Current trend

The EUR/USD pair is trading at 1.0964, poised to continue its downward movement following statements by European Central Bank (ECB) head Christine Lagarde that interest rates have peaked.

On January 12, the official, during her speech to reporters, noted that the cost of borrowing is kept at the peak but could not yet give specific dates for the transition to its reduction since this would require clear signals that the growth rate of consumer prices is approaching the target 2.0%. In addition, Lagarde denied reports about the possibility of early resignation as head of the ECB to join the new French government: her eight-year term expires in 2027.

The asset is further supported by December data on manufacturing inflation in the US: the producer price index decreased by 0.1% MoM, below the forecast of 0.1%, and the core indicator – 0.0% versus preliminary estimates of 0.2%. Against this background, the probability of a US Federal Reserve interest rate cut in March was estimated at 70.0%, according to the Chicago Mercantile Exchange (CME) FedWatch Instrument.

This week, investors’ attention will be focused on the publication of data on the consumer price index in December in the EU on Wednesday, January 17, at 12:00 (GMT 2): experts expect the indicator to be 2.9% YoY, higher than the previous one value of 2.4%, and the core value may reach 3.4%, compared to 3.6% previously, as a result of which the ECB may delay the transition to the “dovish” policy, strengthening the euro.

Support and resistance

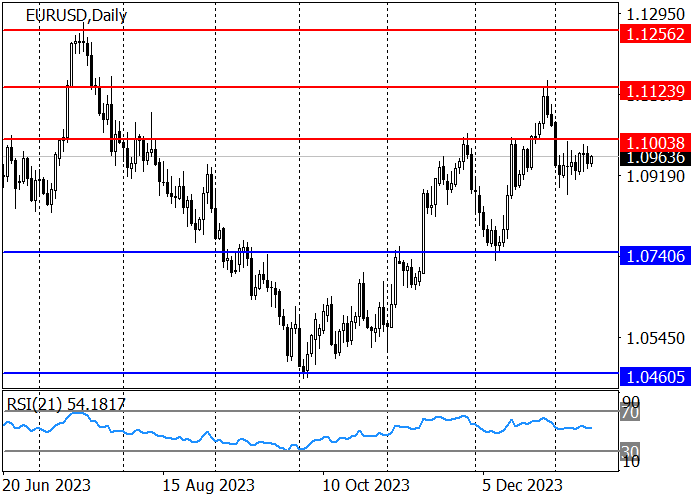

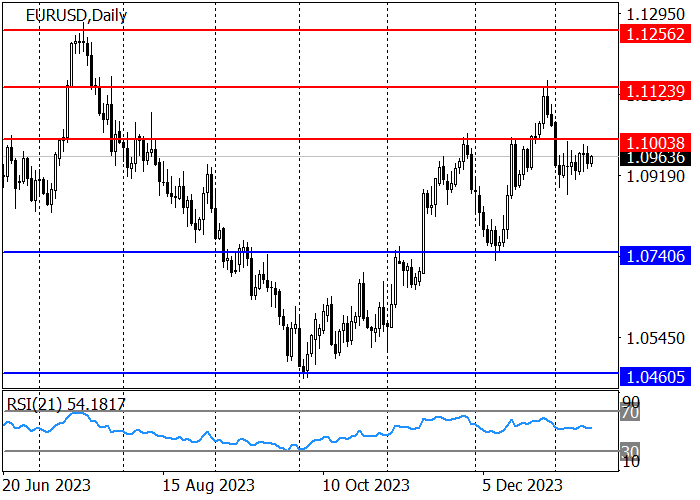

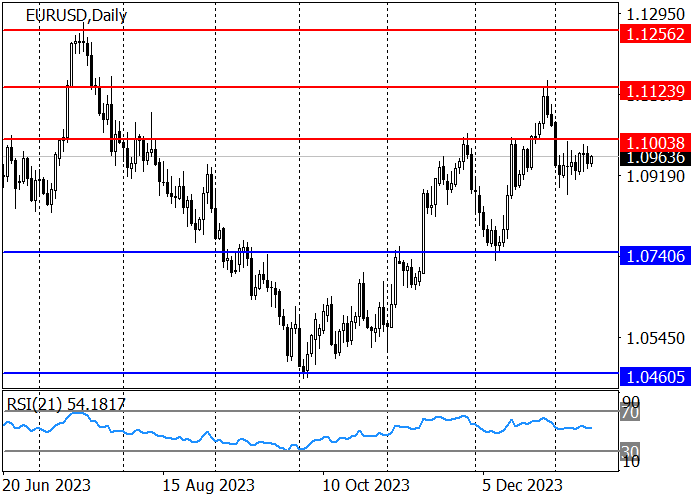

The long-term trend remains downward with a border of 1.1124, after testing which the quotes began to decline and returned below the resistance level of 1.1003; if held, it may reach the support level of 1.0740.

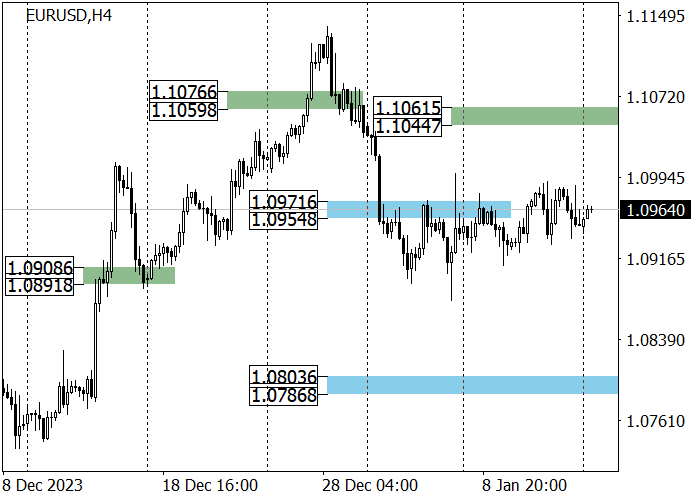

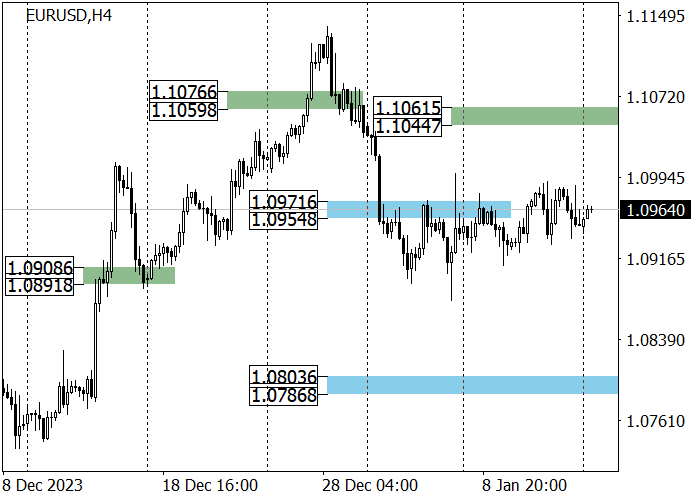

The medium-term trend is downward with the target in zone 2 (1.0803–1.0786) but now the price is moving in a correction. After reaching the trend border of 1.1061–1.1044, short positions with the target at the low of January 5, 1.0880, are relevant.

Resistance levels: 1.1003, 1.1124.

Support levels: 1.0740, 1.0460.

Trading tips

Short positions may be opened from 1.1003 with the target at 1.0740 and stop loss around 1.1070. Implementation time: 9–12 days.

Long positions may be opened above 1.1070 with the target at 1.1256 and stop loss around 1.0985.

Hot

No comment on record. Start new comment.