Current trend

During the Asian session, the AUD/USD pair is trading around 0.6692, recovering from last week’s decline amid the stable performance of the American dollar.

Australia has seen a decline in investment activity in the construction sector: the volume of housing loans in December fell from 5.6% to 0.5%, and the rate of capital investment in real estate – from 8.3% to 1.9%. Considering last week’s statistics, which reflected a significant drop in sales, we can conclude that the sector is putting pressure on the economy since the situation in the labor market has begun to normalize, which is confirmed by a correction in the number of job postings by 0.1% in December relative to –5.1 % previously. The quotes are also supported by Chinese data: exports from the country increased by 2.3% after 0.5% last month, and imports by 0.2% compared to a decrease of 0.6% earlier, which led to an increase in the trade surplus from 68.39B dollars to 75.34B dollars, exceeding preliminary estimates of 74.75B dollars.

The American dollar closed last week’s trading at 102.100 in USDX: despite the relative stability, macroeconomic statistics from the United States disappoint experts: the producer price index in December changed by –0.1% MoM, the same as last month, which means an increase of 1.0% YoY compared to 0.8% in November. The core indicator showed zero dynamics MoM and increased by 1.8% YoY, whereas the growth was 2.0% previously.

Support and resistance

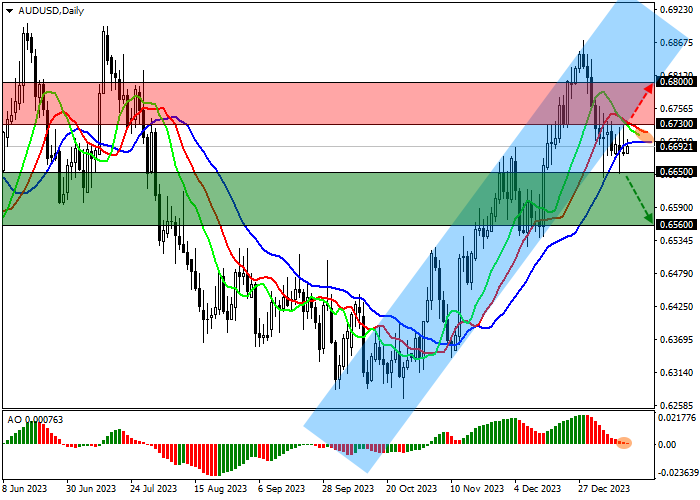

On the daily chart, the trading instrument is trying to leave the ascending channel 0.6850–0.6730.

Technical indicators are slowing down the global buy signal: fast EMAs on the Alligator indicator are above the signal line, narrowing the range of fluctuations, and the AO histogram forms corrective bars, approaching the transition level.

Resistance levels: 0.6730, 0.6800.

Support levels: 0.6650, 0.6560.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.6650 with the target at 0.6560. Stop loss – 0.6700. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 0.6730 with the target at 0.6800. Stop loss – 0.6680.

Hot

-THE END-