Current trend

Last week, the BTC/USD pair had ambiguous dynamics: at first, quotes reached four-year highs, exceeding the 49100.00 mark against the background of approval by the U.S. Securities and Exchange Commission (SEC) of 11 applications for the creation of a bitcoin ETF, but market participants showed caution.

It was expected that the launch of a new instrument would arouse serious interest from institutional investors and lead to an influx of additional funds into the cryptocurrency market, but attention to bitcoin ETFs turned out to be overestimated: the trading volume of funds on the first day amounted to 4.5 billion dollars, and on the second only 3.1 billion dollars. The share price of the new exchange-traded instruments themselves also decreased significantly after a short-term growth, which led to negative dynamics in most of the leading digital assets. In particular, the price of BTC has fallen to the area of 41500.00, although now the instrument has regained some of the lost positions and is trading at 42500.00.

An additional factor in the weakening of cryptocurrencies was the data on inflation in the United States for December published last week: the consumer price index (CPI) resumed growth and amounted to 3.4% instead of the expected 3.1%. Thus, the continuing high inflationary pressure in the economy may well lead to a postponement of the start of the US Federal Reserve's interest rate cut cycle.

Support and resistance

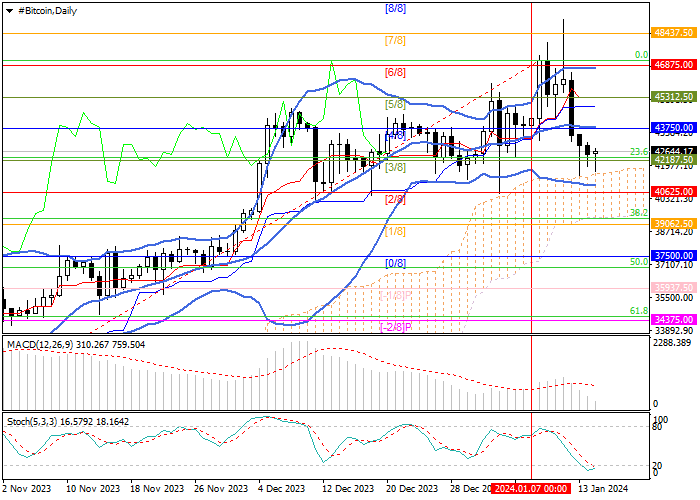

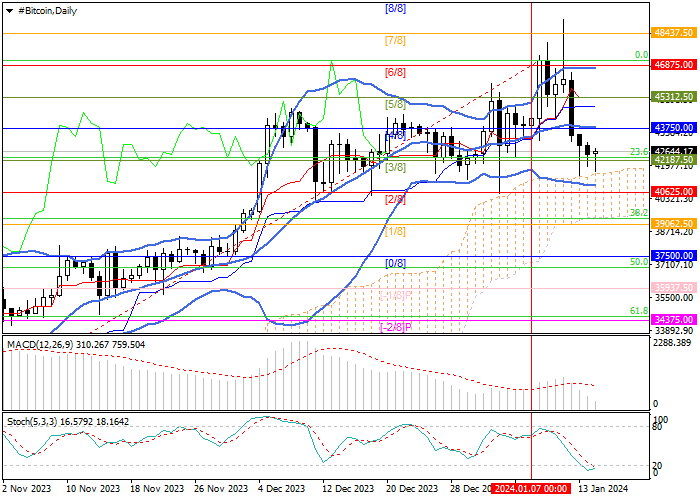

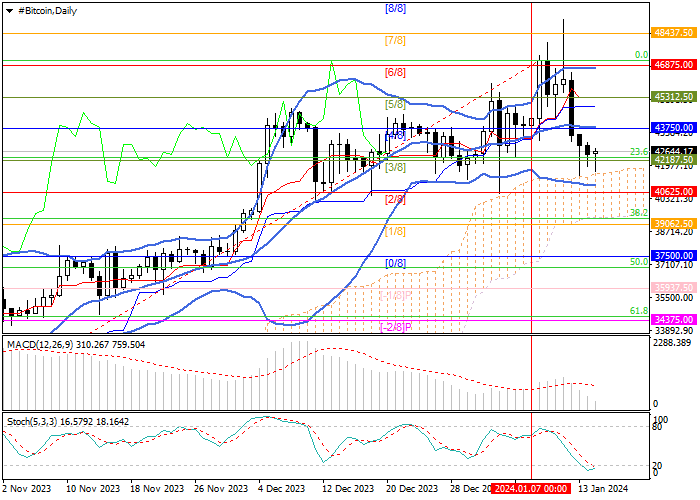

The instrument is testing the 42187.00 mark (Murrey level [3/8], 23.6% Fibonacci retracement), consolidating below which will open the possibility of continuing the decline to 39100.00 (Murrey level [1/8], 38.2% Fibonacci retracement) and 37500.00 (Murrey level [0/8]). A breakout of the 43700.00 mark (Murrey level [4/8]), supported by the central line of Bollinger Bands, will allow quotes to resume growth to the levels of 45312.50 (Murrey level [5/8]) and 46875.00 (Murrey level [6/8]).

Technical indicators do not give a clear signal: Bollinger Bands are horizontal, MACD is preparing to move into the negative zone, while Stochastic is reversing up from the oversold zone.

Resistance levels: 43750.00, 45312.50, 46875.00.

Support levels: 42187.50, 39100.00, 37500.00.

Trading tips

Long positions can be opened above the 43750.00 mark with targets at 45312.50, 46875.00 and stop-loss around 42700.00. Implementation period: 5–7 days.

Short positions can be opened below the level of 42187.50 with targets at 39100.00, 37500.00 and stop-loss at 43300.00.

Hot

No comment on record. Start new comment.