Current trend

During the Asian session, the AUD/USD pair is developing a strong bearish momentum in the short term, renewing local lows from December 13 around 0.6675.

The positive dynamics of the American dollar are developing after the publication of inflation data last week: the consumer price index for December was 0.3%, higher than the forecast of 0.2% and the previous value of 0.1%, and 3.4% YoY against preliminary estimates of 3.2% and 3.1% previously. However, expectations for a US Federal Reserve rate cut are also rising: a week ago, the likelihood of a move to the “dovish” rhetoric in March was estimated at 60.8%, up from 66,3%, according to the Chicago Mercantile Exchange (CME) FedWatch Instrument, which suggests a corrective nature of the currency increase.

The Australian dollar is weakening due to low growth in the national economy: today’s number of building permits issued in December fell from 7.2% to 1.6%, meeting expert forecasts. China’s recent restrictions on exports of rare earth elements used in high-tech industries are also dragging down Australia’s economic recovery, and the government has committed to investing in mining and alternatives in 2024. Together with the fall in commodity prices (oil and gold maintain a medium-term downward trend), the currency will continue to decline after breaking through 0.6608.

Support and resistance

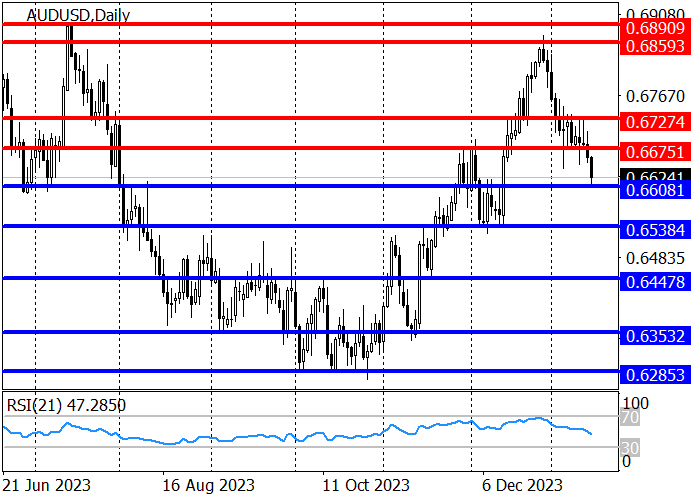

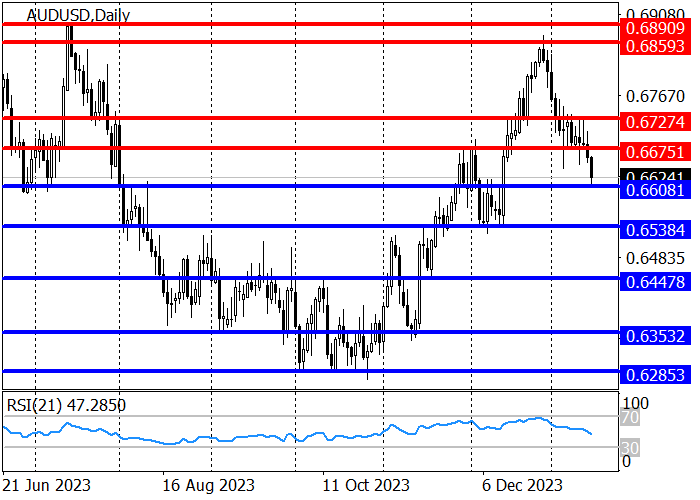

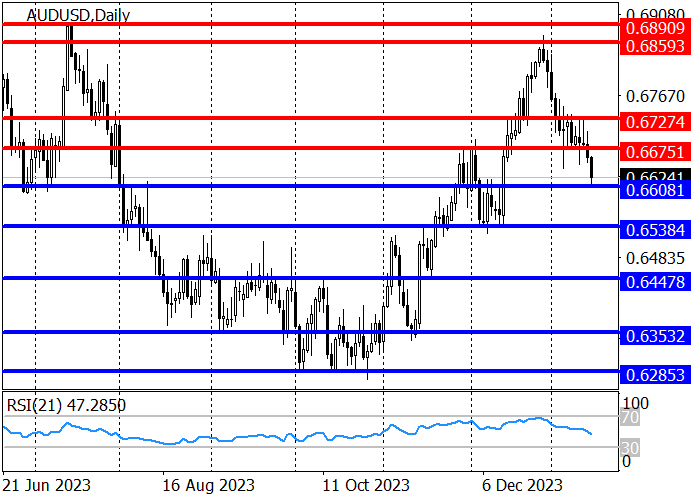

The long-term trend is upward but within a correction, the price broke the support level of 0.6675 and reached 0.6608, after the breakdown of which the negative dynamics will continue with the target at 0.6538. Otherwise, an increase to 0.6727 is expected.

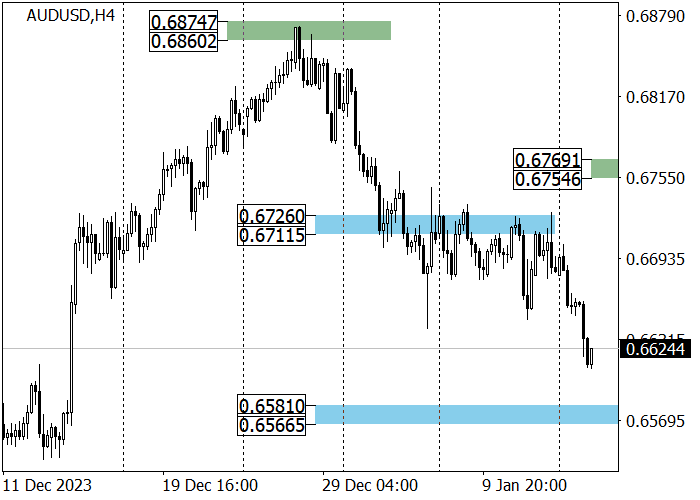

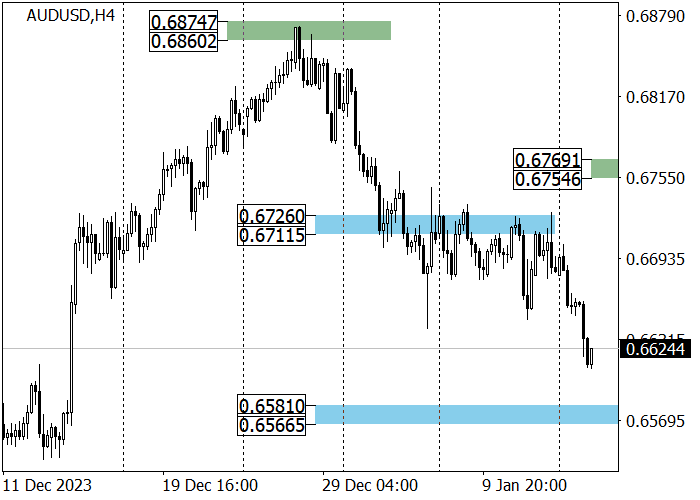

The medium-term trend is downward, and after the breakdown of the zone 0.6726–0.6711, the sales target became zone 2 (0.6581–0.6566), and the trend border shifted to the area of 0.6769–0.6754 after reaching which, as part of the correction, short positions with the target at the current week’s low are relevant 0.6611.

Resistance levels: 0.6675, 0.6727, 0.6859.

Support levels: 0.6608, 0.6538.

Trading tips

Short positions may be opened from 0.6675 with the target at 0.6538 and stop loss around 0.6762. Implementation time: 9–12 days.

Long positions may be opened above 0.6762 with the target at 0.6859 and stop loss around 0.6718.

Hot

-THE END-