Current trend

The leading index of the Australian economy, the ASX 200, is trading near 7508.0: the stock market is correcting against the background of weak macroeconomic reports and downward dynamics in the bond market.

Australian companies will begin publishing their financial reports at the end of the month, but for now the instrument focuses on macroeconomic data. Tomorrow, statistics on the real estate market will be presented: according to forecasts, the number of Building Permits will increase by 1.6% after an increase of 7.5% a month earlier, which in annual terms could lead to a decrease of 4.6% after -6.1% previously, and the number of permits issued for the construction of private houses is likely to fall by 1.7% after an increase of 2.2%.

In the domestic bond market, after local growth at the beginning of the year, a downward trend is now again observed: the 10-year bonds are trading at 4.091%, slightly lower than the previous high in early December at 4.171%, the 20-year bonds are at 4.408% compared to the beginning of the month, when the figure was 4.470%, and the 30-year bonds yield reached 4.475%, slightly below the January 7 peak of 4.506%.

The growth leaders in the index are Super Retail Group Ltd. ( 5.85%), Premier Investments Ltd. ( 4.12%), Elders Ltd. ( 4.40%), JB Hi-Fi ( 3.32%).

Among the leaders of the decline are Nuix Ltd. (-7.24%), Omni Bridgeway Ltd. (-6.16%), Healius Ltd. (-4.28%), IGO Ltd. (-5.21%).

Support and resistance

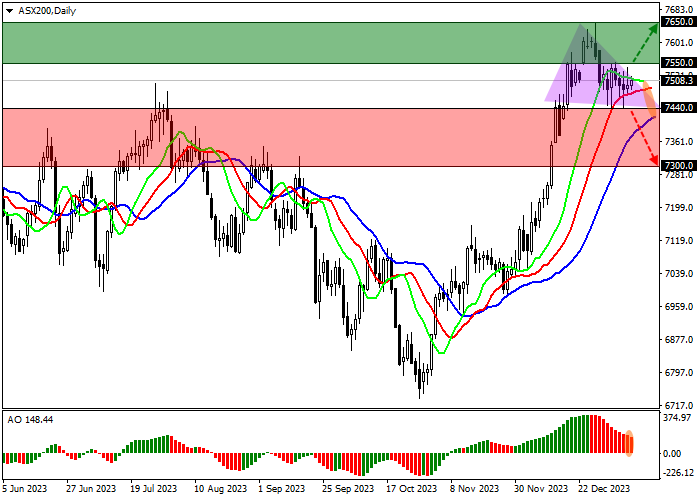

On the daily chart, the price is holding near last year's high at 7650.0, preparing for a new attempt to test it and awaiting positive fundamental factors.

Technical indicators keep quite a stable buy signal: fast EMAs of the Alligator indicator are held above the signal line, keeping the fluctuation range stable, and the AO histogram forms corrective bars, while being in the buy zone.

Support levels: 7440.0, 7300.0.

Resistance levels: 7550.0, 7650.0.

Trading tips

If the asset continues growing, and the price consolidates above the local resistance at 7550.0, long positions with a target of 7650.0 and stop-loss of 7500.0 will be relevant. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 7440.0, short positions can be opened with the target at 7300.0. Stop-loss — 7520.0.

Hot

-THE END-