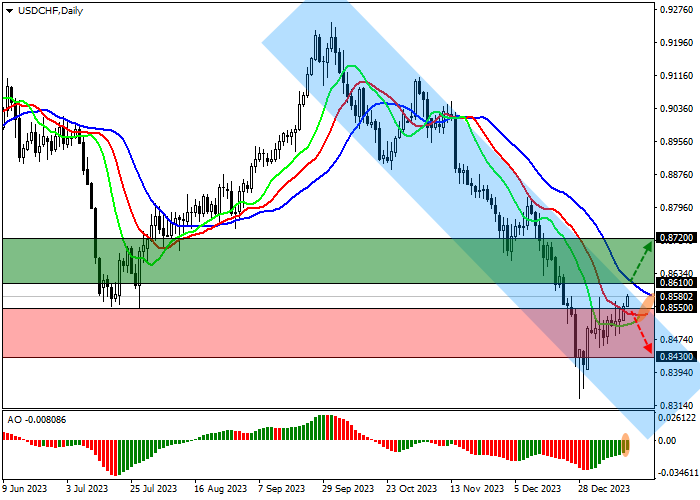

On the daily chart, the trading instrument is correcting to the resistance line of the local downward channel with dynamic boundaries of 0.8650–0.8430.

Technical indicators are weakening the global sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming ascending bars in the sell zone.

Resistance levels: 0.8610, 0.8720.

Support levels: 0.8550, 0.8430.

Trading tips

Long positions may be opened after the price rises and consolidates above 0.8610 with the target at 0.8720. Stop loss is around 0.8540. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 0.8550 with the target at 0.8430. Stop loss – 0.8610.

Hot

No comment on record. Start new comment.